June 25, 2025

at

12:00 am

EST

MIN READ

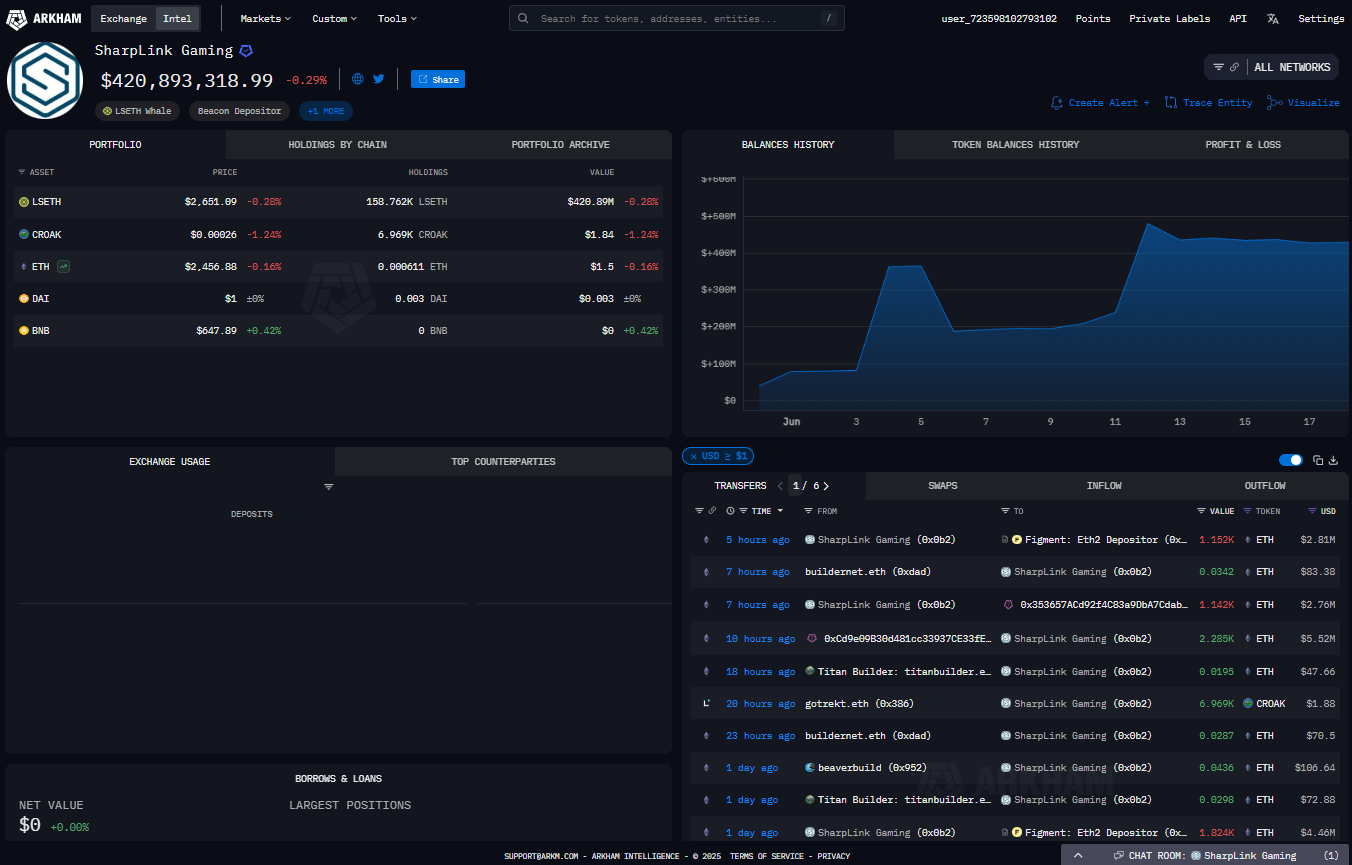

SharpLink Gaming is now on Arkham

Leading ETH treasury company, SharpLink Gaming, has now been identified on Arkham, with over $420M in assets identified on-chain. The company, expectedly, holds the majority of its assets in ETH, with most of it staked as LSETH, under the Liquid Collective, an enterprise-grade staking solution.

SharpLink Gaming announced a $425M private placement in the company to initiate its ETH treasury strategy in late May 2025, led by Joseph Lubin of ConsenSys, with support from other notable investors such as Pantera Capital, Galaxy Digital, ParaFi Capital, GSR and more. With their earlier acquisition of 176,261 ETH for $463M earlier this month, they officially became the largest publicly-traded ETH treasury company. They have since acquired another 12,207 ETH, bringing their total holding to 188,478 ETH.

Originally a provider of sports betting conversion tools and affiliate marketing services, SharpLink Gaming initiated a strategic pivot in early 2025. The company's leadership identified Web3 gaming as the next frontier of digital interaction and saw holding Ethereum's native asset, ETH, as the most direct way to invest in the ecosystem's foundational layer. The landmark $425 million private placement, backed by a consortium of crypto-native venture giants, provided the capital to transform its balance sheet and rebrand the company as a key player in the digital asset space, moving beyond its original business model.

SharpLink Gaming's strategy is part of a growing trend where publicly-traded companies add digital assets to their balance sheets. This movement was pioneered by companies like Strategy, which famously adopted a Bitcoin treasury strategy to hedge against fiat currency inflation and position itself for the growth of the digital economy.

By staking its ETH, SharpLink actively participates in securing the Ethereum network and earns rewards in return. The choice to use a liquid staking solution like Liquid Collective allows the company to stake its assets while receiving a liquid token (LSETH) that represents its holdings. This token continues to accrue staking rewards but remains tradable and can be used in other DeFi applications, providing financial flexibility that would be lost with traditional staking. SharpLink's treasury is not just a passive holding, but an active, yield-generating operation.