August 13, 2025

at

9:45 am

EST

MIN READ

How BitMine became the third Biggest Crypto Treasury Company

BitMine has announced ETH holdings of 1,150,263 tokens with a dollar value of nearly $4.9 billion. This makes BitMine the third largest crypto treasury company in the world, ahead of Twenty One Capital.

Strategy (#1) has over $74 billion in crypto holdings whilst Mara (#2) has $6 billion.

BitMine has reached this point after an aggressive ETH acquisition strategy which started late June 2025. The company has since been consistently acquiring large quantities of ETH.

The company started with zero holdings in ETH and then on June 30th began acquiring, starting with a $250 million placement, followed by another on 8th July, and then a $500 million placement on 14th July.

These purchases fall under the company’s ‘Alchemy of 5%’ strategy in which the company hopes to acquire 5% of the entire ETH circulation.

The company also claims to be a highly liquid stock with trading volume at $2.2 billion daily. BitMine claimed in a post on X that the company is ranked #25 in global trade volume out of 5,700 US listed stocks.

Before becoming the largest and most famous ETH treasury company, BitMine was a Bitcoin mining company.

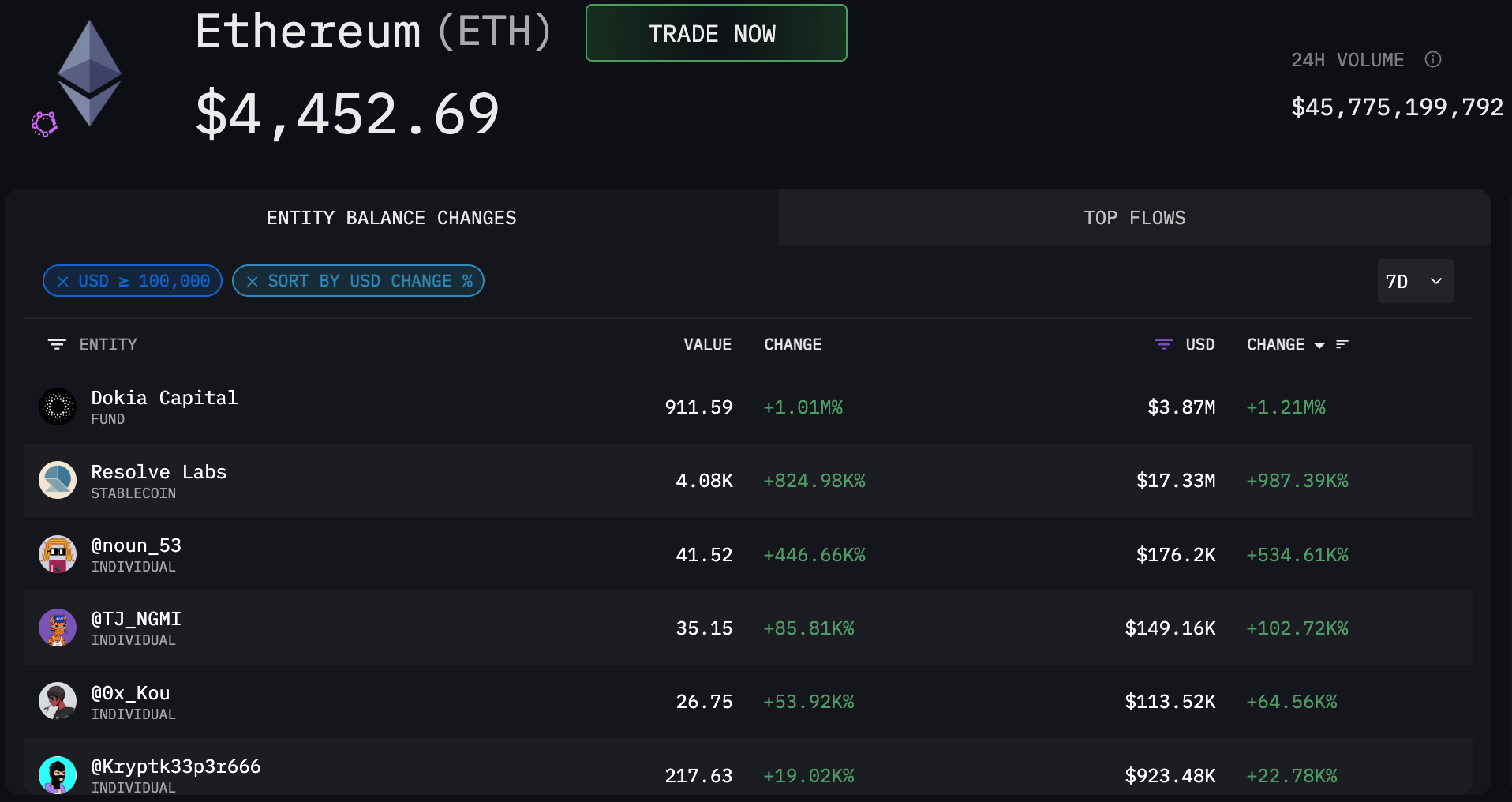

Ethereum has been on a tear in the last few months, up 72% since July 1st. The token has been largely outperformed by Bitcoin in 2025 but in the last few months it has surged and is now on an equal footing with Bitcoin for YTD performance.

ETH has been benefitting from the trend towards ETH treasury companies and also from the approval and launch of nine spot ETFs. In recent weeks, these ETFs have experienced large inflows and have at times outperformed the BTC ETFs.

BitMine’s aggressive acquisition strategy will also have helped to boost the price of Ethereum with the company controlling 0.9% of the supply.