August 14, 2025

at

11:30 am

EST

MIN READ

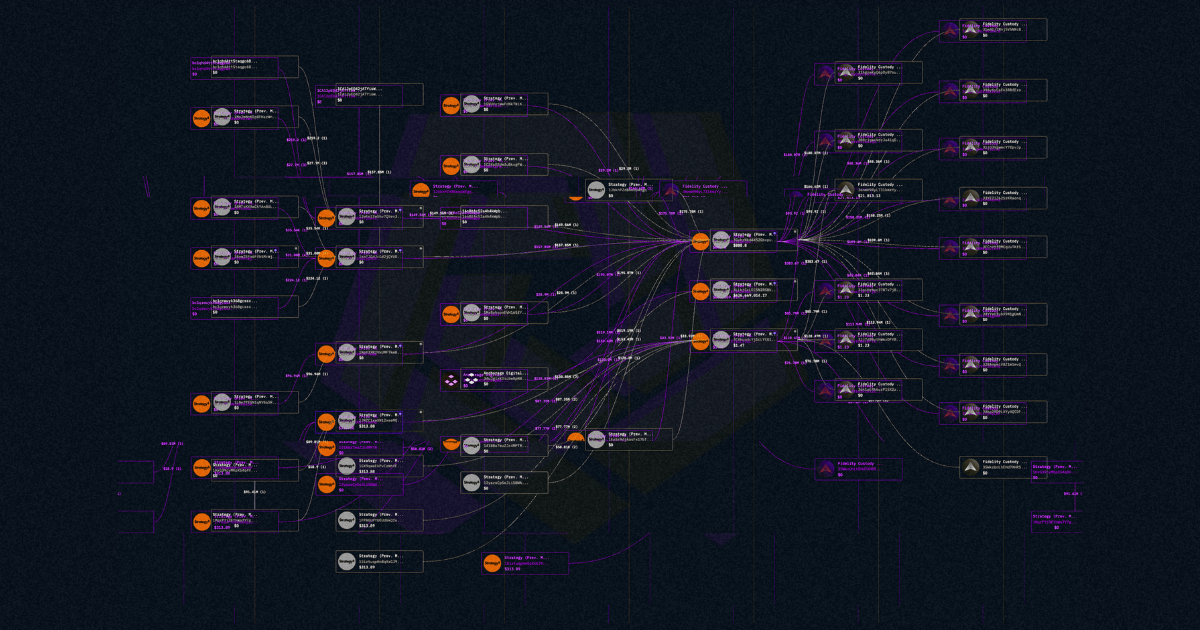

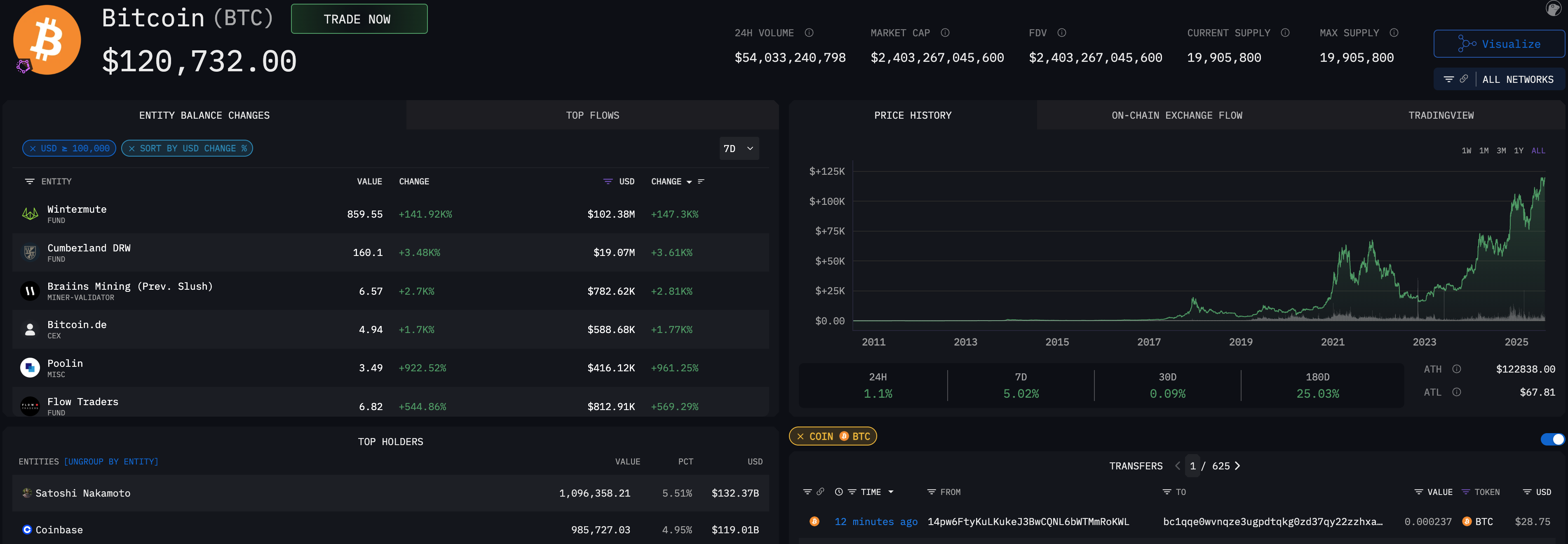

Strategy now has nearly 629k Bitcoin

Strategy has acquired 155 more BTC to take their total holdings to 628,946, nearly 3% of total supply. The move comes just a week after Strategy made its largest purchase of 2025, acquiring 21,000 Bitcoin.

Strategy now has over $30 billion of unrealised profit.

The company that has been so successful at evangelising the idea of crypto treasury companies continues to consolidate its position as one of the biggest Bitcoin holding entities on Arkham Intel.

The software company’s most recent purchase was one of their smallest in the last few months, with a dollar value of $18 million.

Michael Saylor announced the purchase in a post on X Monday. He posted:

“Strategy has acquired 155 BTC for ~$18.0 million at ~$116,401 per bitcoin and has achieved BTC Yield of 25.0% YTD 2025. As of 8/10/2025, we hodl 628,946 $BTC acquired for ~$46.09 billion at ~$73,288 per bitcoin.”

This purchase is the second smallest of 2025. In March, the company executed a purchase valued at just $10 million.

Michael Saylor will feel vindicated that his crypto treasury strategy has looked to be a masterstroke so far. Not only is the stock price up 2,700% since their first BTC purchase, but other companies are copying.

Public companies now hold over $100B in Bitcoin, and private companies hold over $50B.

Bitcoin-holding companies benefit from increased investor appeal, a diversified treasury portfolio, potential for huge profits, and, as always, a hedge against inflation due to BTC’s inherently deflationary nature.

Critics claim that Strategy’s acquisition of 3% of the supply of Bitcoin is against the decentralised ethos of Bitcoin and gives Strategy considerable power to influence the market ad price of Bitcoin.