April 8, 2025

at

12:00 am

EST

MIN READ

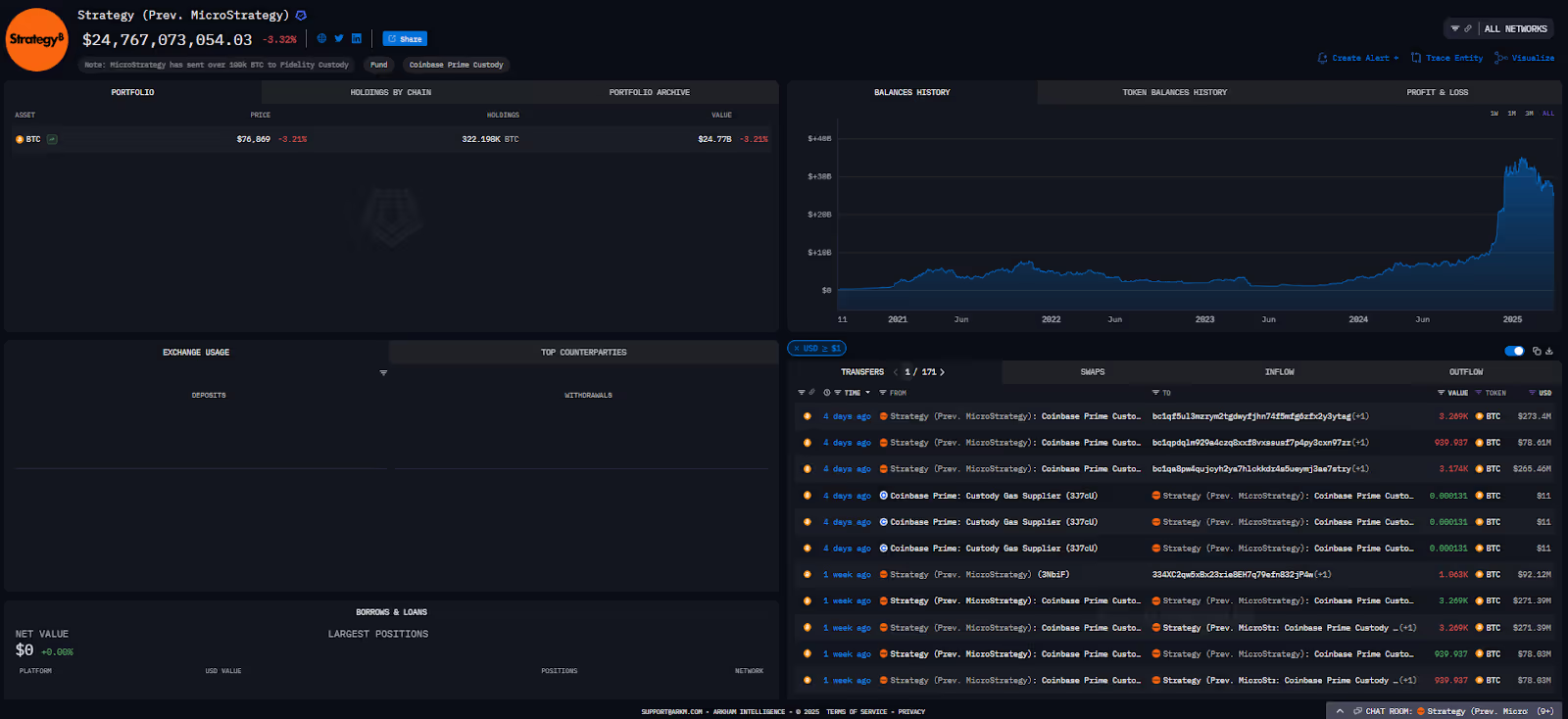

BTC 13% from Strategy's Average Price

Since the beginning of Strategy’s (formerly MicroStrategy) pivot to a Bitcoin treasury company, it has acquired a total of 528,185 BTC for a total of $35.63B. This puts his average cost price at $67,458. With the recent price declines amidst global trade war concerns, the current BTC price is just under 13% away from their average cost price.

The concept of "average cost basis" is critical for evaluating the health of a corporate treasury. Unlike a realized loss where assets are sold for less than they were bought, a dip below this price level puts the company's holdings "underwater" on paper. For public companies, this psychological threshold is significant; it represents the break-even point of their investment thesis. When the market price drops below the average cost, it often fuels investor anxiety regarding the sustainability of the company's strategy, potentially leading to volatility in the company's stock price alongside the asset itself.

While Strategy’s largest financial obligations are still in 2027 and beyond, in a recent 8-K filed by the company, they mentioned the ability to sell off some of their BTC holdings to meet their financial obligations. With the market’s reliance on Strategy’s purchases as a core narrative for BTC, a sale of any size from Strategy could easily shake the market’s confidence in the asset as a whole.

This fear stems from the economic reality of "market depth." While Bitcoin is a highly liquid asset, there are limited buy orders available at any specific price point to absorb a sale of this magnitude. If a "whale" entity like Strategy were to liquidate a significant portion of its holdings, the sheer volume of sell orders would likely chew through the available liquidity, driving the price down rapidly. This phenomenon, known as slippage, acts as a deterrent for large holders but remains a looming risk for the broader market should they be forced to sell.

.png)