February 15, 2025

at

12:00 am

EST

MIN READ

LIBRA Token Plummets After Javier Milei Deletes Tweet

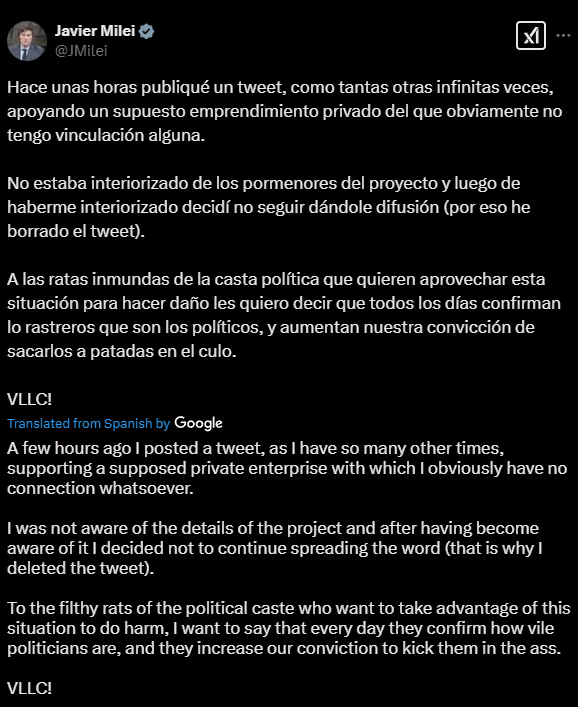

Over the weekend, the President of Argentina, Javier Milei, tweeted a contract address on Solana of a newly launched memecoin, LIBRA. While the token did initially surge to a peak valuation of $4.5B, it quickly plummeted 95% as President Milei deleted his original tweet and distanced himself from the token, stating that he was not endorsing the launch and it was “private enterprise” instead.

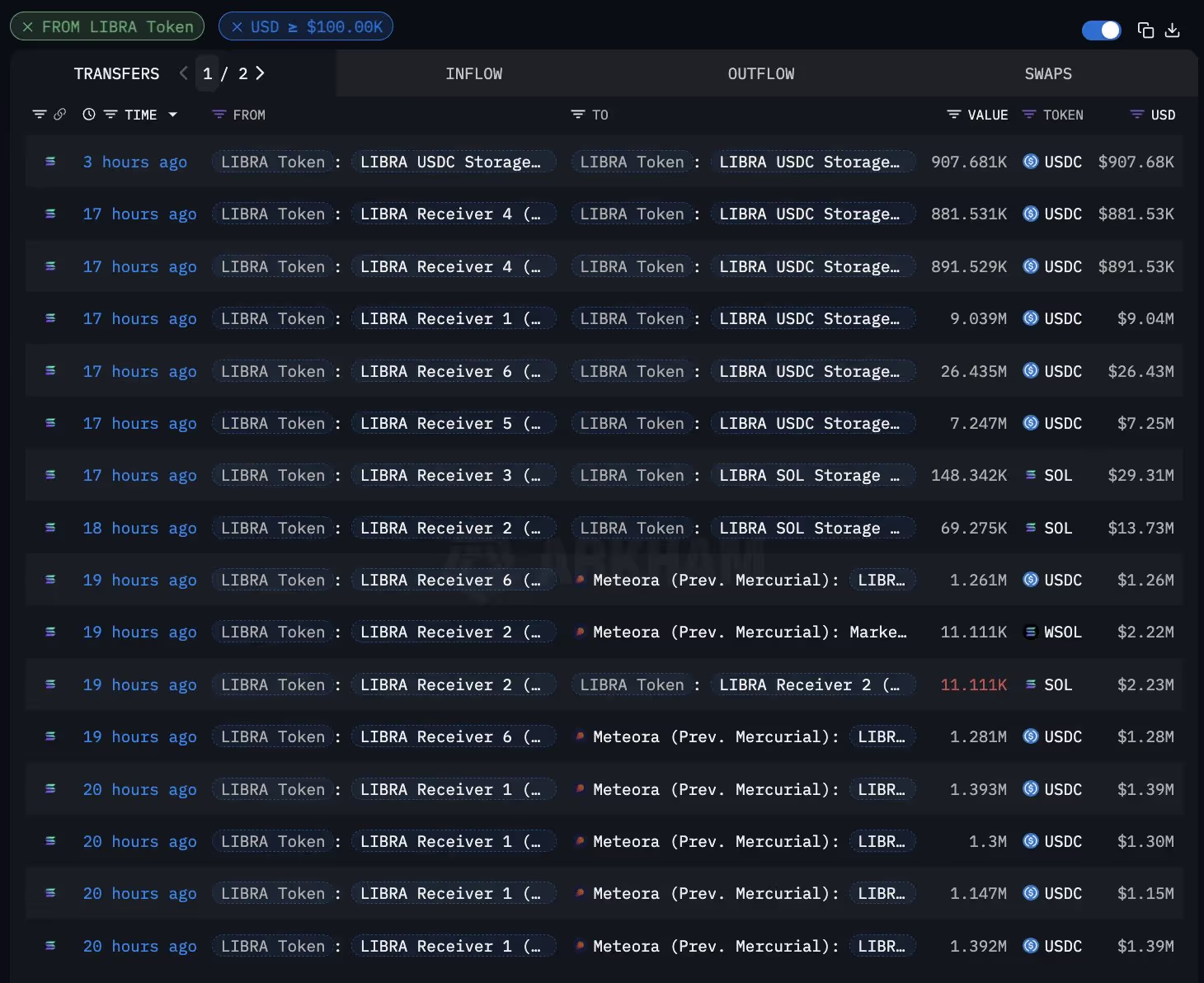

The extraction of value through liquidity provision in this scenario points to a sophisticated understanding of decentralized exchange (DEX) mechanics. In automated market makers (AMMs) on networks like Solana, liquidity providers earn a percentage of every trade as a fee. By supplying the initial liquidity for a highly hyped token, the deployers effectively positioned themselves as the "house" in a casino. As trading volume exploded into the billions due to the President’s tweet, these wallets passively collected immense sums in transaction fees before finally removing their liquidity and dumping the underlying tokens, executing a classic "rug pull" maneuver that left retail buyers with illiquid assets.

Furthermore, the volatility witnessed here is characteristic of "celebrity coins," a sector of the crypto market driven almost entirely by social signaling rather than fundamental utility. When a high-profile figure endorses a low-cap token, it creates an immediate demand shock that algorithmic trading bots, often referred to as "snipers", are programmed to exploit. These bots buy within the first seconds of a contract launch and sell into the subsequent wave of retail fomo (fear of missing out), exacerbating the pump-and-dump cycle and leaving latecomers with substantial losses once the initial catalyst is removed.

Behind the token launch, the token developer and addresses linked to the deployer have extracted more than $100M in SOL and USDC from the token launch, with many of them profiting off trading fees from liquidity provision and then later selling for SOL or USDC.

Rumors also circulated of several memecoin trading groups having insider knowledge of the token launch beforehand, with clipped streams of said traders mentioning it on stream during the token launch.

This incident serves as a stark reminder of the transparency inherent in public blockchains. While the President’s tweet was deleted, the on-chain trail remains immutable. Analysts can trace the flow of funds from the deployer wallets to centralized exchanges or other DeFi protocols, permanently linking the "insider" wallets to the event. This on-chain evidence often contradicts public statements regarding lack of involvement, as the timing of wallet funding and token deployment can be mathematically correlated with the public endorsement to millisecond precision.

.png)