January 16, 2026

at

8:15 am

EST

MIN READ

A Guide To Crypto Treasury Companies in 2026

Introduction to the Crypto Treasury Strategy

A crypto treasury company is a publicly traded business that holds a significant portion of its assets in cryptocurrencies. Crypto treasury companies, or Digital Asset Treasury (DATs) companies exist primarily through Bitcoin and Ethereum, although there are DATs for Solana, XRP, Tron and more.

In practice, this results in the stock’s price action often mirroring that of the crypto investment they hold, with some describing such companies as betas to their underlying investments. As such, investors who seek exposure to digital assets but prefer exposure via traditional equity markets can opt to gain indirect access through such companies.

The core playbook is simple:

- The company first raises money from public markets usually through stock or debt issuance

- The proceeds are utilized to acquire and hold the digital assets of choice

This strategy was pioneered by Strategy (formerly MicroStrategy) in 2020, pivoting from their stagnant software development business to their current Bitcoin treasury strategy. As Strategy made a name for themselves with the surge in Bitcoin prices, the playbook has since been adopted by several other new players. Other companies such as Marathon Digital Holdings (MARA), BitMine Immersion Technologies Inc. (BMNR) and even household names like Tesla and SpaceX have adopted crypto treasuries to varying degrees over the years.

Summary

- A crypto treasury company is a publicly-listed company that acquires and holds a significant portion of their assets in one or more cryptocurrencies.

- They raise capital via stock or debt issuance, giving investors indirect access to crypto exposure via traditional equity markets.

- The crypto treasury strategy amplifies both upside and downside, with risks tied to volatility, leverage, and regulation.

- On-chain analysis tools like Arkham Intelligence provide real-time tracking of holdings and movement of funds in crypto treasury companies.

Who Are They?

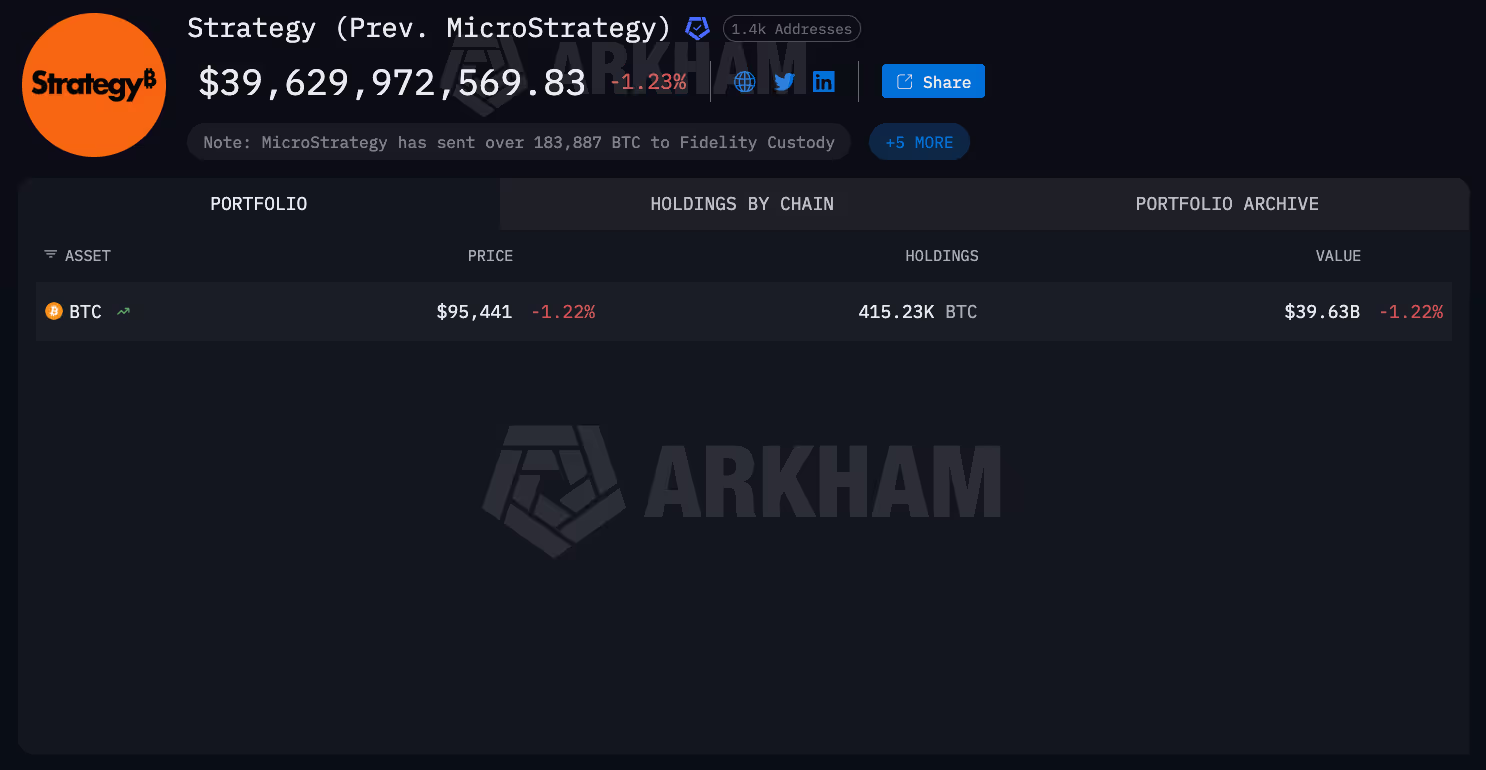

Strategy (formerly MicroStrategy)

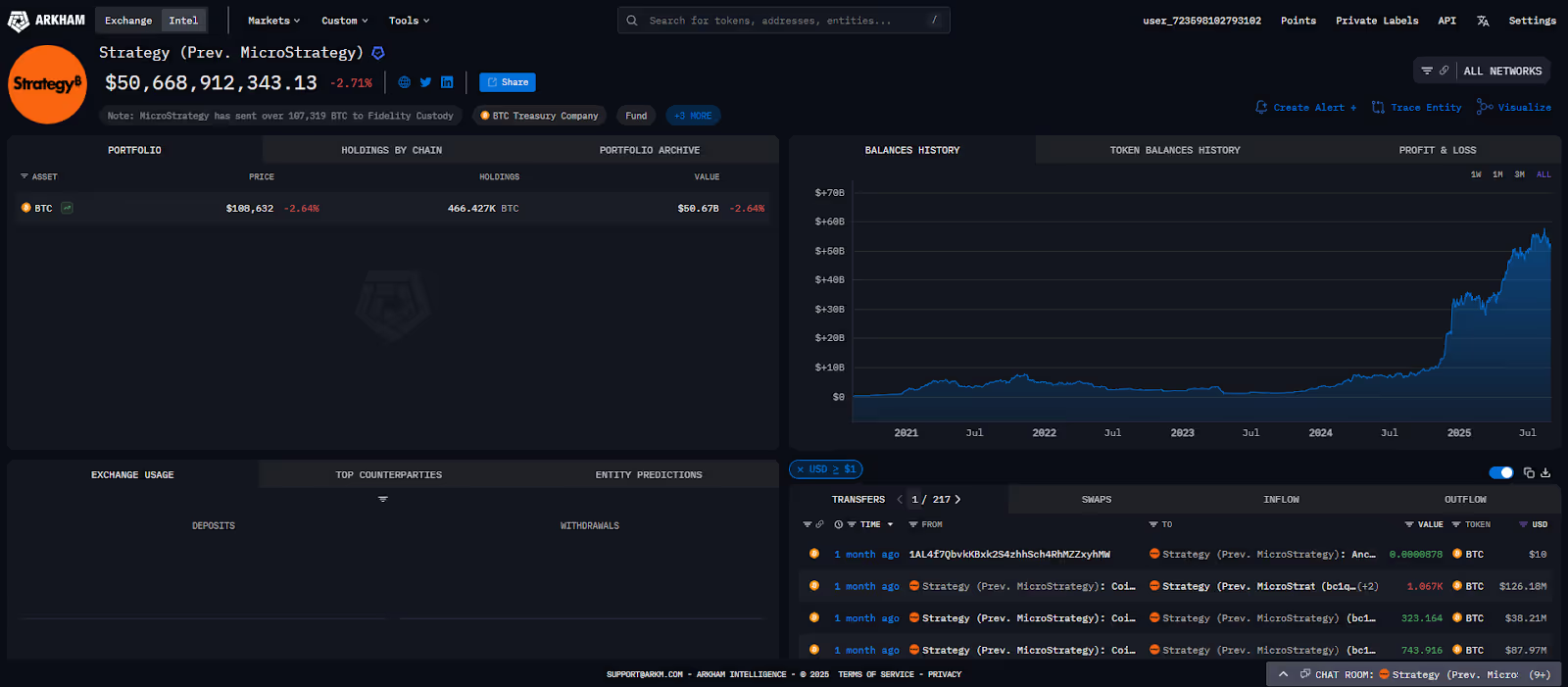

The crypto treasury business model originated with Strategy (then MicroStrategy), which operated a software development business. Under the leadership of founder and CEO, Michael Saylor, the company pivoted to their Bitcoin treasury strategy, directing all excess cash and new capital into acquiring Bitcoin. Almost five years since their first purchase, Strategy is today the largest corporate holder of Bitcoin, holding more than 687K BTC.

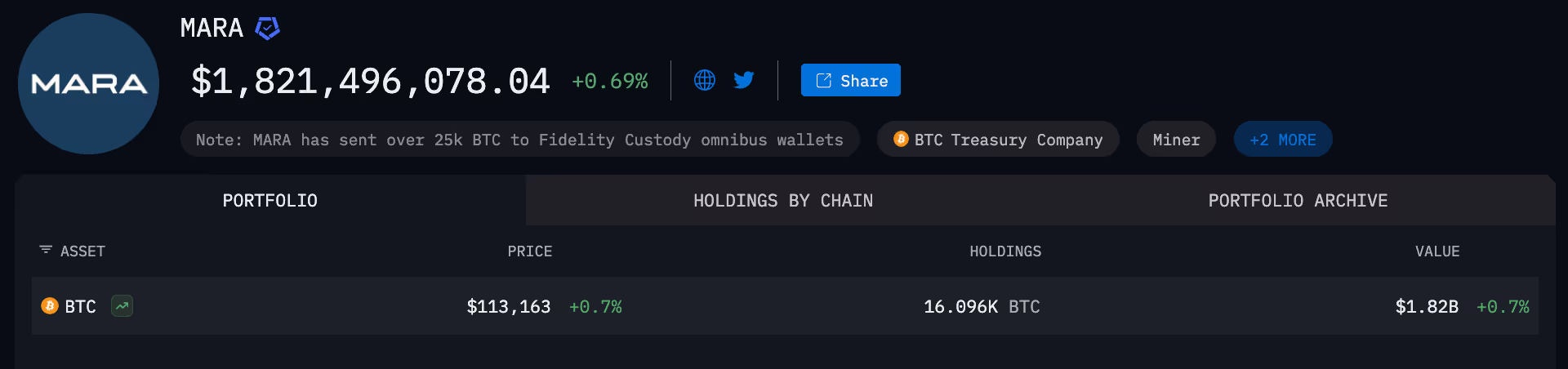

Marathon Digital Holdings (MARA)

Marathon Digital Holdings is one of the largest publicly traded Bitcoin miners in the world. As a Bitcoin mining firm themselves, Marathon Digital takes on a hybrid approach for their Bitcoin treasury strategy, accumulating Bitcoin through their mining operations as well as through using the proceeds of debt and equity issuance.

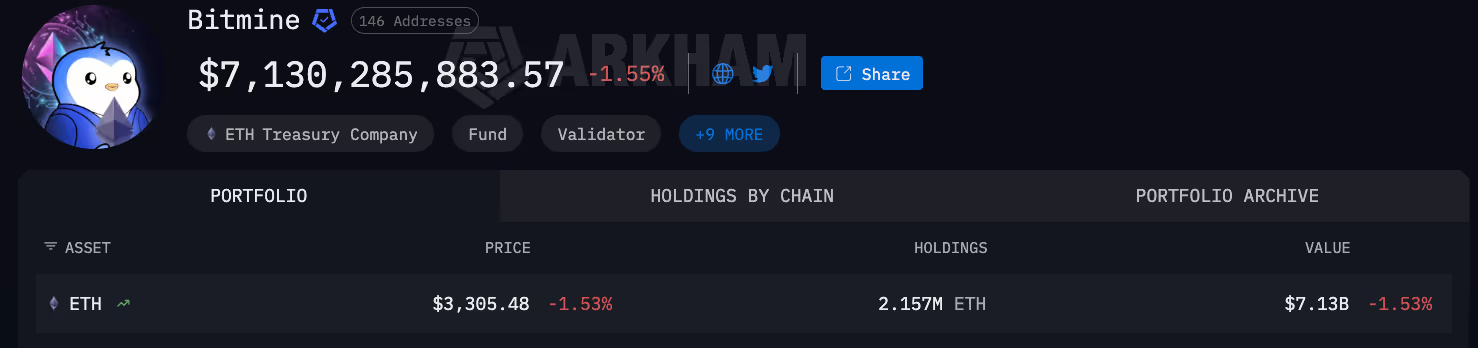

Bitmine Immersion Technologies Inc. (BMNR)

In a crypto treasury strategy helmed by FundStrat’s Tom Lee, Bitmine Immersion Technologies has quickly risen over the past few months to become the leading Ethereum treasury company. Interestingly, Bitmine is a Bitcoin mining firm, which initially accumulated Bitcoin as part of their overall business strategy, similar to Marathon Digital. However, they have since sold most of their Bitcoin for Ethereum, in line with their new treasury strategy. As a Proof-of-Stake (PoS) network, Ethereum treasury companies such as Bitmine are able to generate additional yield on their treasury holdings through staking their Ethereum tokens.

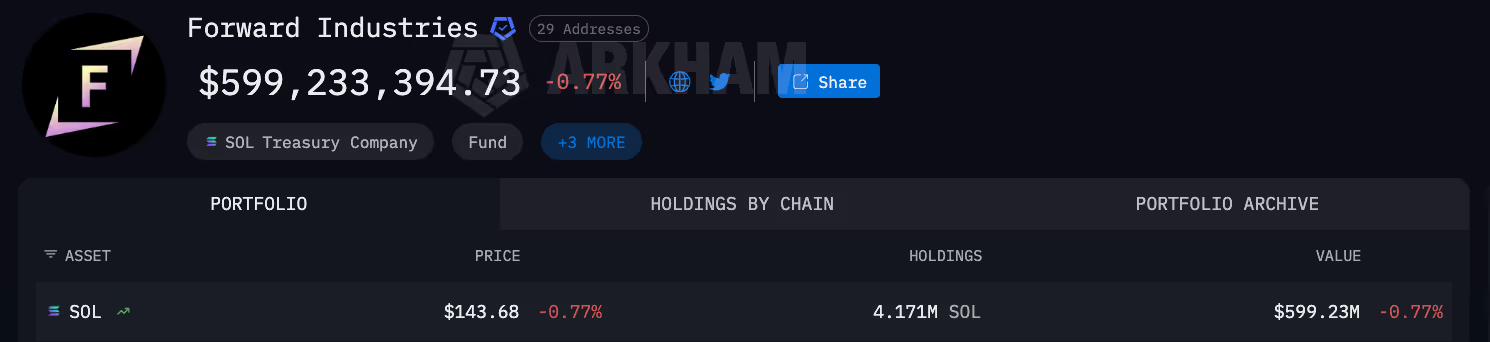

Forward Industries (FORD)

Forward Industries is the biggest pure Solana treasury company. The design company has verifiable on-chain holdings of SOL worth (at the time of writing) $600 million. It holds nearly 7 million SOL. The company funded it's SOL purchase through a PIPE deal with Galaxy Digital, Multicoin and Jump. Since completing its first SOL purchase, and becoming the biggest SOL treasury company, it has announced a $4 billion ATM offering and its intention to tokenize its own FORD shares using Superstate's Opening Bell platform.

Read our explainer on Forward Industries here.

Other Notable Names

Beyond the above few, several newer companies have also adopted the crypto treasury strategy in the 2024/2025 cycle, inspired by the success of Strategy. A notable name is MetaPlanet, a Japanese hotel operator, which has since been dubbed the “MicroStrategy of Asia”, with a treasury of now 35K BTC. In 2025, many Ethereum treasury companies emerged with names like SharpLink Gaming and The Ether Machine entering the space.

Other more well-known names have also dabbled in crypto treasuries, albeit to a smaller degree. Elon Musk’s Tesla and SpaceX famously added Bitcoin to their balance sheets in 2021, which then resulted in a surge in the price of Bitcoin. Although they have since sold off the majority of their holdings, the two companies still hold a combined 19.7K BTC.

When Did it Start?

The crypto strategy was pioneered by Michael Saylor under MicroStrategy in 2020, led by his belief that Bitcoin was a better hedge against inflation than traditional fiat currencies. He likened it to gold, highlighting Bitcoin’s capped supply of 21 million coins, which protects it from the value erosion that traditional fiat is subjected to. This was especially so in 2020, due to the impacts of a low-interest rate environment and quantitative easing from the world’s governments.

Back then, the strategy was viewed as a novel and radical concept, with few corporations holding Bitcoin on their balance sheets, much less as their primary business model. However, as the success of the MicroStrategy playbook showed itself in the bull run of 2024/2025, the playbook quickly became the blueprint for new crypto treasury companies.

Bitmine recently took their stack of staked ETH tokens to nearly 1.7 million, equating to over 1% of the supply of Ethereum. Bitmine’s staked ETH tokens represent more than 1% of the total Ethereum supply. Assuming a conservative estimate of 2.8% APY, this equates to $157 million a year. An optimistic APY of 3.5% equates to $196 million a year.

How Does It Work?

The crypto treasury strategy generally follows a standard sequence of events:

- Raising Capital: Companies first raise capital via stock issuance through At-the-Market (ATM) offerings or debt issuance through convertible notes or bonds to raise cash. In essence, these investors directly fund the company’s ability to acquire more crypto. Other available methods of raising cash also include private investment in public equity (PIPE) deals, which have become popular in recent months to fund crypto treasury companies.

- Acquiring Crypto: The capital raised is then used to buy Bitcoin, Ethereum, or any other digital asset that they have selected for their strategy. These purchases are made either through open markets or via over-the-counter (OTC) transactions to avoid slippage.

When investors buy shares in these companies, which trade on traditional stock exchanges, they gain indirect exposure to crypto prices without the need to custody tokens themselves. In addition, companies may be able to raise capital at premiums in trending markets, which would enable them to accumulate more crypto per share than an individual investor could. This combination of equity markets and crypto balance sheets makes treasury companies unique financial vehicles.

What are the Risks?

While initially an attractive value proposition, crypto treasury companies are not without their own unique risks.

As an asset class known for volatility, it is no surprise that the main risk to crypto treasury companies is the downside volatility on their treasury assets. A crash in crypto prices can easily lead to large losses for the company and its investors.

In a drawn out bear market, the company may also need to sell off a portion of their treasury assets for operational expenses or to repay debt owed to investors. This further locks in their losses suffered from the price decline of their treasury assets.

Finally, crypto treasury companies have only come into existence over the last five years, with mainstream acceptance only in the last year or so. The regulatory and accounting treatment of crypto treasury companies and their assets are still ever-changing and may adversely affect existing crypto treasury companies in a less crypto-friendly environment.

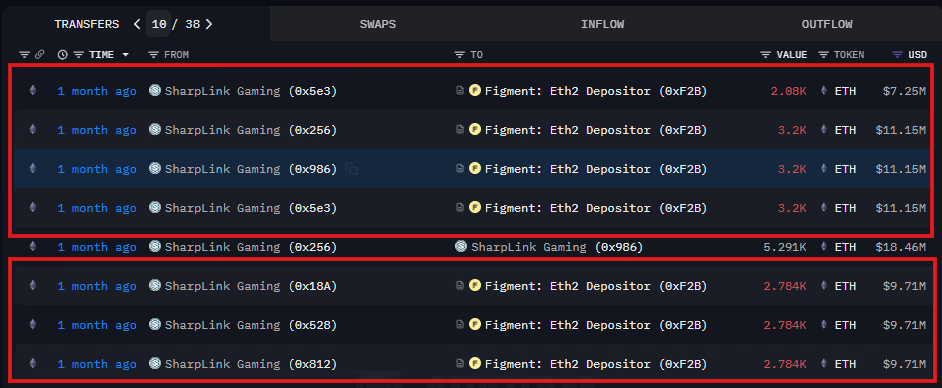

How to Track on Arkham?

When the valuation of a company largely relies on the actual amount of crypto they hold, transparency is a top priority for investors. Arkham Intelligence provides the tools to track these crypto treasury companies in real-time.

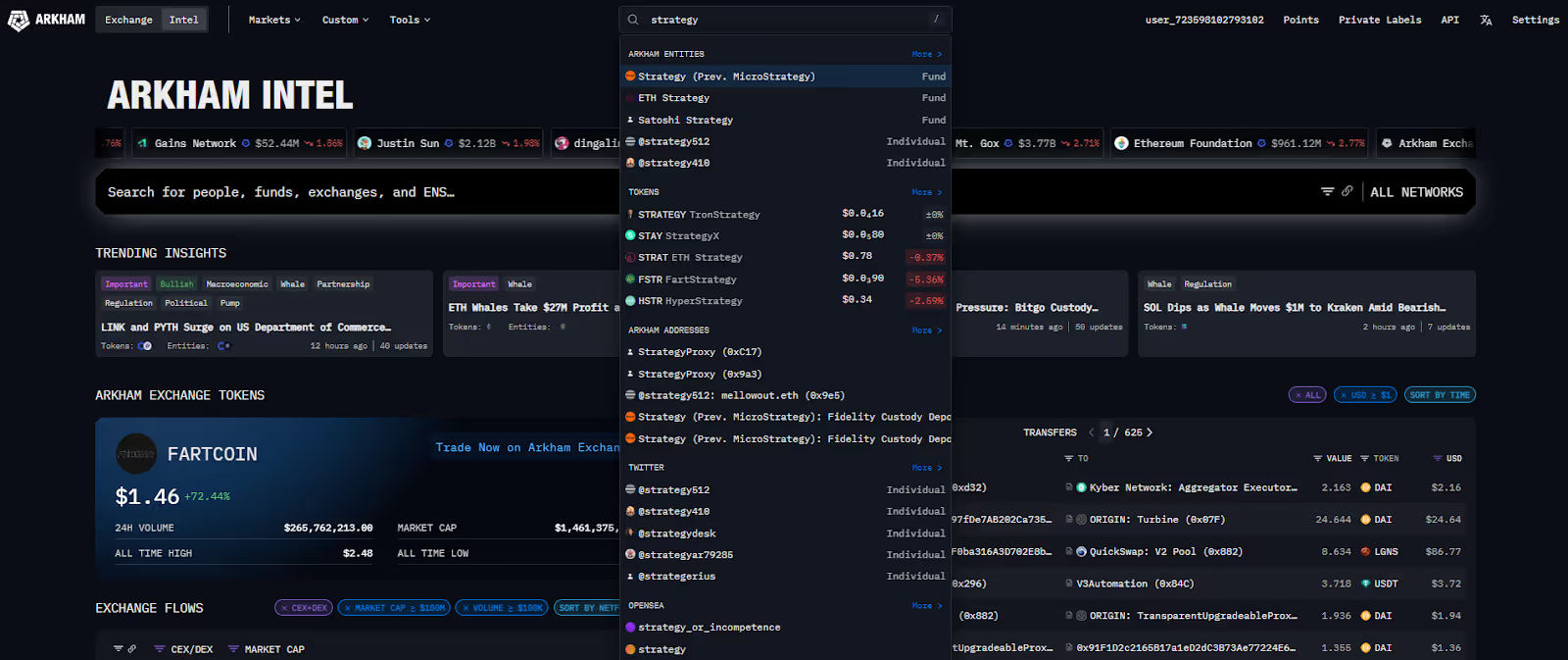

- First, search for the public company’s entity on Arkham Intelligence (e.g. “Strategy” or “Bitmine”).

- Dive into their on-chain balances, recent transfers in and out of the entity’s wallets as well as the addresses they regularly interact with.

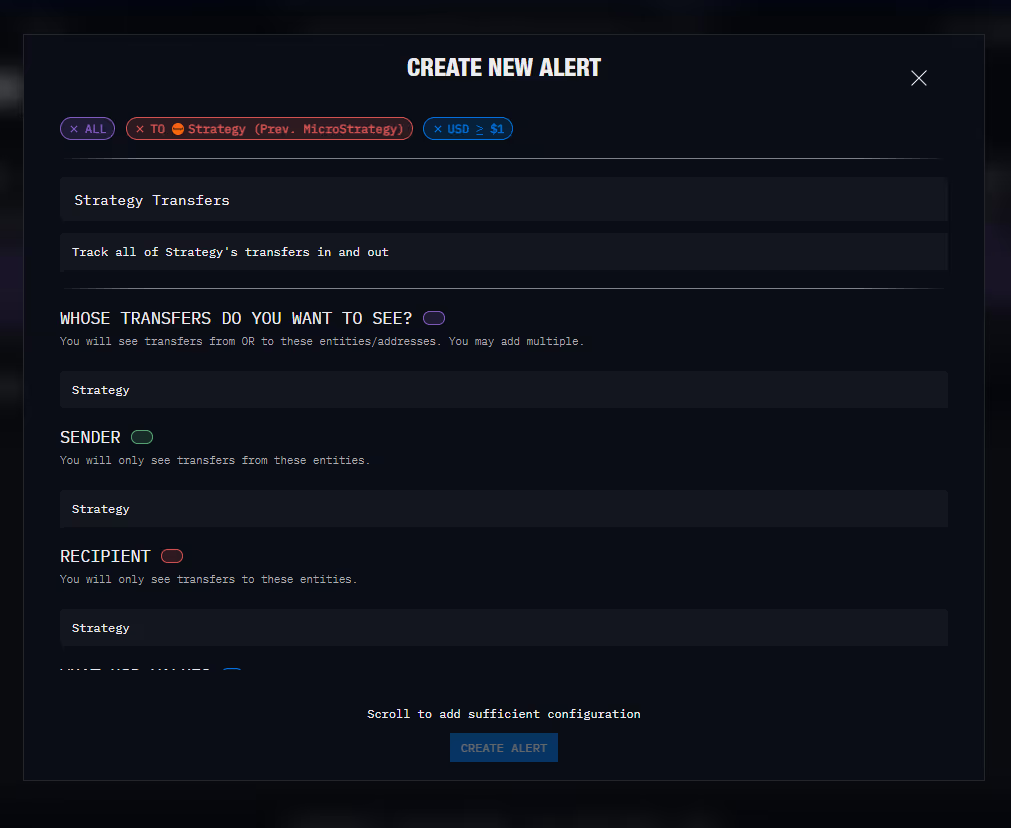

- Set custom alerts to be notified on movements in and out of your selected entity’s addresses, filtered down by transaction value, tokens, chains and even specific counterparties. Such alerts provide users with real-time insights on an entity's on-chain activity, even before news outlets report on them.

What Is Meant By NAV and mNAV?

In discussions regarding crypto treasury companies, NAV and mNAV are terms that frequently come up.

Net Asset Value (NAV) refers to the current total market value of a company’s crypto assets. If a company holds 10,000 BTC, with the current price of BTC at $100K, the NAV of the company’s crypto holdings is $1B.

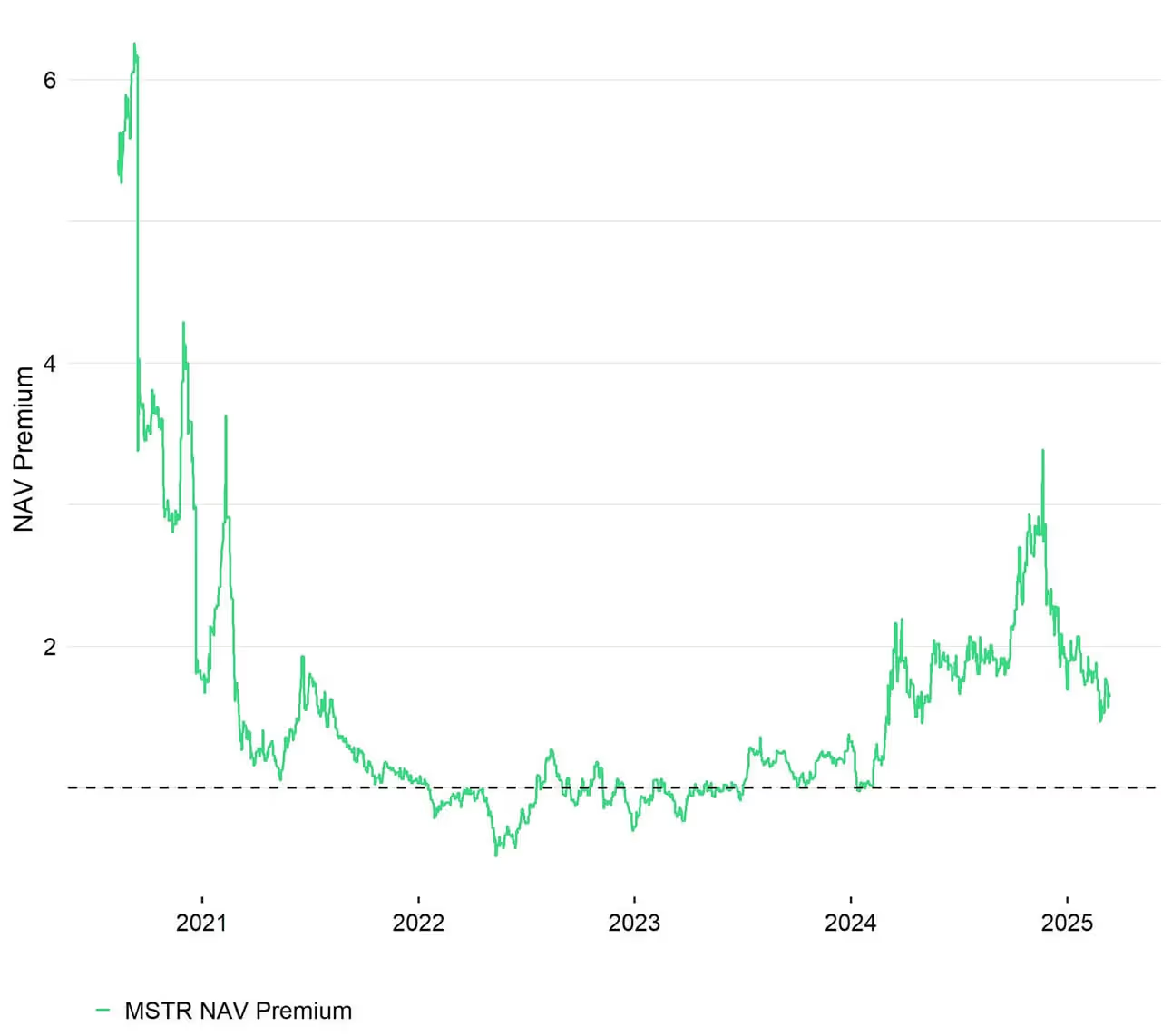

Multiple of Net Asset Value (mNAV) is a ratio which measures the enterprise value of a company to its NAV. Using the same company holding 10,000 BTC at $100K per BTC, if the company has an enterprise value of $1.5B, it can be said that this company has a mNAV of 1.5.

The mNAV of a company is often used as a measure of the premium that investors are willing to pay for this company currently. The higher the premium, the more easily a company is able to raise capital for future crypto purchases.

However, mNAV can also be seen as a measure of how overvalued or undervalued a crypto treasury company is. In bullish conditions, mNAV may rapidly increase due to investors piling in without regard for the underlying NAV. Similarly in bearish conditions, the reverse can also happen.

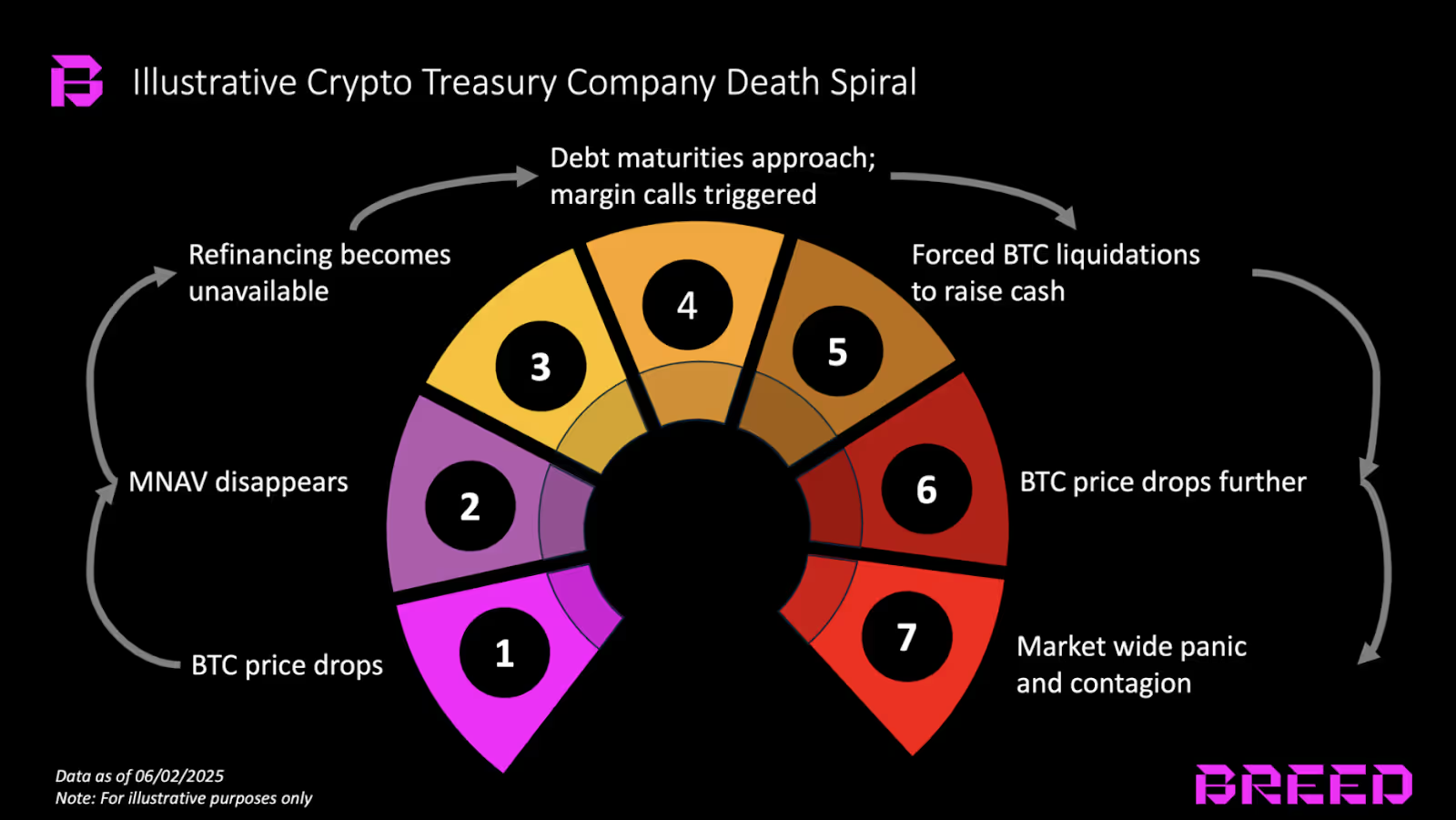

What Happens if the BTC Price Crashes?

As Bitcoin prices fall, naturally the publicly traded stock of these crypto treasury companies will take a hit, often to a larger degree than their underlying crypto assets. Balance sheets will record their losses on their treasury assets, which could shake investor confidence in the company. If the company has outstanding debt, treasury assets may have to be sold off to repay their debts, which could further impact investor confidence.

Additionally, companies may face a “death spiral” situation where they continue to issue stock at depressed prices, resulting in dilution and further downward pressure on their stock price.

What Are the Differences Between BTC and ETH Treasury Companies?

Although similar on the surface, the fundamental differences in Bitcoin and Ethereum are also reflected in their respective treasury companies.

Bitcoin is often compared to digital gold as a store of value, which supports a more “buy and hold” strategy. Ethereum, on the other hand, is often viewed as a productive asset, due to its role in the Ethereum ecosystem.

Additionally, Ethereum’s PoS mechanism allows Ethereum treasury companies to generate yield on their holdings via staking. Prominent ETH treasury company, SharpLink Gaming, is known to have staked almost all of their ETH with Figment, an institutional ETH staking service. This enables an additional revenue stream for the company beyond price appreciation of the asset, an option not available to Bitcoin treasury companies.

Similarly, due to Ethereum’s active DeFi ecosystem, some Ethereum treasury companies may eventually also choose to actively use their ETH in DeFi applications to increase their yields, although this introduces additional risks to their strategy.

Conclusion

Crypto treasury companies are one of the most distinctive financial innovations of the current bull cycle. Through bridging traditional corporate finance with crypto assets, they allow investors to gain exposure to digital assets through regulated equity markets. That said, it also comes with its own risks, including market volatility, leverage and potential regulatory hurdles in the future.

On-chain transparency through tools like Arkham Intelligence empowers investors, through real-time monitoring of their holdings and transactions, providing them with a layer of transparency that cannot be found in traditional finance.

Ultimately, the trend of crypto treasury companies illustrates the growing convergence between traditional finance and the crypto industry. Whether it endures will depend on market cycles, regulatory clarity, and the strategic discipline of the companies leading the charge.

.png)