February 25, 2026

at

5:20 am

EST

MIN READ

A Guide to the Max Pain Price in Crypto

The Max Pain Price is a price level where, theoretically, the maximum number of options expire worthless, resulting in the greatest loss for option buyers and the greatest gain for option sellers. This article is a guide to Max Pain, the Max Pain Price Theory, and an explanation of how it all applies to crypto.

The Max Pain concept originated in traditional equities and has since gained traction in crypto markets, particularly as Bitcoin and Ethereum options volumes have expanded across platforms such as Deribit, Binance, and OKX. Observers often note that, in the days leading up to an options expiry, price action appears to converge toward a particular level, the so-called “Max Pain” zone.

This phenomenon can have tangible implications for short-term price behavior, especially in the crypto markets where derivatives can heavily influence price. In this article, we examine the definition, calculation, and theoretical underpinnings of the Max Pain Price, and explore how it applies to cryptocurrency markets.

Summary

- Max Pain Price refers to the level at which the greatest number of options contracts expire worthless, maximizing losses for buyers and profits for sellers.

- Calculation involves analyzing open interest across all strikes to find the price where total option holder losses are highest.

- Max Pain Theory suggests prices often gravitate toward this level near expiries due to market maker hedging and delta-neutral positioning.

- In crypto markets, where derivatives heavily influence spot prices, Max Pain may indicate short-term price compression zones and extremes in market sentiment.

What is Max Pain Price?

The Max Pain Price is defined as the price at which the largest number of options, both calls and puts, expire worthless. It represents the point of maximum collective loss for option holders, and consequently, the point of maximum profit for option writers.

To understand why this level matters, a brief understanding of the basic mechanics of options is key:

- A call option gives the holder the right, but not the obligation, to buy an asset at a specified strike price.

- A put option gives the holder the right, but not the obligation, to sell an asset at a specified strike price.

If the underlying asset’s price settles below a call’s strike price, or above a put’s strike price, those options expire worthless. Conversely, the option seller, who takes the opposite end of the trade realizes maximum profit when the option expires worthless.

Across all strikes, there exists a single price where the greatest number of contracts on both sides simultaneously expire out of the money. This is the Max Pain Price. For instance, suppose Bitcoin has significant open interest in calls at $115,000 and puts at $110,000. If most contracts are concentrated around those levels, the price at which both sets of holders experience the least favorable outcome might be near $112,500. This would be the Max Pain level, the point where the maximum number of traders lose, and option writers, who sold those contracts, benefit most.

How to Calculate the Max Pain Price?

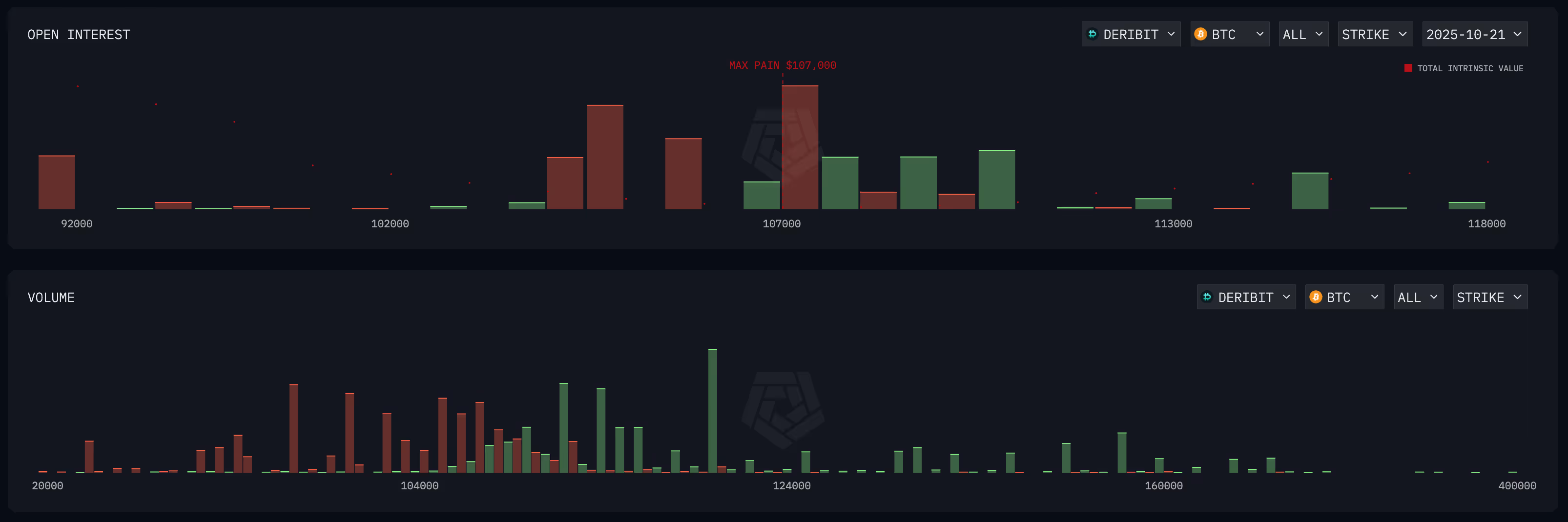

The calculation of the Max Pain Price involves analyzing the open interest, the number of active options contracts that have yet to be settled, across all strike prices and determining where the aggregate losses of call and put holders are greatest.

A simplified step-by-step process is as follows:

- Collect Open Interest Data: Obtain the open interest for both call and put options at each strike price. Most of the top crypto derivatives exchanges, such as Deribit and Binance, publish this information publicly.

- Estimate Potential Losses: For every possible expiration price, calculate the potential losses that option holders would incur if the asset settled there.

- Call option losses are realized when the asset settles below the strike price.

- Put option losses occur when the asset settles above the strike price.

- Sum Across All Strikes: Add the total losses for all open call and put options at each possible expiration price. The price at which this combined total is maximized represents the Max Pain Price.

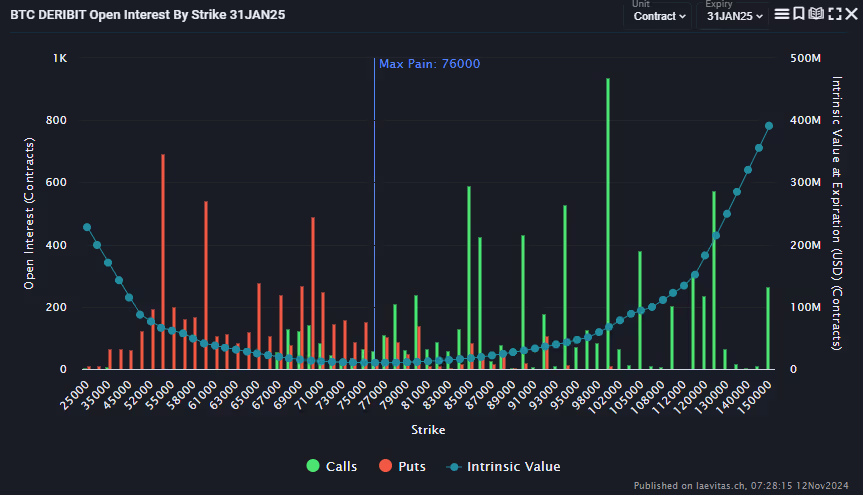

- Visualize the Result: Traders often plot these values on a chart, with strike prices on the x-axis and total loss, or open interest, on the y-axis. The point of the curve where loss is greatest marks the Max Pain level.

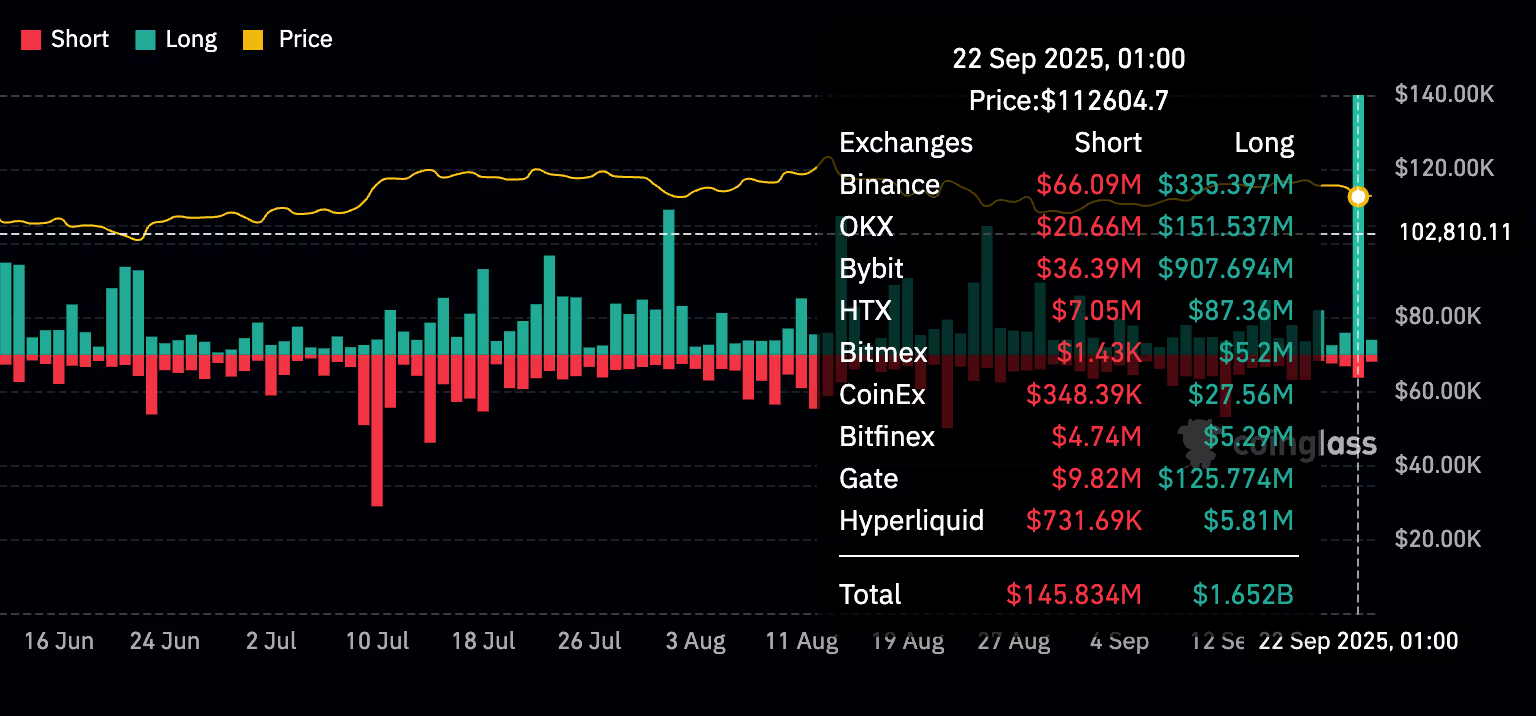

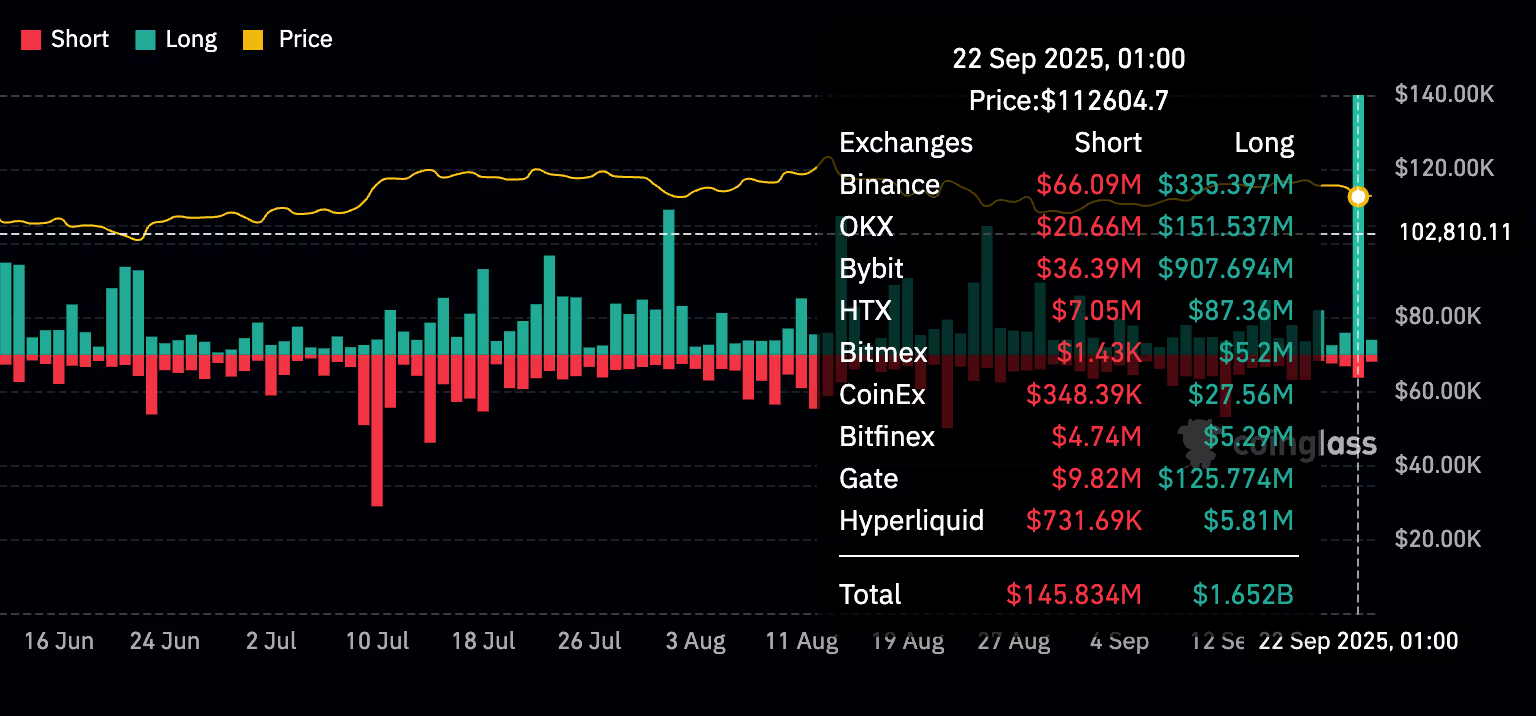

Several crypto analytics platforms, such as Coinglass, Laevitas, and The Block, provide automated Max Pain charts for major cryptocurrencies. For example, if the data suggests that Bitcoin’s Max Pain for a given expiry is at $76,000, analysts may observe that prices sometimes cluster near this zone as expiries approach.

However, it is important to note that the Max Pain calculation is descriptive rather than predictive. It highlights where losses would be maximized, but not necessarily where prices will settle.

What is The Max Pain Theory?

The Max Pain Theory builds upon the mechanics of options trading and the behavior of market participants. It suggests that asset prices tend to converge toward the Max Pain Price as options expiry approaches, largely due to hedging activity and market maker positioning.

The theoretical framework behind this idea posits that market makers are generally option sellers rather than buyers. These entities frequently sell both calls and puts to provide liquidity to option buyers in the market. As a result, this leaves them with exposure to the underlying asset’s price movements.

To remain market-neutral, market makers hedge their exposure by buying or selling the underlying asset. For example, if the market maker is short BTC calls, they are exposed to negative delta, meaning that they lose money on their positions as price rises. To counteract this negative delta, they may long spot BTC to hedge the risk of a quick surge in BTC price. These hedging actions are dynamic, with market makers adjusting their positions to offset risk as prices move.

As expiry nears, this hedging process can create self-reinforcing pressures that drive the price toward the level where their net exposure is minimized: the Max Pain Price. When prices rise above this level, call sellers hedge by buying the underlying to offset their short delta, which can apply upward pressure on price. Conversely, when prices fall below it, put sellers hedge by selling the underlying, applying downward pressure.

The combined effect can cause prices to “pin” near the Max Pain level during expiry periods. This phenomenon, known as options pinning, has been observed across traditional equities, commodities, and increasingly in crypto markets.

While this theory provides a compelling explanation for short-term price behavior, it should not be interpreted as a deterministic rule. Broader market forces such as macroeconomic data, liquidations, or significant news events can easily override these dynamics.

How Does It Apply to Crypto?

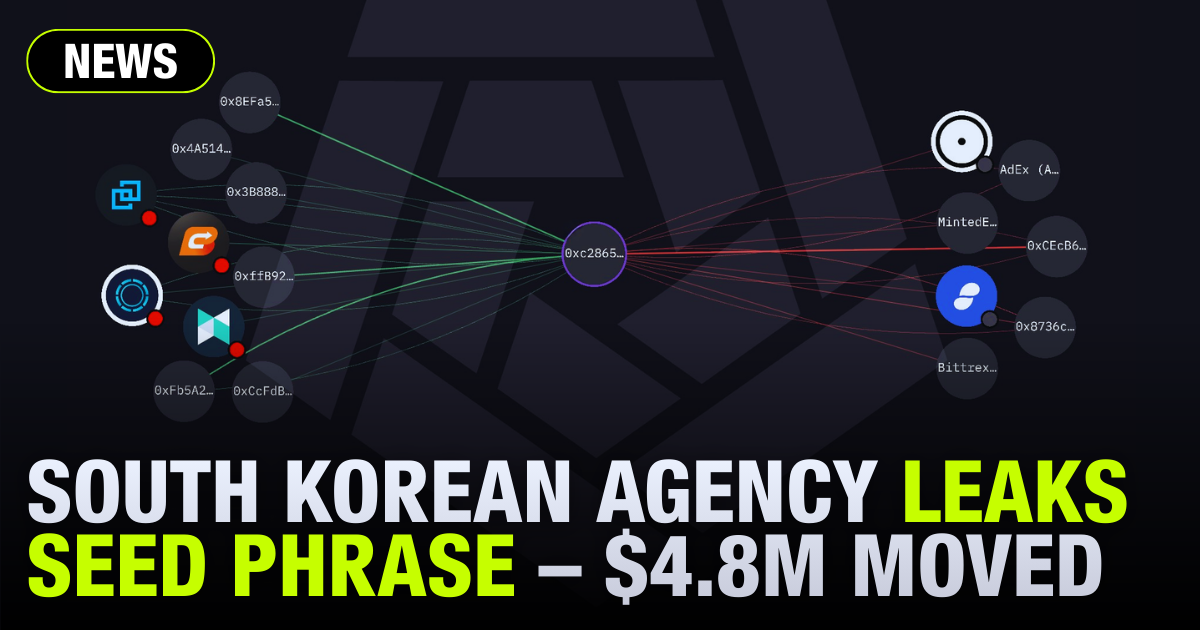

The Max Pain concept has found renewed relevance in the cryptocurrency space, especially as the crypto options market matured and larger traditional players entered the market. Platforms such as Deribit, which dominate Bitcoin and Ethereum options trading, now regularly record over several billion dollars in open interest. This deep liquidity means derivatives activity could potentially exert meaningful influence on spot prices.

Several characteristics of the crypto market further amplify the impact of the Max Pain effect on spot prices.

A significant portion of crypto options volume comes from retail and speculative traders, many of whom favor out-of-the-money contracts with low premiums and high potential payouts. Statistically, most of these contracts expire worthless, reinforcing the structural imbalance that gives rise to the Max Pain dynamic.

Additionally, due to the highly volatile and speculative nature of the market, crypto options markets feature weekly, and in some cases, daily expirations. This creates a continuous cycle of hedging and unwinding that keeps the Max Pain level relevant almost every week. Price behavior in the final days leading up to Friday expiries often reflects the gravitational pull of this price.

Unlike traditional markets, where derivatives follow spot activity, crypto often exhibits the reverse. Futures and options can influence the underlying spot price due to the often thin liquidity on orderbooks in crypto and the high leverage that is readily available. The approach of a large expiry can, therefore, suppress volatility until contracts settle, after which volatility often returns as hedges are lifted. Some speculators also bet on the reverse of the Max Pain effect after option expiries as the hedges are unwound. For example, if price gravitates downwards to the Max Pain price, prices may subsequently rebound after option expiry as market makers unwind their hedges.

As such, traders and analysts should monitor the Max Pain level as a contextual indicator rather than a trading signal. The Max Pain price can highlight price levels where volatility may temporarily compress and provide an insight into potential support or resistance zones near expiry. It may also offer perspective on sentiment in the market. If the spot price trades well above Max Pain, it may indicate over-optimism among call buyers. Consequently, if the spot price trades well below Max Pain, it could imply overly bearish sentiments fuelled by put buyers.

Regardless, the Max Pain framework should always be used in conjunction with other indicators, such as implied volatility, delta skew, and funding rates, to form a comprehensive market view.

Conclusion

The Max Pain Price is a key concept in options theory that offers valuable insight into how market structure and participant behavior can influence short-term price movements. In cryptocurrency markets, where derivatives play a crucial role in driving price action, understanding this dynamic can be particularly relevant.

At its core, Max Pain reflects the interplay between speculation and hedging. It highlights the point where the collective losses of option holders are maximized, often coinciding with a region of price stabilization around option expiries. While it is not a predictive tool in isolation, it provides context for understanding price compression, sentiment, and the influence of large derivatives positions on market behavior.

In essence, the Max Pain Price does not dictate where the market is headed, it only indicates where the market may choose to settle in accordance with the interests of large players in the market. Recognizing this dynamic allows traders to factor in its impact on their trades and better navigate the market’s short-term price action.

.png)

.png)

.webp)

.webp)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.webp)