August 20, 2025

at

10:10 am

EST

MIN READ

Solana ETF Decision Delayed

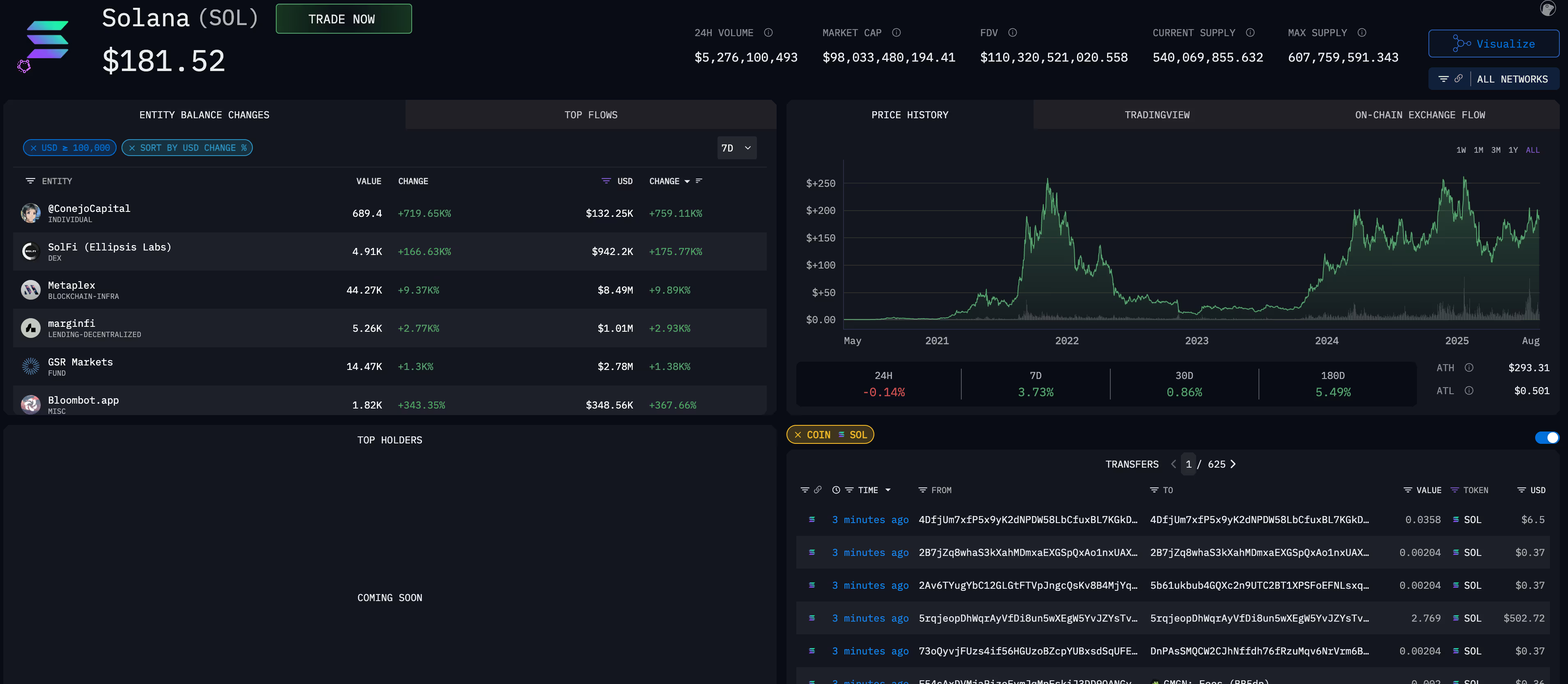

The US Securities and Exchange Commission (SEC) has this week delayed a decision on two spot Solana ETFs from Bitwise and 21Shares. They have pushed the deadline back to October 16th.

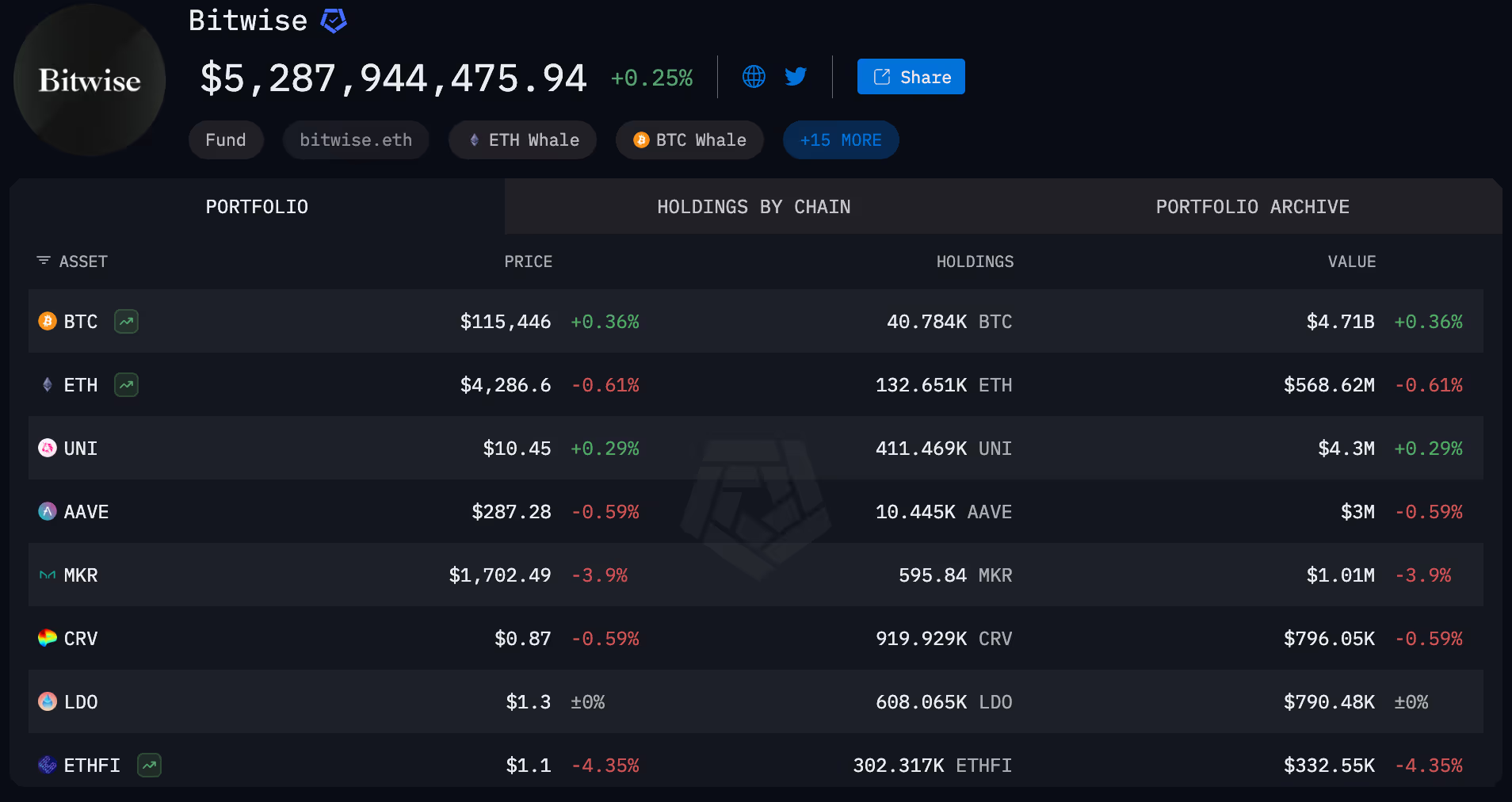

Crypto asset management firms Bitwise and 21Shares, who also run Bitcoin and Ethereum ETFs, were looking to provide investors with exposure to Solana through a regulated and traditional financial framework.

The SEC also delayed the decision on Trump’s Truth Social BTC and ETH ETF until 8th October, and an XRP Trust from 21Shares until 19th October.

October is set up to be a big month for crypto ETFs with several SEC decisions now scheduled for then.

The SEC delaying the deadline for a decision like this is normal, according to ETF expert James Seyffart. In May, he posted on X:

“The SEC *typically* takes the full time to respond to a 19b-4 filing. Almost all of these filings have final due dates in October. Early decisions would [be] the action that's out of the norm. No matter how "Crypto-friendly" this SEC is”

The delay in decision-making may be normal but it does not mean the approval of the Solana ETF is a foregone conclusion. Similarly, just because the ETH ETFs were approved, it also does not mean the SOL ETFs will receive the same treatment.

The SEC may, understandably, be more hesitant to begin approving ‘altcoin’ ETFs. There remains some significant regulatory hurdles to overcome before the Solana ETFs can be approved. Namely, the commodity vs. security debate which ETH was able to navigate through.

A commodity is a basic, interchangeable good, like gold, oil, or wheat, where the value comes from the good itself. You buy it for its direct use or because you believe its market price will rise due to supply and demand.

A security, on the other hand, is a financial instrument that represents an investment in a common enterprise with the expectation of profit to come from the efforts of others.

If the Solana ETFs are to be approved, the SEC will need to be convinced that, like Bitcoin and Ethereum, SOL is a commodity and not a security.

How much of this decision comes down to cold, hard facts, and how much of it comes down to pressure from a crypto-friendly administration is anybody’s guess.

.png)