September 2, 2025

at

6:00 pm

EST

MIN READ

The 90+ Alt-Coin ETFs Coming This Fall

The SEC is set to decide on the future of over 90 crypto ETFs this fall. Industry experts believe all of these are likely to be approved, but many are likely to fail due to poor inflows.

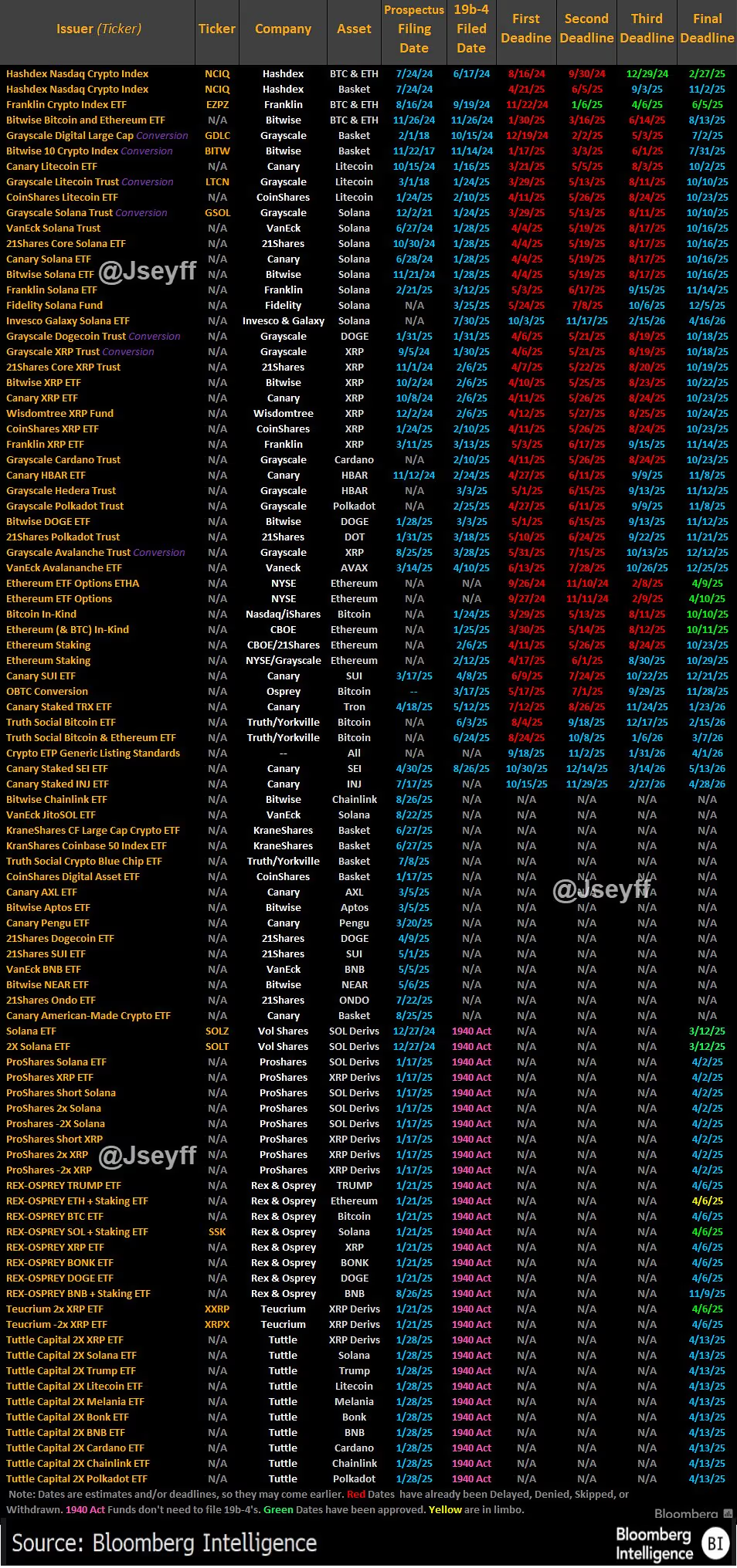

Bloomberg ETF analyst, James Seyffart, posted an image on X showing a long list of pending ETF applications that he is tracking.

The list consists largely of Solana, XRP and crypto index ETFs. However, there are also applications for Dogecoin, BONK, Trump and Melania official tokens, as well as Cardano, BNB, SUI, Litecoin, Chainlink and Polkadot.

It could be a very interesting time of year for the crypto industry. Experts are predicting strong inflows for Solana ETFs but potentially weak inflows to some of the others on the list.

Luca Prosperi, co-founder and CEO of stablecoin platform M0, said this:

“I don’t think many of them will be long-lived. I think there are very few, if any, [digital] assets that are large and mature enough to support an ETF beyond Bitcoin, Ethereum, and Solana.”

Whether he is right or not, the approval of the alt-coin ETFs is yet another sign of the continued enmeshing of the traditional and the crypto financial worlds. The significance of Grayscale’s legal victory against the SEC (which kickstarted the crypto ETF trend) in August 2023 continues to grow.

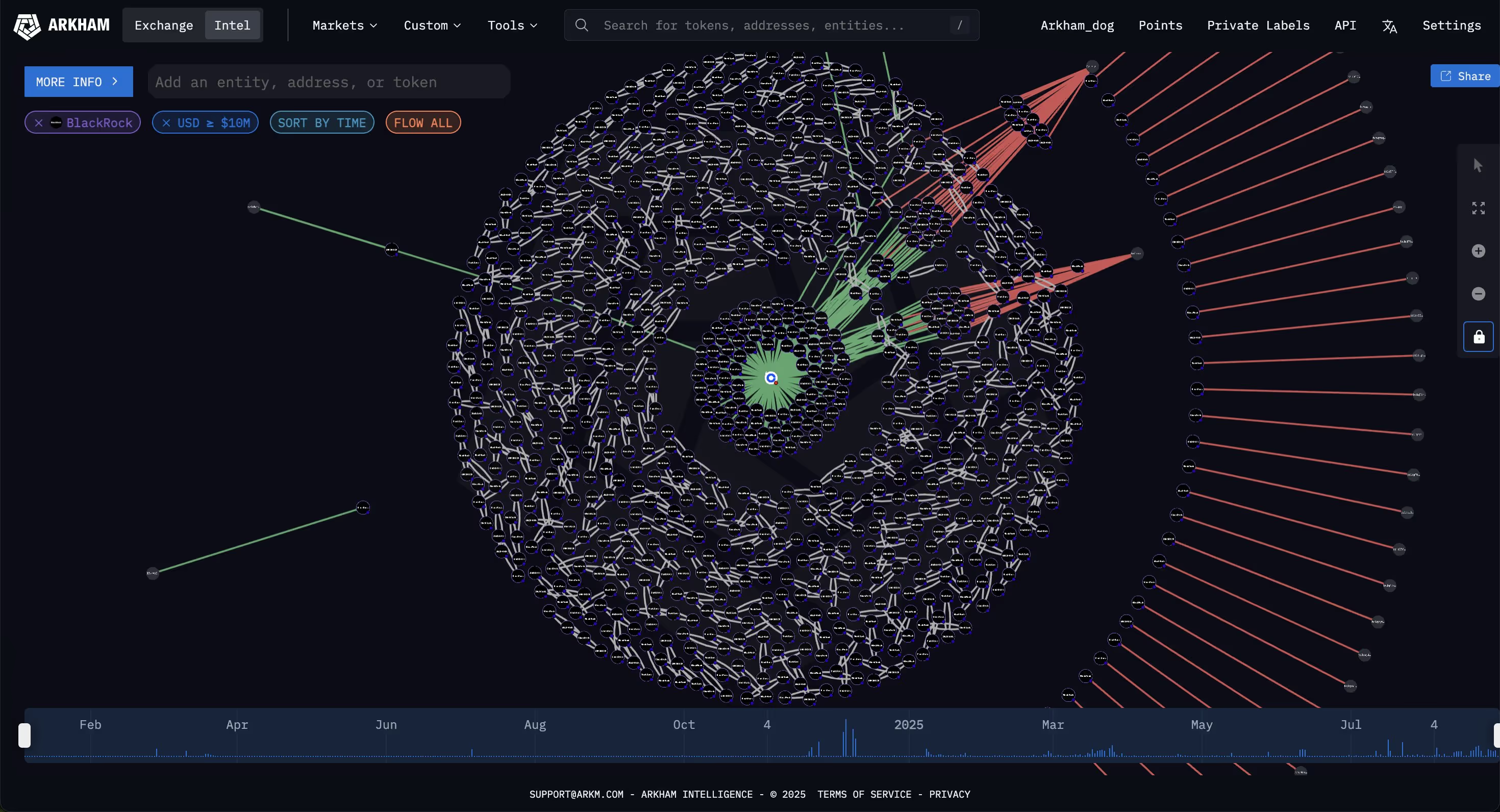

Total AUM for the approved BTC and ETH ETFs now stands at over $165 billion. Find out how to keep track of the biggest ETF entities on Arkham with our new ETF guide.

The Ethereum ETFs have been outperforming the Bitcoin ETFs in recent days. Last week, inflows for the Ethereum ETFs were comfortably over $1 billion. BlackRock alone bought $968.2 million worth of ETH.

Clearly there is an appetite among traditional investors to gain exposure to digital assets that aren’t Bitcoin via ETFs. Whether this appetite trickles down to memecoins like DOGE, BONK and MELANIA remains to be seen.

.png)