January 13, 2026

at

2:05 am

EST

MIN READ

SOL and XRP ETFs Have $1B+ in Assets - Here’s How To Track Them

Spot Solana ETFs, which launched in late October, hold over $1 billion in Solana after over 2 months of near solid inflows. Bitwise’s BSOL – which benefitted from being the first spot Solana ETF – leads the pack with $761 million in assets.

Grayscale’s GSOL, which launched only a day after BSOL on the 29th October, has $190 million in assets. Fidelity’s FSOL, which launched on the 18th November, completes the top three with $147 million in assets. There are eight spot Solana ETFs in total.

According to data from AI-powered crypto research platform SoSoValue, the Solana ETFs have recorded just three days of net outflows since they launched.

The spot XRP ETFs have performed even better than Solana ETFs, recording just one day of outflows (on 7th January) since they launched on November 14th. The XRP ETFs have outpaced Solana, reaching $1.5 billion in assets.

There are five spot XRP ETFs, all of which have over $250 million in assets:

- Canary’s XRPC ($373 million)

- Bitwise’s XRP ($305 million)

- 21Shares’ TOXR ($245 million)

- Franklin’s XRPZ ($270 million)

- Grayscale’s GXRP ($276 million)

The success of both the Solana and XRP spot ETFs has caused some of the largest financial institutions to pay attention. Wall Street giant Morgan Stanley recently submitted paperwork for a spot Solana ETF (along with a BTC ETF and an Ethereum Trust). However, WisdomTree recently withdrew its application for a spot XRP ETF without providing any reasons for the withdrawal.

As more products enter the market, keeping track of their daily inflows and outflows will be a key metric for Solana and XRP traders.

ETF flows indicate investor sentiment and potential future demand/supply for the underlying assets. Large flows can create temporary price pressure and impact liquidity, which traders can use in their strategies.

AI-powered crypto investment and research platform SoSoValue has a dashboard where traders can track both Solana and XRP ETF performance.

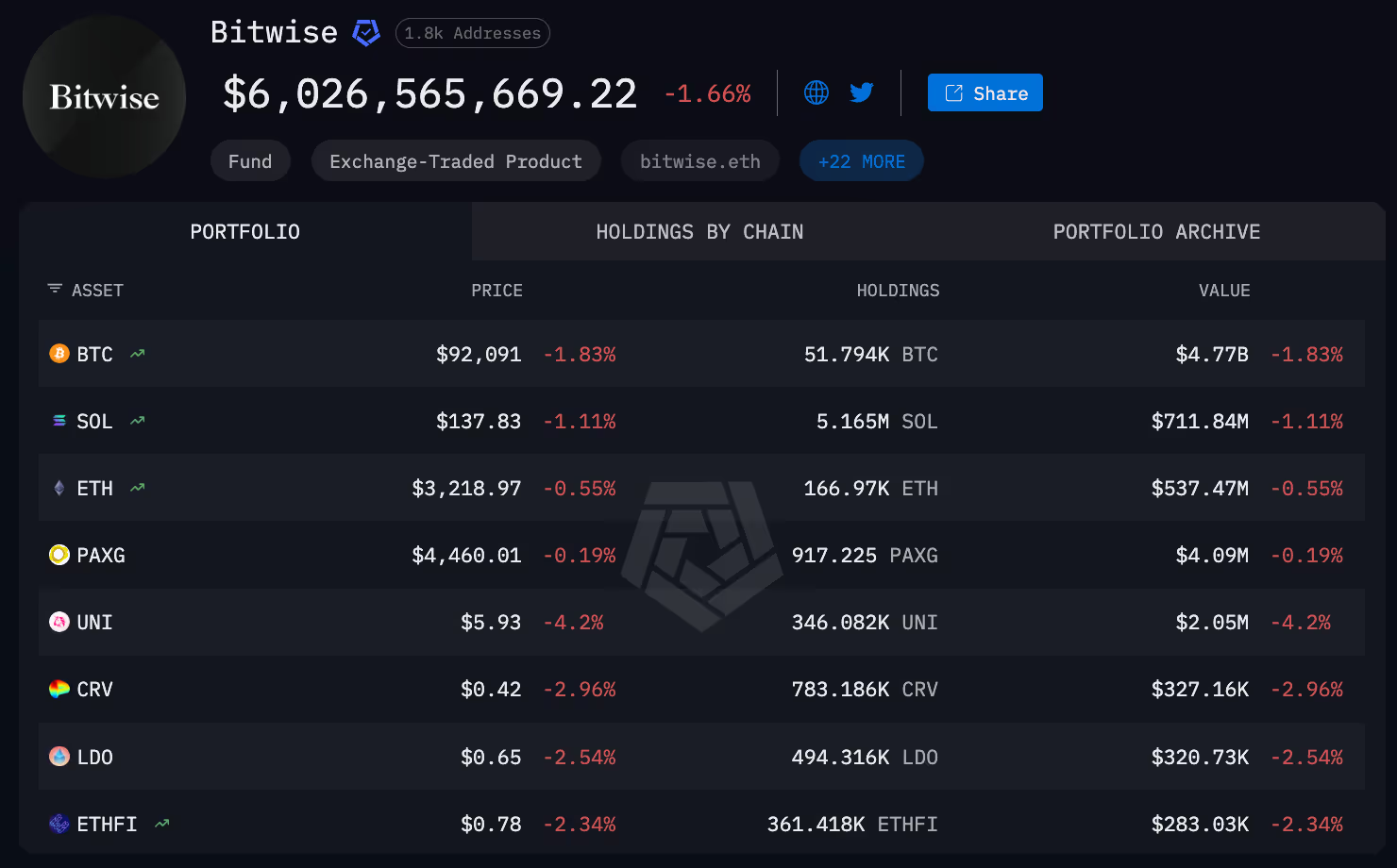

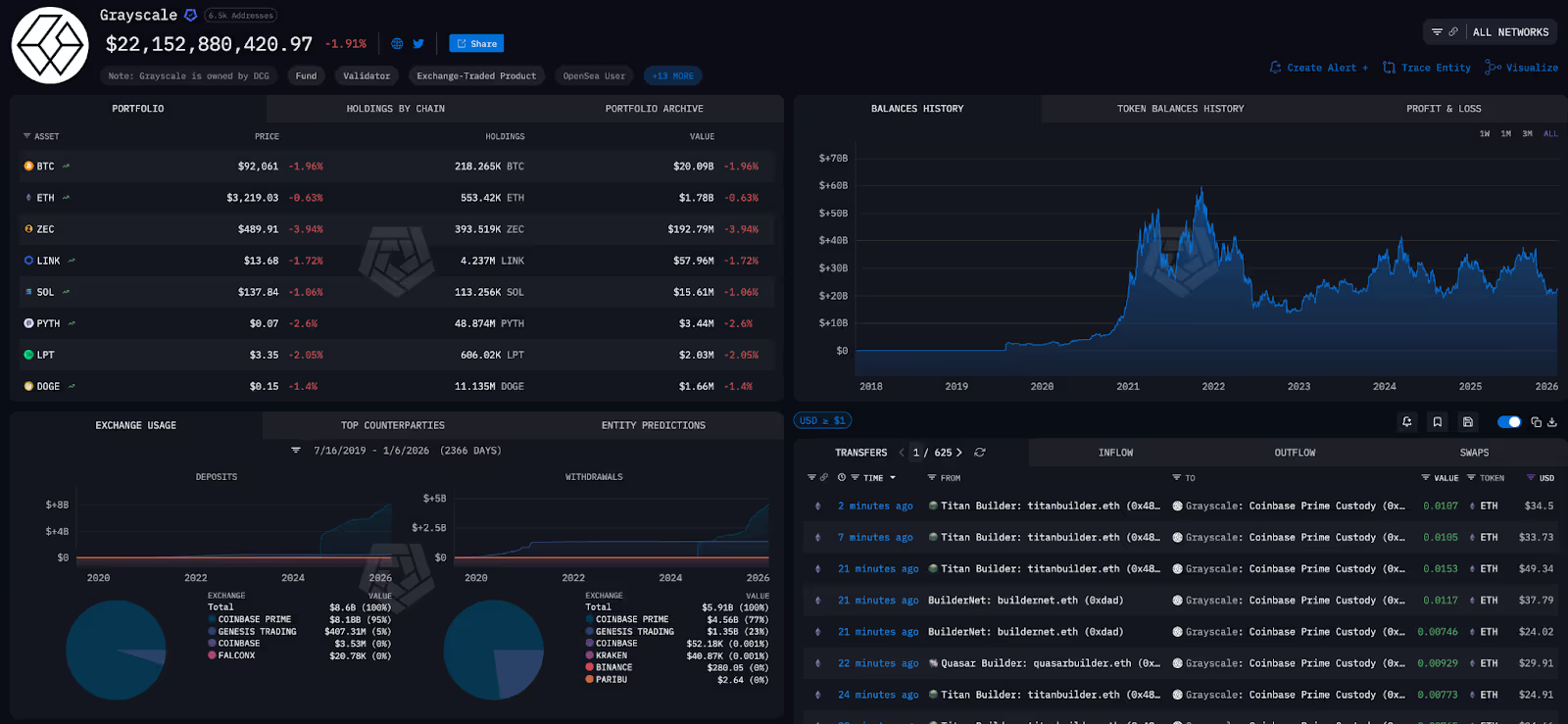

The Arkham Intel Platform also provides powerful tools for monitoring the wallets of ETF issuers. The platform has labelled entity pages for Bitwise, Grayscale, Fidelity, 21Shares and more, allowing users to observe the movement of SOL tokens in real-time. For an explanation on how to make sense of crypto ETFs, read our guide here.

It is important for traders to understand the concept of T+1 settlement when it comes to crypto ETFs. In traditional finance, trades are settled one business day after the transaction (T+1). This means that the on-chain reflection of ETF inflows and outflows is not immediate. For instant "alpha," it can sometimes be more advantageous to monitor off-chain sources, such as the ETF issuers' own websites and reputable financial news outlets, which will report on flows before they are fully settled on the blockchain.

.png)