February 3, 2026

at

6:25 am

EST

MIN READ

Andrew Kang: Top Crypto Traders (2026)

INTRODUCTION

Andrew Kang is an investor and the founder of the crypto venture capital firm Mechanism Capital. He has been a crypto user for over 10 years now, and is well known in crypto circles for his public investment theses around specific tokens and narratives.

TL;DR

- Andrew Kang is a cryptocurrency trader and founder of venture capital fund, Mechanism Capital.

- Kang has been active in DeFi since 2018 with investments in multiple prominent DeFi protocols, including MakerDAO, Synthetix and Thorchain.

- As an NFT collector, he holds more than 300 Azuki NFTs and plays a key role in PleasrDAO, a DAO formed to collect culturally significant NFT works.

- He is now channeling significant investment into the humanoid robotics sector, which he sees as a next frontier, with investments in Apptronik and Figure.

ANDREW KANG’S BACKGROUND AND INTRODUCTION TO CRYPTO

In 2013, Andrew Kang was a college student interested in weightlifting and video games (specifically StarCraft). He reportedly first encountered crypto in December 2013 through the r/dogemarket subreddit, a Reddit community based around buying and selling DOGE.

Dogecoin had been gaining significant popularity on Reddit as a rudimentary tipping mechanism for the site’s users, but the difficulty of safely buying/trading crypto at that point meant that Dogecoin frequently traded at a significantly higher price on Reddit than on exchanges, and users often paid 200% or even 300% of the Dogecoin market price.

This was because at the time, DOGE was only commonly traded against BTC. Kang sensed an arbitrage opportunity and signed up for multiple onramping sites, crypto trading platforms and set up wallets for both Doge and Bitcoin.

He was active on r/dogemarket for about 3 weeks, during which he netted around $5K in profit through selling DOGE, trading steam games for DOGE, and mining scrypt-based coins including DOGE and Vertcoin.

He later returned to crypto in 2018 as an analyst in a hedge fund focused on digital assets, Crypto Asset Management (later Digital Capital Management). As part of this role, he contributed to a number of different research articles, including ‘The Seven Pillars of ICO Investing’ as well as an article on Binance Coin (BNB).

He left Crypto Asset Management in late 2018 to start an OTC firm, ‘Azoth Group’, which he ran for around a year and a half with co-founder Tamara Frankel.

From late 2018 onwards, Kang began to spend a lot more time on Twitter - falling into the rabbit hole of decentralized finance (DeFi), and analyzing new DeFi projects such as Synthetix, Compound, MakerDAO and Thorchain. Most of his tweets during early 2019 were about MakerDAO, as they prepared to launch multiple collateral types and introduce MCD (Multi-Collateral DAI).

Tweets and threads on his investments slowly built up Andrew Kang’s following on Twitter, where he went by the handle @Rewkang. While he traded SAFTs and crypto secondaries, he also posted a lot of research on ETH-adjacent projects as twitter threads and articles.

Kang had already been closely following DeFi as DeFi Summer hit in 2020. In addition to posting extensive threads about DeFi mechanisms (and his investments such as BNT, SNX and RUNE), he was also heavily involved in using DeFi protocols to receive token rewards (also known as ‘farming’).

In September 2020 Kang made the transition to full-time investing, setting up his crypto venture capital fund using internal capital with Daryl Lau and Benjamin Simon. That fund is Mechanism Capital.

ANDREW KANG’S MOST NOTABLE PUBLIC TRADES

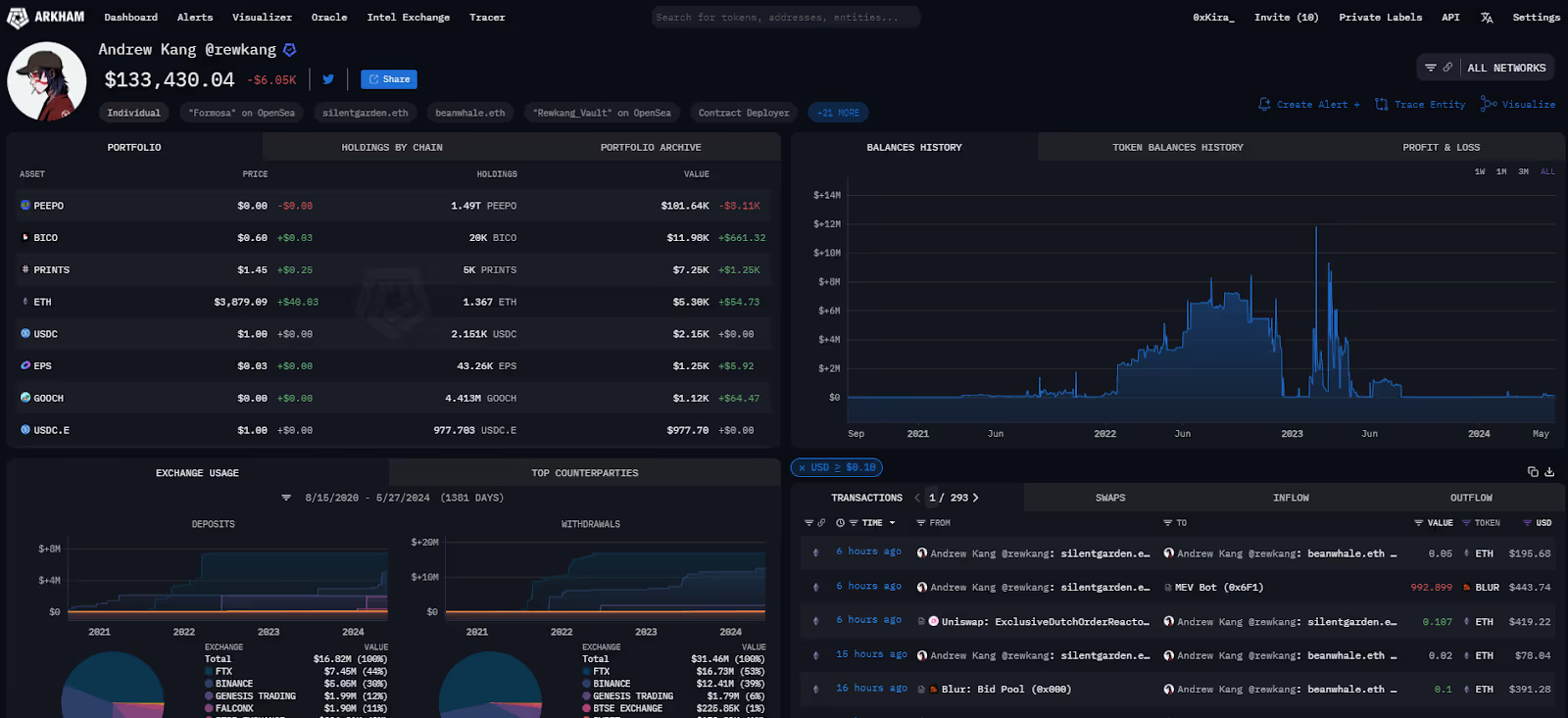

Many of Andrew Kang’s wallets are public and have resulted in numerous traders attempting to track and copytrade him based on his owned ENS handles, NFT holdings or prior interactions. Arkham tracks 4 wallets tagged as “Andrew Kang” and 10 wallets tagged as “Mechanism Capital”. These wallets can all be viewed on Arkham under their respective entity tags.

PRE-2021 - EARLY 2021: BINANCE SMART CHAIN

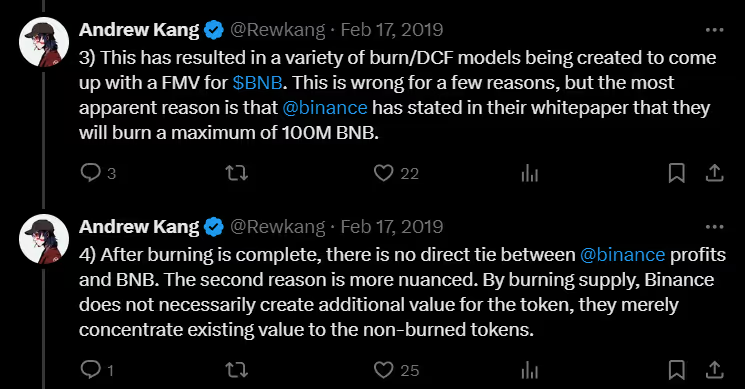

One of the first tokens Kang mentioned publicly on Twitter was Binance Coin (BNB), a token released by Binance in 2017. In addition to writing an article for Crypto Asset Management on how to value BNB, Kang wrote a number of tweets to illustrate how BNB worked, and to counter mainstream valuation models.

As Binance used a portion of its profits to burn a proportional amount of BNB on a quarterly basis, many attempted to value BNB as a stock, or tried to use traditional valuation models such as discounted cash flow (DCF) models. Kang broadly rejected this, and countered allusions that BNB is a legal security by comparing BNB to MakerDAO’s token MKR.

He proposes that the value of BNB comes as a medium of exchange - such as in paying for trading fees on Binance and eventually in transactions on decentralized exchanges (DEXs) such as Binance DEX, (eventually BNB Chain).

2020-2021: DEFI SUMMER

Andrew Kang began to research DeFi as early as 2018, becoming well-acquainted with some of the most notable DeFi projects, namely MakerDAO, Synthetix, Thorchain and Yearn Finance. These names would later become some of the biggest projects in 2020’s DeFi summer.

MakerDAO was one of the projects Andrew Kang publicly wrote about early on Twitter. Kang valued the MKR token as a commodity, with an inherent demand pressure from the MakerDAO ecosystem and a continual burn in stability and liquidation fees.

Kang kept up with project updates, such as the release of MakerDAO’s Multi-Collateral DAI and wrote research on the implications for MKR’s price. In this case, Kang predicted a large buy pressure on the MKR token over time as Single Collateral DAI positions are closed.

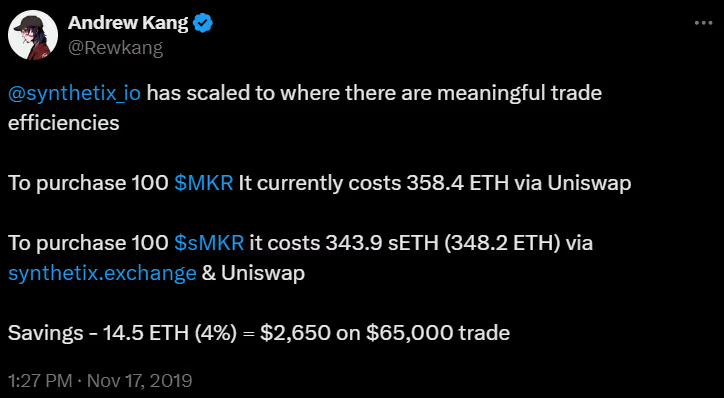

Kang first mentioned the synthetic asset trading platform, Synthetix in May 2019. Kang wrote extensively about opportunities for traders to provide liquidity, farm yield and trade synthetic assets on Synthetix, and would go on to extensively cover the project’s development throughout 2019 and 2020.

During 2020, he favored Synthetix over Uniswap - in this tweet highlighting how traders were able to fill orders at 4% better prices on Synthetix as opposed to Uniswap, the leading DEX at the time.

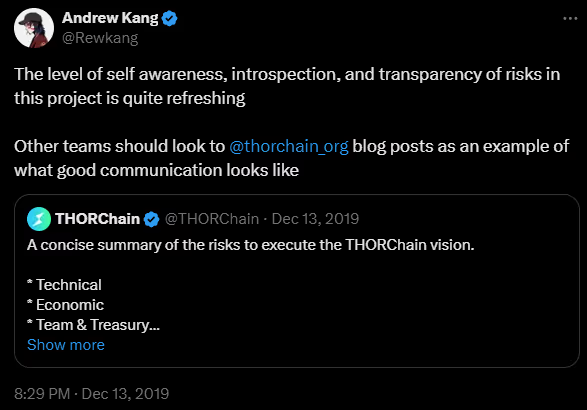

Another Uniswap competitor that Kang first mentioned during late 2019 was Thorchain, which claimed to be able to solve impermanent loss for liquidity providers using its cross-chain liquidity pools.

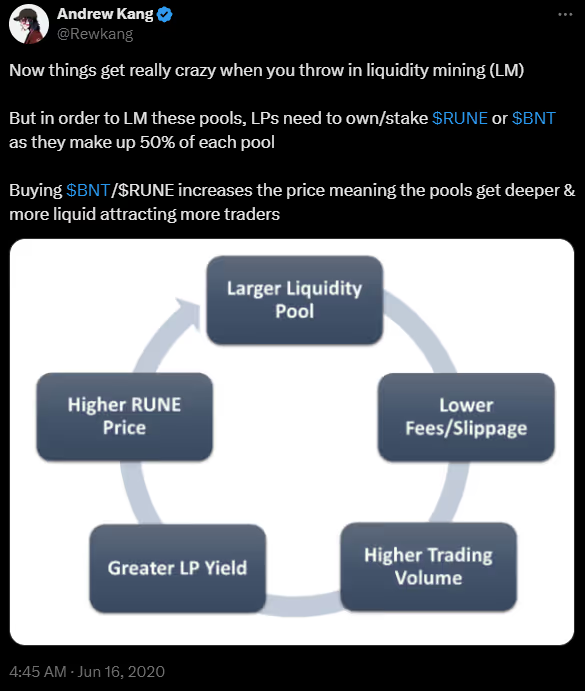

Kang posted a full thesis on Thorchain’s positive liquidity flywheel in June 2020. The idea was that Thorchain could theoretically create massive growth by allocating liquidity mining incentives to attract liquidity providers, trading volume, and buy interest for their token RUNE.

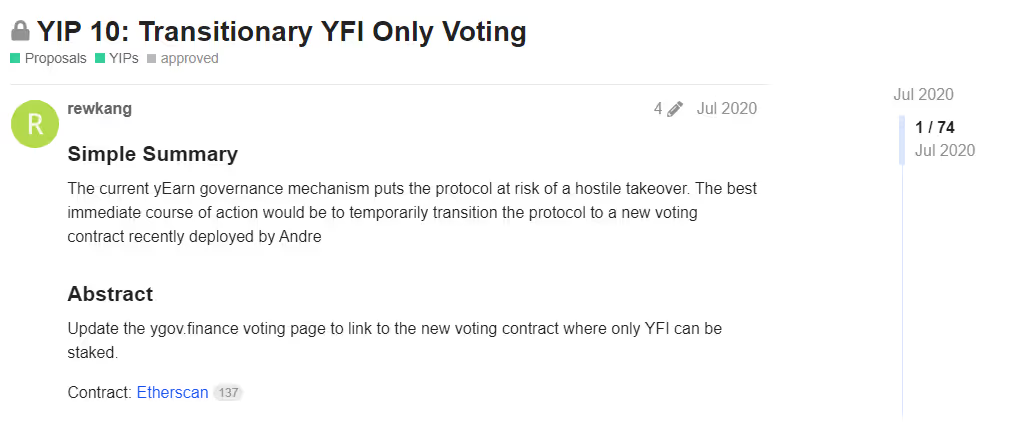

Finally, another darling of the DeFi Summer period, Yearn Finance was another of Kang’s favored projects, with his first tweets about the project occurring in early 2020. Kang was active on the forums in the first week of YFI’s launch, and was the author of one of the first community proposals on Yearn forums to be approved, YIP-10.

2023: ARBITRUM AND BEYOND

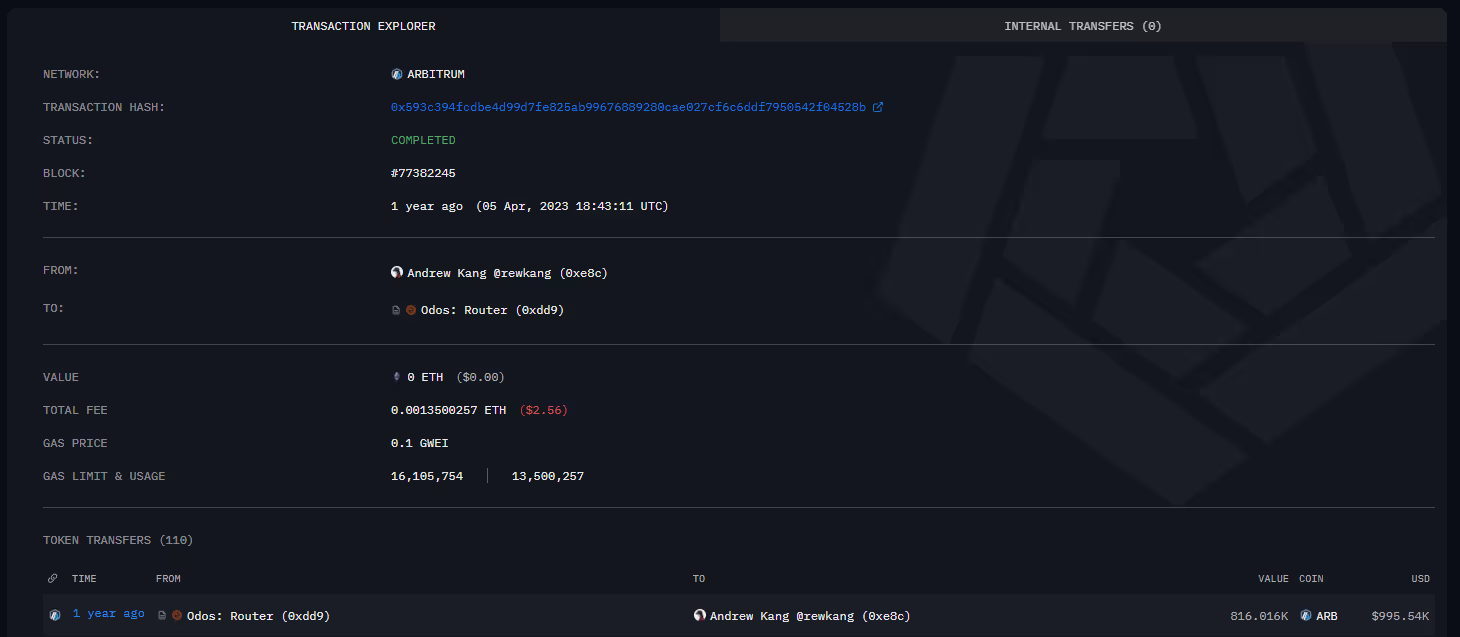

In addition to supporting new projects in DeFi, Kang also trades liquid markets with his personal funds. From 4th-5th 2023, shortly after the launch and airdrop of the ARB token, Kang acquired $2.85M of ARB between 4th and 5th April 2023 at an average cost of $1.25.

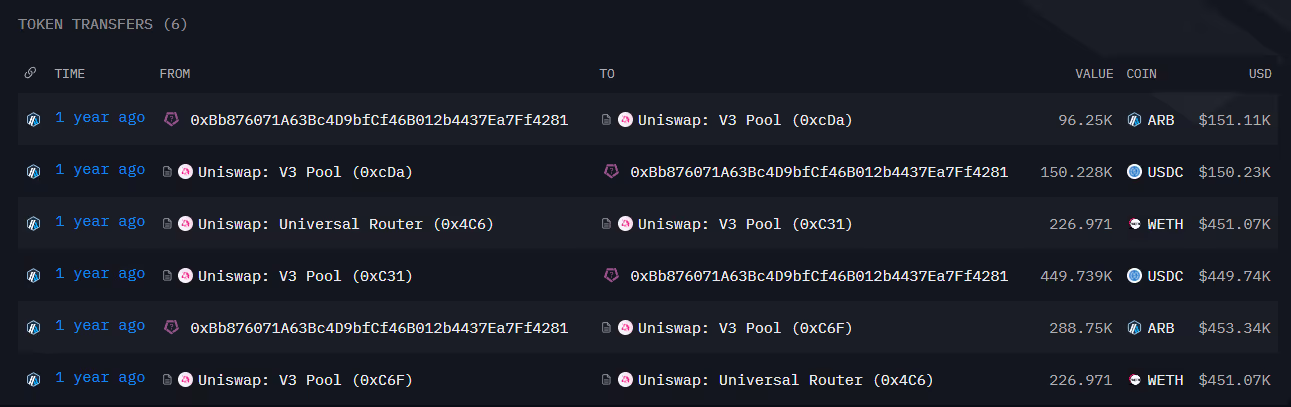

Over the next two weeks, the price of ARB would rally to a high of $1.82, before reversing. On 19th April, Kang sent 2.285M ARB tokens to another wallet (0xBb87) which then sold all of the tokens between prices of $1.56-1.57, closing the trade for a +$600K (26.4%) return.

Aside from his investment in the Arbitrum governance token, he also invested heavily in the ecosystem, specifically in the omnichain lending protocol, Radiant Capital (RDNT). In June, he purchased 2.245M RDNT tokens for $650K. During the same period, 2.33M RDNT tokens (worth $660K) were received from a Binance Hot Wallet to Kang’s wallet. This transaction coincided with a tweet thread released by Kang, where he outlined his thesis on Radiant Capital and how it compared against top lending protocols, Aave and Compound.

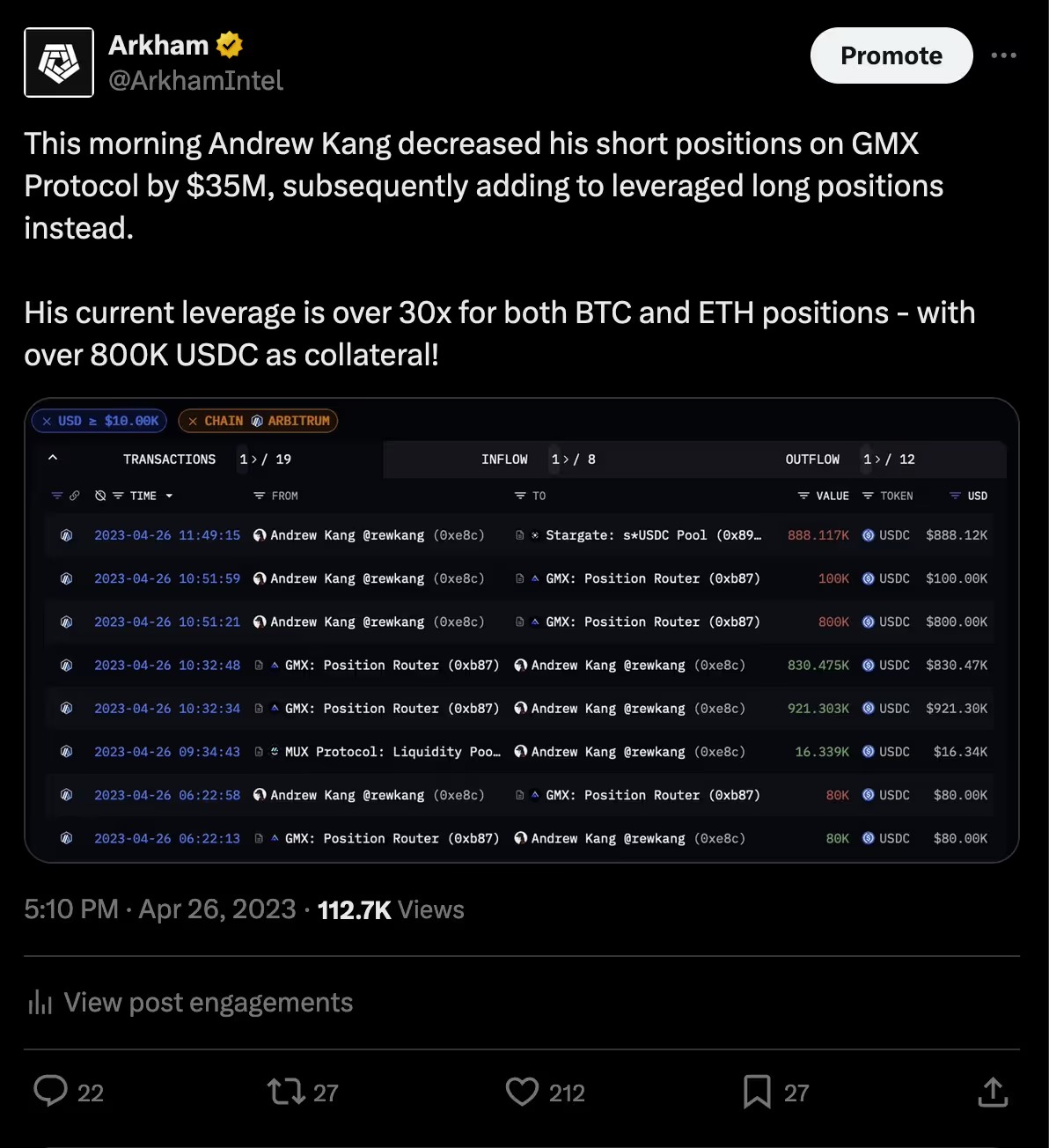

Andrew Kang is also well known for being a perp trader, with some of his positions publicly visible on perp markets such as GMX, Kwenta and MUX Protocol. In 2023, he was famously highlighted for taking high leverage trades on BTC and ETH worth mid 8-figures. Some of these trades ended up in his favor, with his BTC and ETH short positions notably being more than $10M in unrealized profit in February 2023. However, as often happens with high leverage positions, ultimately many of them were liquidated.

Since only his public positions are visible, many have also speculated that these trades could have been hedges for positions held on other wallets or on centralized exchanges, possibly making them an inaccurate representation of his actual portfolio positioning.

ANDREW KANG: THE AZUKI WHALE

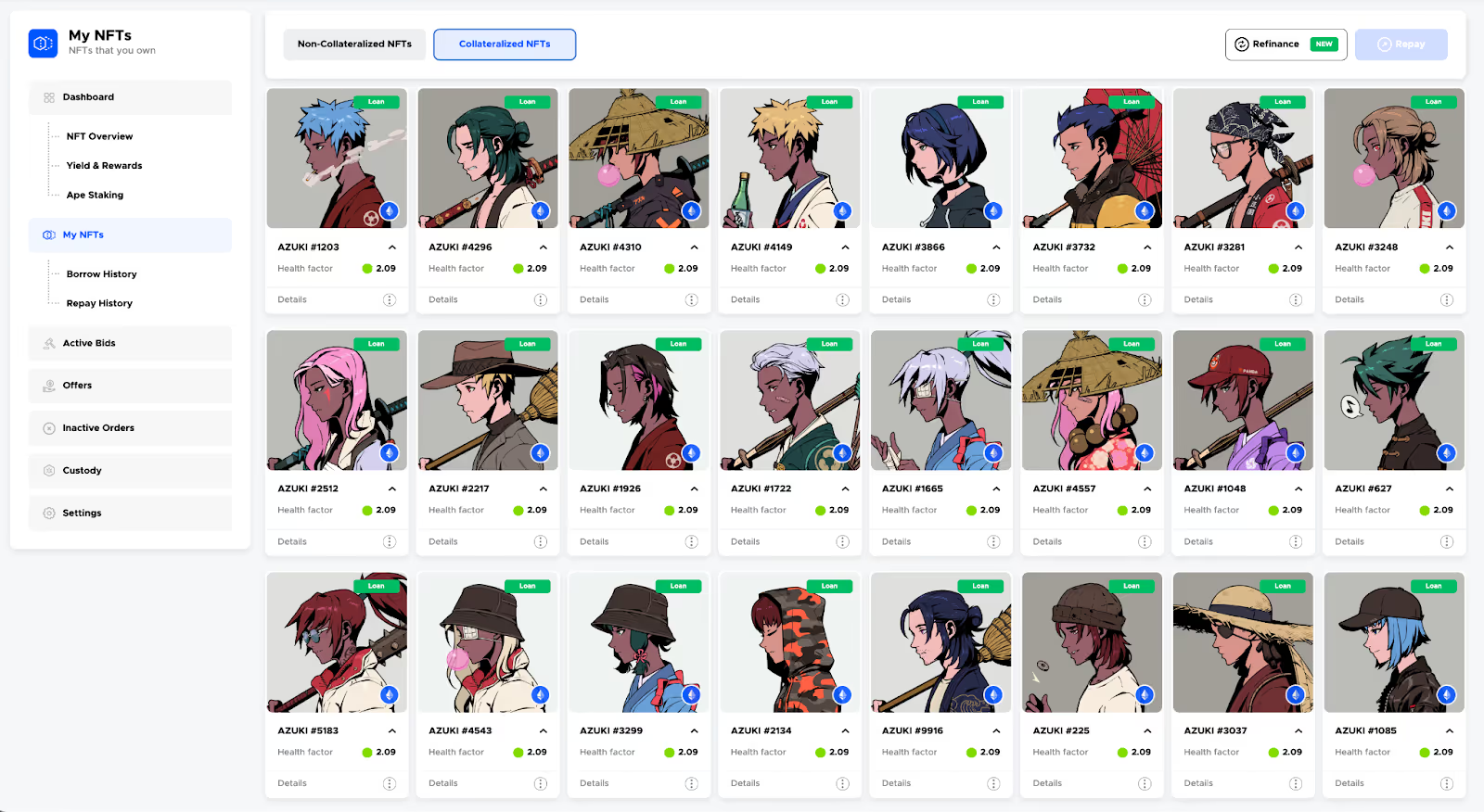

Andrew Kang has been known to invest in not only fungible tokens, but also NFTs. On his main NFT account (0xff3), named Rewkang_Vault on Opensea, he holds a significant investment in NFTs under the Azuki brand. On this wallet alone, he is holding 26 Azukis, 437 Azuki Beans and 622 Azuki Elementals, among other NFTs including several Bored Apes and Mutant Apes.

Leveraging his holdings in Azukis, he regularly lends his Azukis and Apes out to NFT lending platforms such as BendDAO and Blur’s Lend Pool to borrow ETH against his holdings. Excluding the 26 Azuki NFTs on his wallet, he holds an additional 291 Azukis in NFT lending protocols, placing his total holdings at 317 Azukis or around 3.2% of the total Azuki supply.

PLEASRDAO: CURATING CULTURALLY SIGNIFICANT NFTS

Extending beyond his own collection of NFTs, Kang contributes to the NFT space via PleasrDAO, a decentralized autonomous organization (DAO) formed in March 2021 focusing on the collection and curation of NFT pieces deemed to be culturally significant or timeless.

The DAO was initially formed by its other members which included PoolTogether founder Leighton Cusack, Calvin Liu of Compound Finance and Tarun Chitra of Gauntlet Network, to acquire the iconic Uniswap “x * y = k” NFT by digital artist, pplpleasr. On the other side of the auction was Andrew Kang who placed a starting bid of 100 ETH. Instead of breaking out into a bidding war, the DAO reached out to Kang to invite him into PleasrDAO, agreeing to acquire the NFT together to fractionalize it as a DAO. And thus began Kang’s involvement in PleasrDAO.

Some of the more famous pieces curated under the DAO include the Edward Snowden Stay Free NFT and the Doge meme NFT. The Edward Snowden Stay Free NFT was purchased at an auction on 16 April 2021 for 2,224 ETH (~$5.5M), where proceeds were donated to the Freedom of the Press Foundation, of which Snowden served as the President until 2022.

In June 2021, the Doge meme NFT was acquired by PleasrDAO for 1,696.9 ETH (~$4M) in the auction set up by Atsuko Sato, the owner of Kabosu, the Shiba Inu behind the popular Doge meme. The proceeds were donated to a variety of charities based in Japan.

MECHANISM CAPITAL

Set up in August 2020, Mechanism Capital is a crypto venture capital fund founded by Andrew Kang, alongside fellow crypto investors Daryl Lau and Benjamin Simon. The fund initially invested in DeFi but has since expanded to cover additional sectors including blockchain infrastructure, gaming and AI. Mechanism Capital’s tagged wallets can be tracked under the Mechanism Capital entity on Arkham.

Some of Mechanism Capital’s notable investments include DeFi projects such as Curve and Ethena, infrastructure projects Biconomy and Arweave, as well as in L1/L2 projects such as Arbitrum and Near Protocol.

In 2022, Mechanism Capital also began to place a heavy focus on crypto gaming, with the launch of Mechanism Play, a $100M branch of the Mechanism Capital brand focused on Play-to-Earn (P2E) crypto gaming. This arm was launched after Mechanism Capital’s initial success in their gaming investments, which included the games Star Atlas and Ember Sword, as well as leading gaming guild, Yield Guild Games.

Beyond venture investments, Mechanism Capital also makes trades in liquid tokens. These positions are sometimes revealed through Andrew Kang’s Twitter account, where he makes tweets explaining their latest liquid positions. One example was Mechanism Capital’s positions in the TRUMP memecoin and the Trump Digital Trading Cards NFT collection in early February 2024, leaning into the upcoming US elections as its catalyst.

ANDREW KANG: A CRYPTO TWITTER INFLUENCER

Andrew Kang now has an audience of over 245K followers on Twitter, after years of sharing his research and opinions on DeFi, yield farming and early stage investing. He publicly shares his thoughts on the markets and his theses surrounding specific tokens and narratives. He also occasionally shares positions or venture investments made by Mechanism Capital, as the face of the fund.

With the tide shifting on regulatory stance in the US, Kang has been vocal about his thoughts on significant developments such as the approval of spot BTC and ETH ETFs by the Securities and Exchange Commission (SEC), the recent FIT21 Crypto Bill, and their impact on the crypto markets.

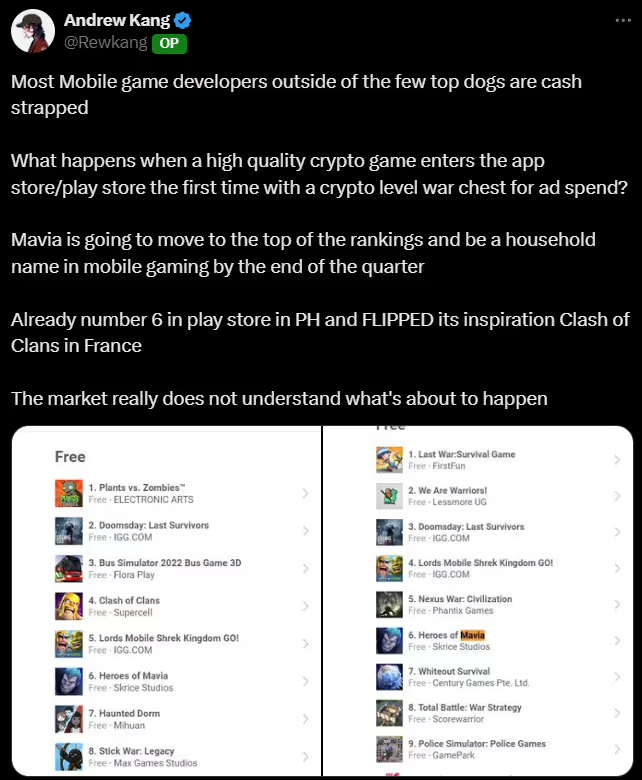

One narrative that Kang strongly believes in is gaming, evidenced by Mechanism Capital’s large investments in crypto games such as Heroes of Mavia, Nyan Heroes and Shrapnel. Kang regularly tweets about the sector, citing developments in the mobile gaming industry, the size of the gaming market and how these impact the investments held by himself or his fund.

Late in 2025, Kang wrote a scathing essay - which he posted on X - which criticised Bitmine Chair Tom Lee's entire ETH thesis. He called Lee's thesis “one of the most r*tarded combinations of financially illiterate arguments I’ve seen from a well known analyst in a while.”

Kang breaks down Lee’s ETH thesis into five key components and provides refutations of all five of them:

(1) Stablecoin & RWA Adoption

(2) Digital oil comparison

(3) Institutions will buy and stake ETH to contribute to the security of the network in which they are tokenizing their assets & as operating capital

(4) ETH will be equal to the value of all financial infrastructure companies

(5) Technical Analysis

You can read our analysis into Kang's criticism by clicking the image below.

Non-Crypto Investments: Robotics

In 2024, Andrew Kang once again caught the attention of the crypto community with Mechanism Capital’s move into non-crypto investments. This marked a pivot from the fund beyond crypto to broader frontier technologies, with a focus on robotics. Mechanism Capital took significant positions in two standout robotics companies: Figure and Apptronik, which are both focused on humanoid robots designed to complete complex tasks and reduce the cost of manpower. Kang’s X account also followed this pivot, driving a new narrative around robotics, frequently posting analyses and commentary that depart from his long-standing crypto-centric content.

Kang’s public writings and social media posts make clear that he views robotics as being in an early-stage “growth phase,” akin to crypto’s rapid expansion years ago. He believes general-purpose humanoid robots will be the next trillion-dollar technology platform, as they begin to address global labor shortages and unlock massive new markets.

Conclusion

Andrew Kang’s lengthy track record in crypto has made him a prominent member of Crypto Twitter, both as an individual investor and as the founder of Mechanism Capital. From trading Dogecoin on underground Reddit markets in 2013, to exploring the early stages of DeFi in 2019, to trading NFTs with Pleasr in 2021 and even lately making personal investments in memecoins, Kang has a considerable record of his crypto activity. More recently, he has shifted significant attention and capital toward the humanoid robotics sector, signaling the huge growth potential of this sector in the coming years.

.png)