November 4, 2025

at

11:45 am

EST

MIN READ

Everything We Know About The Trump-Backed World Liberty Financial Project

When World Liberty Financial launched in 2024, just months before Donald Trump's successful bid for a second term as President, it immediately became one of the most polarizing and closely watched projects in the crypto world. This article dives into the company, its tokenomics, its ongoing controversies, and what World Liberty Financial means for the rapidly evolving intersection of politics, finance, and blockchain technology.

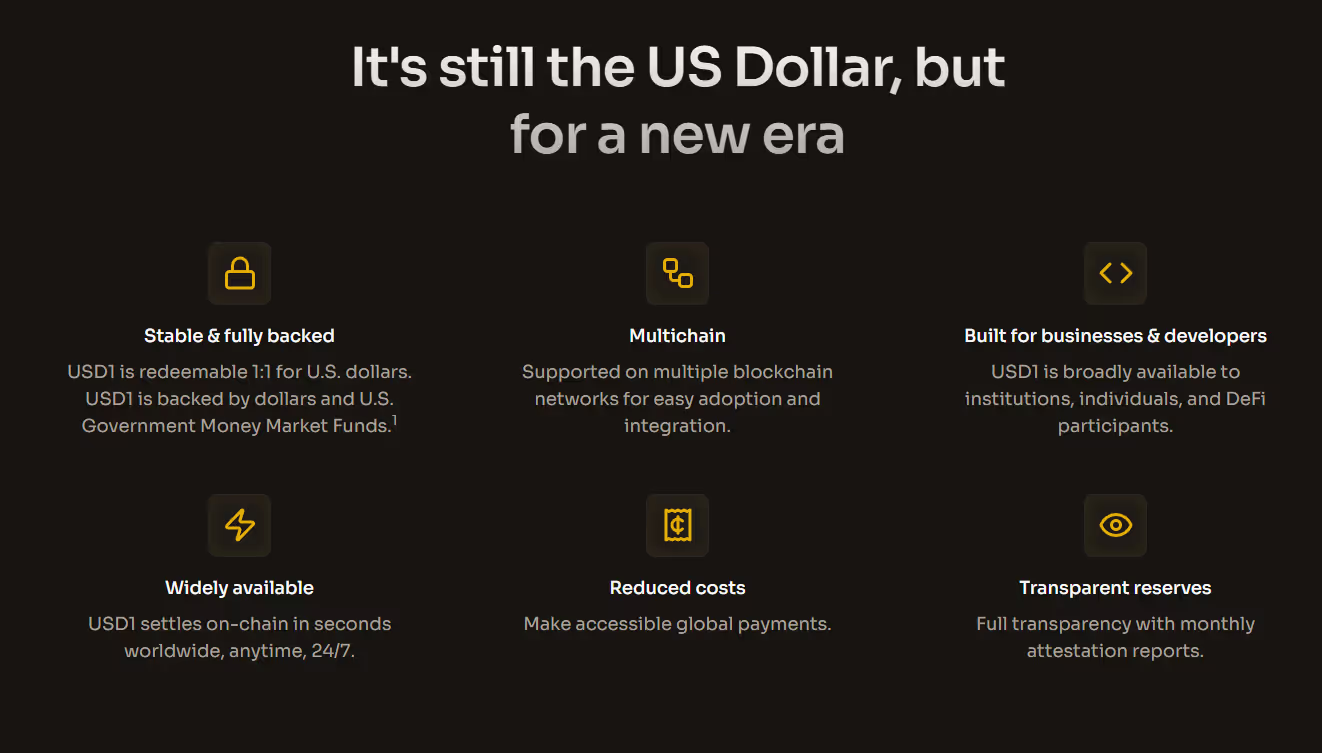

World Liberty Financial markets itself as a decentralized finance (DeFi) ecosystem that aims to bridge "legacy finance and the open economy." To do this, it has planned a suite of products that includes tokenized assets, a dollar-pegged stablecoin - USD1 - money markets and more.

Since its debut, the project has drawn the attention of investors, regulators, and critics in equal measure. This scrutiny has centered on the project's ambitious roadmap and the operational complexities of its governance model.

Summary

- World Liberty Financial is a Trump-backed DeFi protocol seeking to democratize finance by bridging traditional finance with crypto technology.

- Led by several members of the Trump family, close supporters and entrepreneurs, the project has garnered significant attention in the crypto space with their recent token launch.

- The project features the WLFI governance token, and USD1, a fiat-backed stablecoin secured by US Treasuries, short term US dollar deposits and cash equivalents.

What is World Liberty Financial?

World Liberty Financial describes itself as “the bridge between legacy and what's next” through combining the transparency of blockchain with the stability and scale of the US dollar. Its stated mission is “to unlock financial access for all by replacing the limits of traditional banking with open, on-chain infrastructure, and by creating a fairer system where opportunity isn't defined by location, status, or permission”.

The governance token, WLFI, allows token holders to vote on decisions related to protocol development, integrations, and treasury management. Alongside the governance token, the project also issues its own stablecoin. USD1 is a US dollar-backed stablecoin supported by short-term US treasuries, bank deposits, and other cash equivalents.

The ecosystem is supported by integrations with established DeFi applications. Its planned lending and borrowing functionality is intended to be built on an instance of the Aave V3 lending protocol, leveraging its secure framework to offer lending and borrowing services. USD1 has also been a focal point for cross-chain connectivity, with its gradual rollout on multiple blockchains, including Ethereum, BNB Chain, and Tron, with Chainlink’s CCIP supporting cross-chain interoperability.

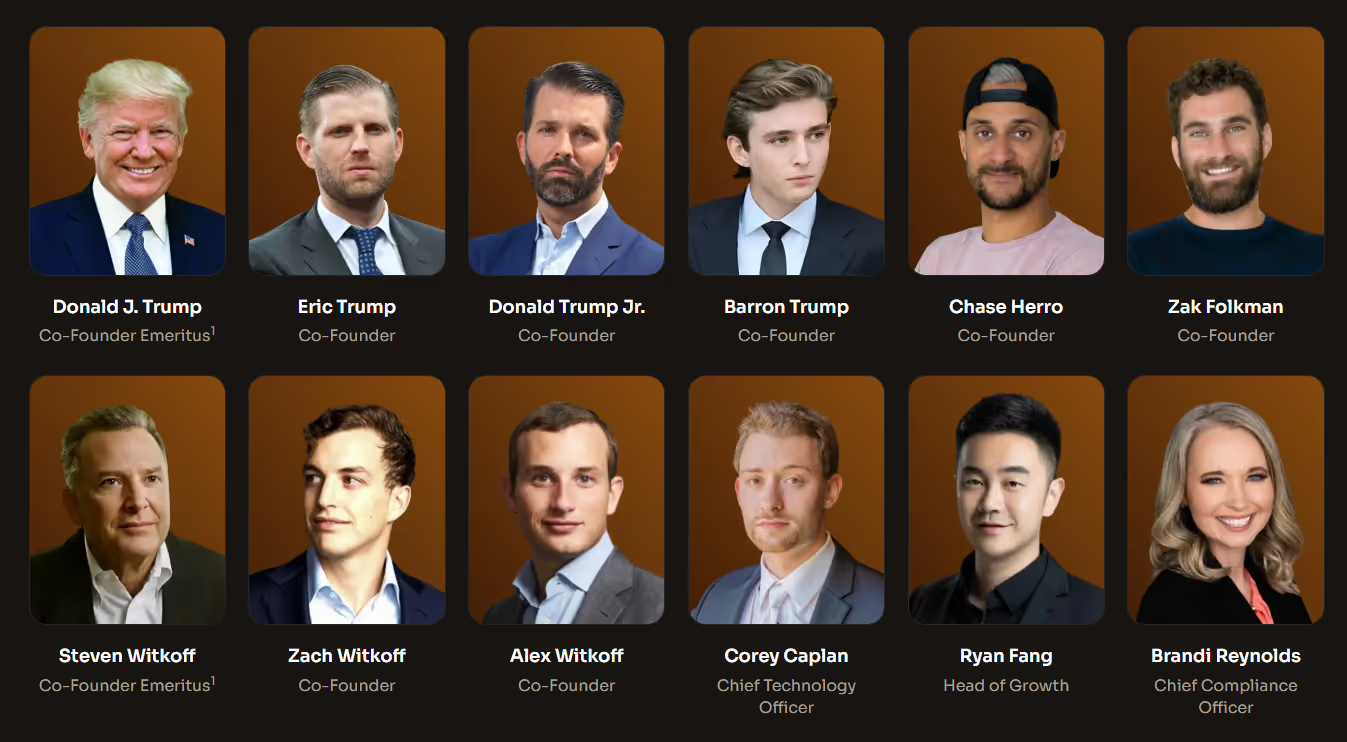

Who is Behind World Liberty Financial?

A Trump business entity - DT Marks Defi LLC - maintains a controlling financial position in World Liberty Financial, owning 60% of the company and entitled to 75% of all revenue generated from token sales. President Trump himself serves in an official capacity as the project's "Chief Crypto Advocate" while his sons, Eric Trump, Donald Trump Jr., and Barron Trump, are actively involved in the venture's management and public relations, listed as co-founders on the project’s site. This deep family involvement has been the primary factor in World Liberty Financial’s high profile nature.

Beyond the Trump family, other key operational figures include Zachary Folkman, Chase Herro, and Zach and Alex Witkoff. Folkman and Herro had previous experience co-founding a blockchain application called Dough Finance, which shut down after a $2.1M exploit in 2024. Zach and Alex Witkoff, the sons of a prominent real estate developer and Trump confidante, Steven Witkoff, also play crucial advisory roles as listed co-founders on the project.

This combination of political firepower from the Trump family and operational expertise from crypto entrepreneurs forms the core leadership structure. The team has been granted ~33.5 billion WLFI tokens, granting them substantial control and a significant financial stake in the project’s future. At the moment, these tokens are believed to be locked.

What Products Do They Offer?

World Liberty Financial’s product suite is centered around its two tokens: WLFI, the project's governance token, and USD1, its US dollar-pegged stablecoin, both with their own distinct tokenomics.

The WLFI governance token is designed to provide token holders with a say in the protocol’s future and direction. It has a maximum token supply of 100 billion tokens, with a current circulating supply of 24.56 billion tokens. 25% of the total token supply was sold to the general public in a token sale beginning in October 2024, during which 20% of the total token supply was offered for sale at a fully diluted valuation (FDV) of $1.5B. As demand increased, an additional 5% of the token supply was offered up, but at a FDV of $5B. Eventually, the full 25% was sold and the token sale completed, raising a total of $550M.

The initial token allocation was criticized as highly concentrated, with 33.5% of the token supply allocated to the team and advisors to the project. Of the 33.5% allocation, it is reported that 22.5% is held by the Trump family and its affiliated business entities.

The utility of the WLFI token is primarily in governance, allowing holders to vote on key protocol upgrades, changes to incentive structures, and the overall strategic direction of the ecosystem.

The direction of the protocol, including the unlock and vesting schedule for locked WLFI tokens, is actively discussed on the WLFI Governance Forum. In early September, the first major unlock occurred with 20% of early investor tokens being released, amounting to 5% of the supply.

The USD1 Stablecoin is designed as a fiat-backed stablecoin, aiming to maintain a 1:1 parity with the US dollar. Its tokenomics are structured around a full-reserve model, meaning every USD1 in circulation is theoretically backed by equivalent high-quality, liquid assets. The reserves are comprised of short-term US Government Treasuries, US dollar deposits, and other cash equivalents.

A key aspect of its tokenomics is the appointment of BitGo as the trusted custodial partner, which holds the underlying reserve assets and provides infrastructure for minting and redemption. This setup is intended to meet high institutional standards for transparency and compliance, distinguishing it from offshore stablecoins facing reserve composition scrutiny. The stability mechanism relies on the standard mint-and-redeem process: users can redeem one USD1 for one US dollar worth of collateral, incentivizing market arbitrage to maintain its peg. USD1 has been aggressively integrated across multiple blockchains including Ethereum, BNB Chain, Solana, Tron, and more, to maximize its utility for global transactions and institutional settlement.

What Has Happened Since Launch?

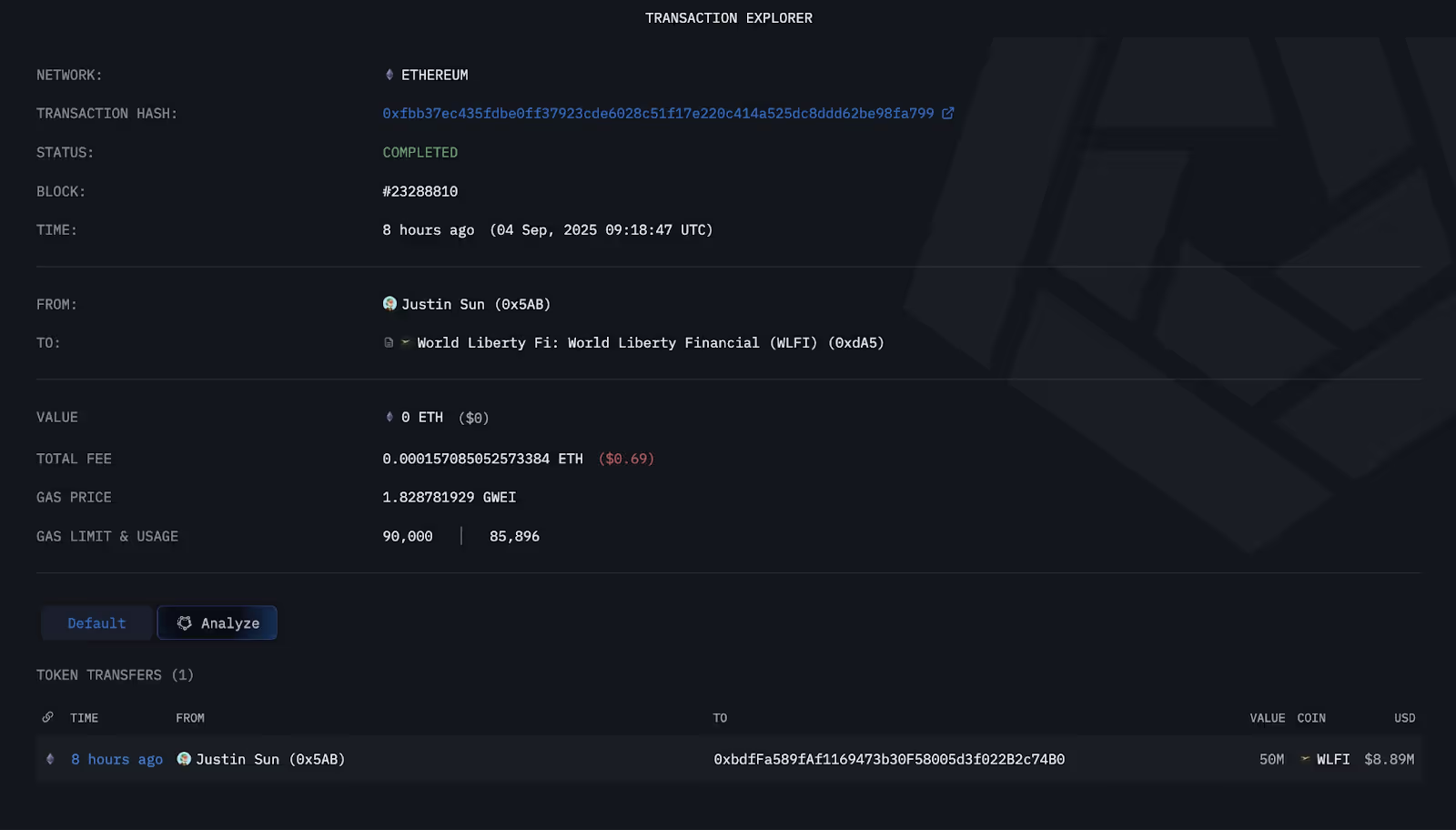

The first controversy emerged in September 2025, when the project’s smart contracts blacklisted a wallet address belonging to Tron founder and crypto public figure, Justin Sun. On-chain data showed that the address held 595M WLFI tokens, worth approximately $107 million at the time.

World Liberty Financial froze Sun’s address after it had completed several large outbound transfers. It has been suggested that Sun transferred his WLFI to HTX in order to offer a high-yield product to HTX users. World Liberty Financial subsequently blacklisted Sun for manipulating the WLFI tokenomics. Critics argued that the ability to freeze assets contradicted the team’s claims of decentralization while others defended the action as a necessary step to enforce contractual obligations.

Shortly after, the World Liberty Financial team made a sale of 100M locked WLFI tokens to Bitcoin mining firm, Hut 8, for $25M. The sale was made at a price of $0.25 per token, or around 25% premium to the market price at the time.

DeFi vs TradFi Dilemma

This hybrid model, which many label as “TradFi-with-DeFi-branding”, may not necessarily doom the project. It could, in fact, appeal to institutional investors looking for regulatory clarity and brand assurance. But for the crypto community, which values decentralization and censorship-resistance above all else, it poses an existential contradiction.

Conclusion

World Liberty Financial represents an experiment into the convergence of politics, finance, and blockchain technology. It aspires to democratize finance while remaining anchored to one of the most prominent political brands today.

.png)