October 11, 2025

at

8:30 pm

EST

MIN READ

Will the U.S. Government release inflation data during a shutdown?

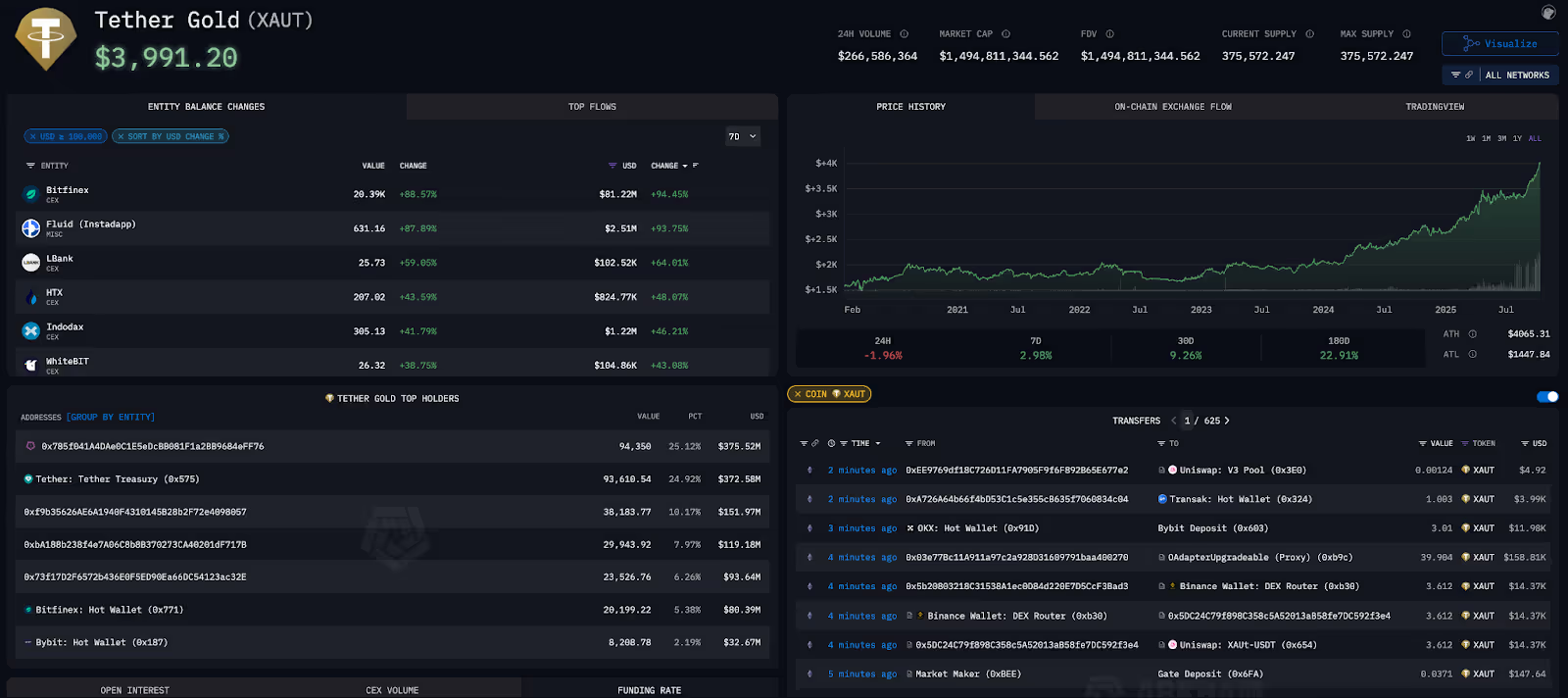

It’s been a chaotic few weeks for asset prices, capped by yesterday's sudden market crash. The Nasdaq and S&P 500, which had been at all-time-highs, tumbled after Trump announced potential new China tariffs. The sell-off comes after a period where Gold became the most expensive it has ever been, topping $4,000, and Bitcoin hit an all-time-high of over $126k last week before sliding to over $111k at the time of writing.

Soaring valuations came amidst a backdrop of a ‘dollar debasement’ narrative taking hold across financial markets, and as crypto approaches the typical bull market end of its usual four year cycles.

With all of this going on, markets are paying close attention to the Fed’s interest rate decisions as a change to the cost of borrowing will likely have profound effects on markets that had been feeling overextended before Friday’s shakedown.

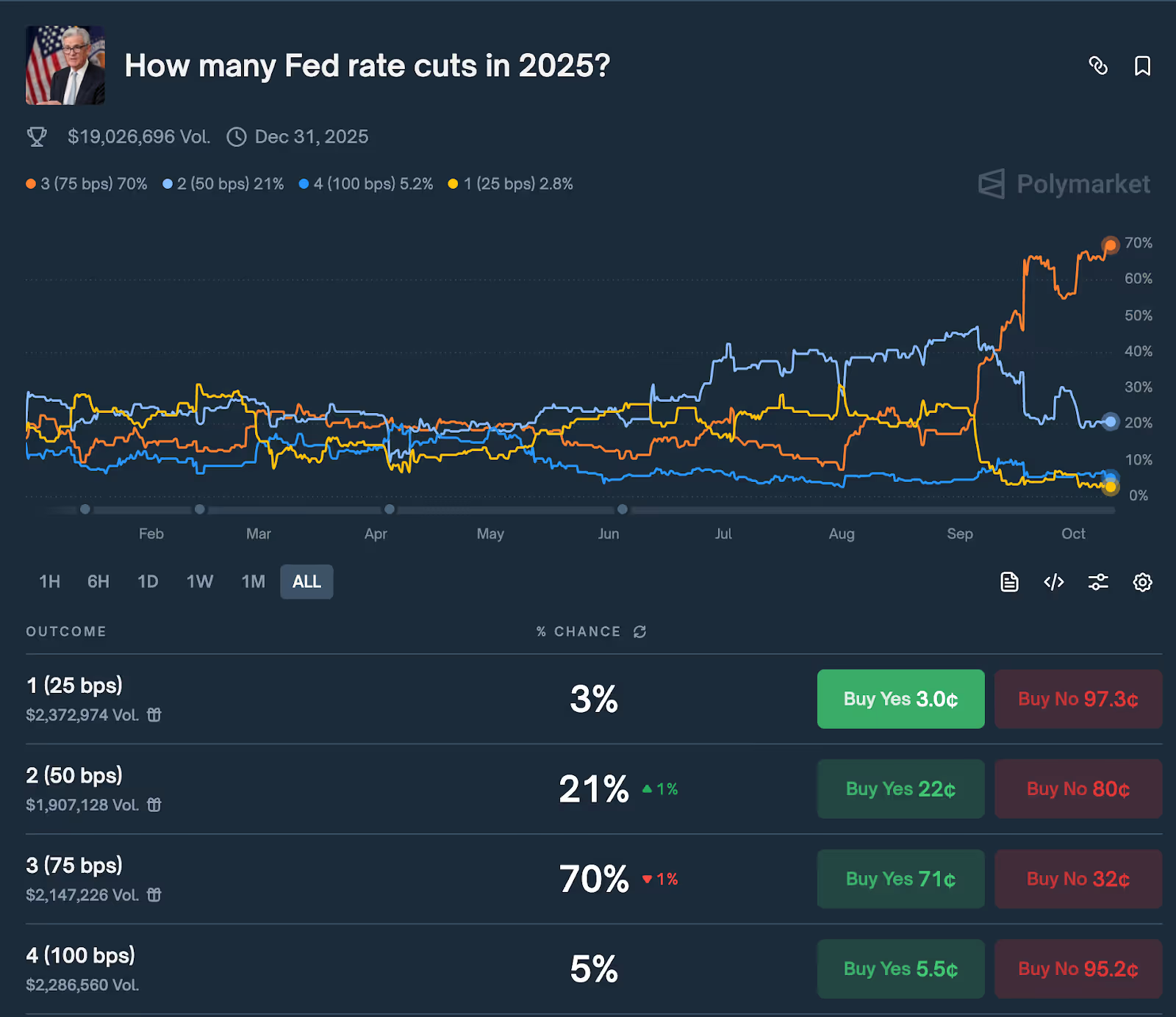

Three 25bps cuts for the rest of the year seem to be priced in, bringing the rate’s target range down to 3.25%-3.5%. But investors will be looking for any sign at all that this baked-in narrative could change over the next few weeks.

A major indicator for markets will be next Wednesday’s CPI (Consumer Price Index) figures. August’s month-on-month figure was 0.4%. For September’s figure, a significant increase, or higher than forecast figure, could make it less likely the Fed will deliver 75bps in cuts before the end of the year and markets could respond negatively to this news.

However, the ongoing U.S. government shutdown complicates matters. According to an article in the New York Times, the Bureau of Labor Statistics has called back a few key workers - who will be working unpaid due to the lack of an agreed budget - to get the raw data that composes this vital data processed and analyzed.

The article goes on to state that the CPI data will be released, but suggests that the 15th October release date is not guaranteed.

The knock-on effect of this extended shutdown - 11 days at the time of writing - is that the release of October’s economic data could also be delayed next month.

With markets suddenly fragile after yesterday's crash, which has intensified talk of an asset price bubble, the delay to the data could add significantly to the uncertainty around the future of prices.

.png)