January 16, 2025

at

12:00 am

EST

MIN READ

World Liberty Finance Buys $10M ETH

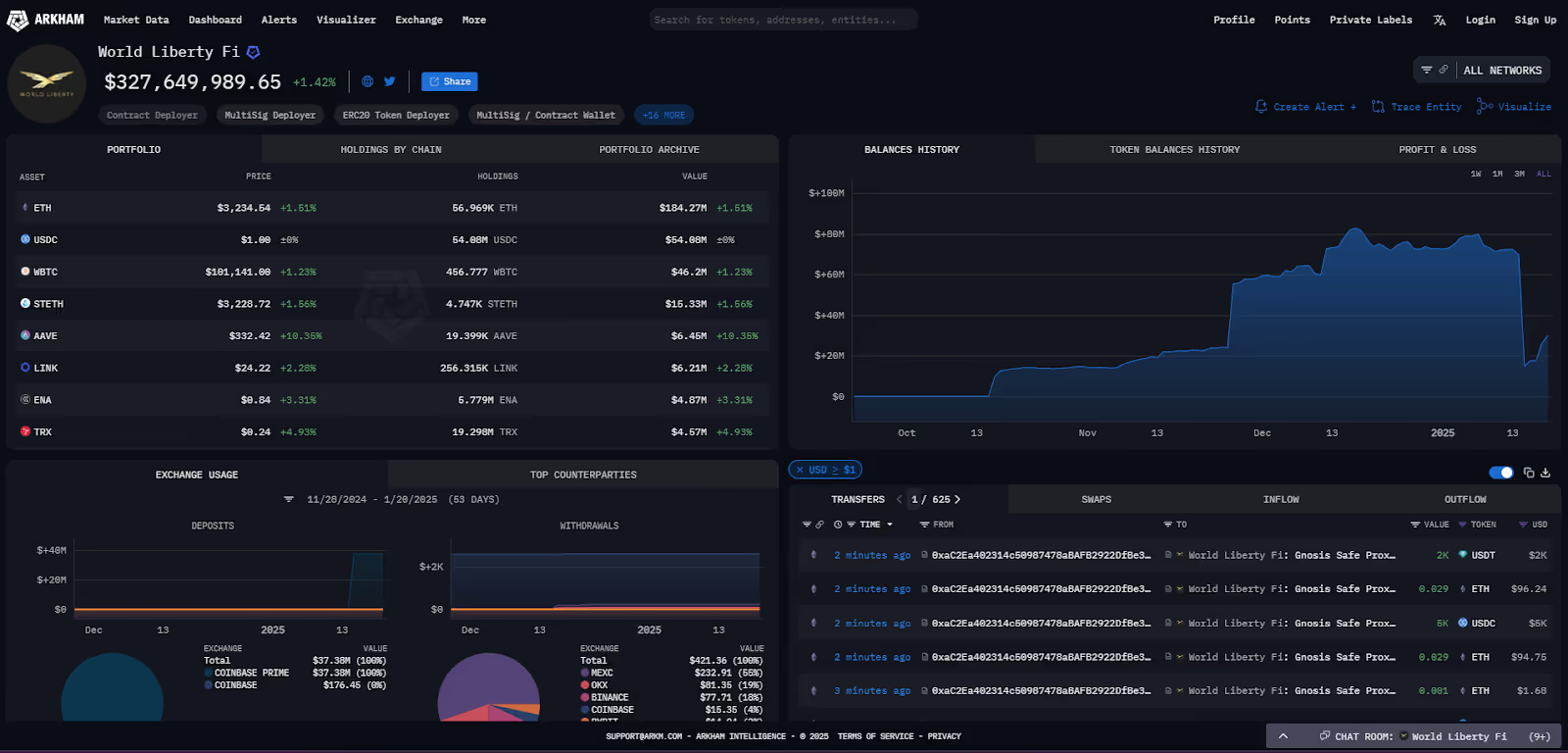

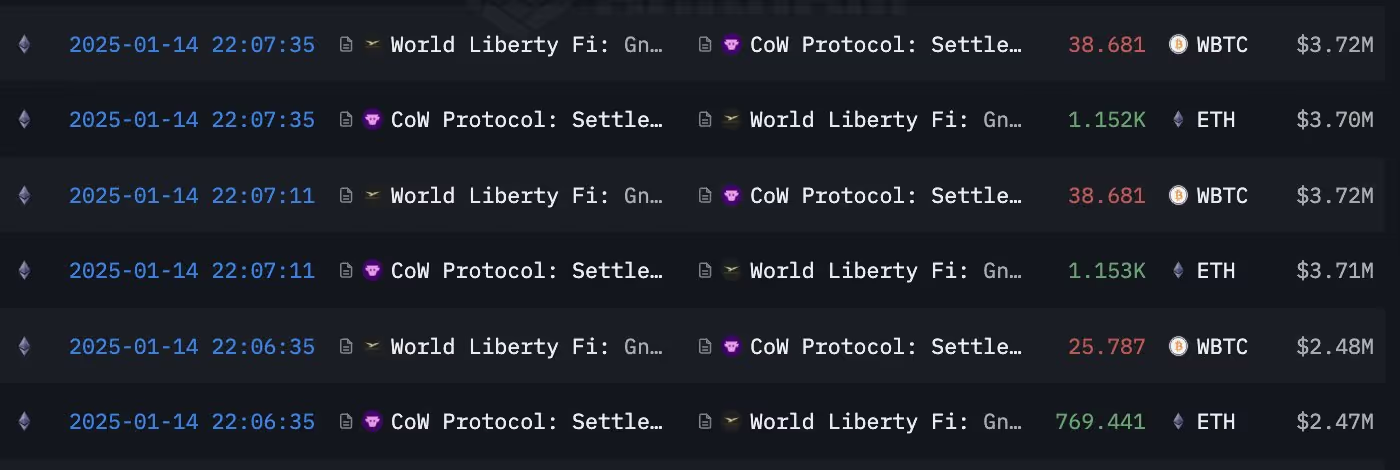

Incoming US president Donald Trump’s DeFi project, World Liberty Finance has once again begun acquiring ETH, with the project purchasing another $9.88M in ETH or 3,120 tokens. The purchase was made using their WBTC holdings this time instead of USDC, which were purchased almost exactly one month ago on 18th December for ~$10M.

This specific transaction is notable because it represents a direct rotation from WBTC (Wrapped Bitcoin) into ETH. Instead of injecting new fiat-backed stablecoins, the project is strategically shifting its allocation from the market's primary asset to the leading smart contract platform, signaling a specific conviction in Ethereum's potential.

The move is a continuation of Trump’s on-chain activity on Ethereum, which started in December after he acquired both WBTC and ETH tokens on-chain via World Liberty Finance. Additionally, the project has also acquired holdings in Chainlink (LINK), Aave (AAVE) and Ethena (ENA) over the same period. These on-chain transactions have provided a tailwind for the Ethereum ecosystem, which has mostly underperformed throughout 2024, to the dismay of their supporters.

The chosen assets—LINK, AAVE, and ENA—are not random; they represent core pieces of the decentralized finance infrastructure, from oracles to lending and synthetic dollar protocols. This diversification beyond just ETH and WBTC suggests a deeper, more calculated investment thesis in the foundational layers of the Ethereum economy, adding to the bullish sentiment.

.png)