February 11, 2026

at

2:20 am

EST

MIN READ

Bitcoin Crash: Why They Happen and The Effect They Have

If you are reading this, it is highly likely that Bitcoin has just crashed. A crash is usually defined as a sharp, sudden and unexpected drop in price which causes the price of other digital assets to follow suit.

This has happened countless times in Bitcoin’s relatively short history due to Bitcoin’s characteristic volatility. Whilst short-term crashes are largely unpredictable, there are patterns to the way BTC’s price moves.

Historically, Bitcoin has followed a recurring pattern of boom and bust tied to four-year cycles. These cycles often end with a "blow-off top" followed by a sharp correction downwards. Though this may not always be the case in the future, it has happened often enough in the past to make market participants well aware of it.

A crash often signals the official start of a bear market, or the continuation of an already existing one. During this phase, excitement drops and participants often become forced sellers, dumping assets at a loss.

What Triggers A Crash?

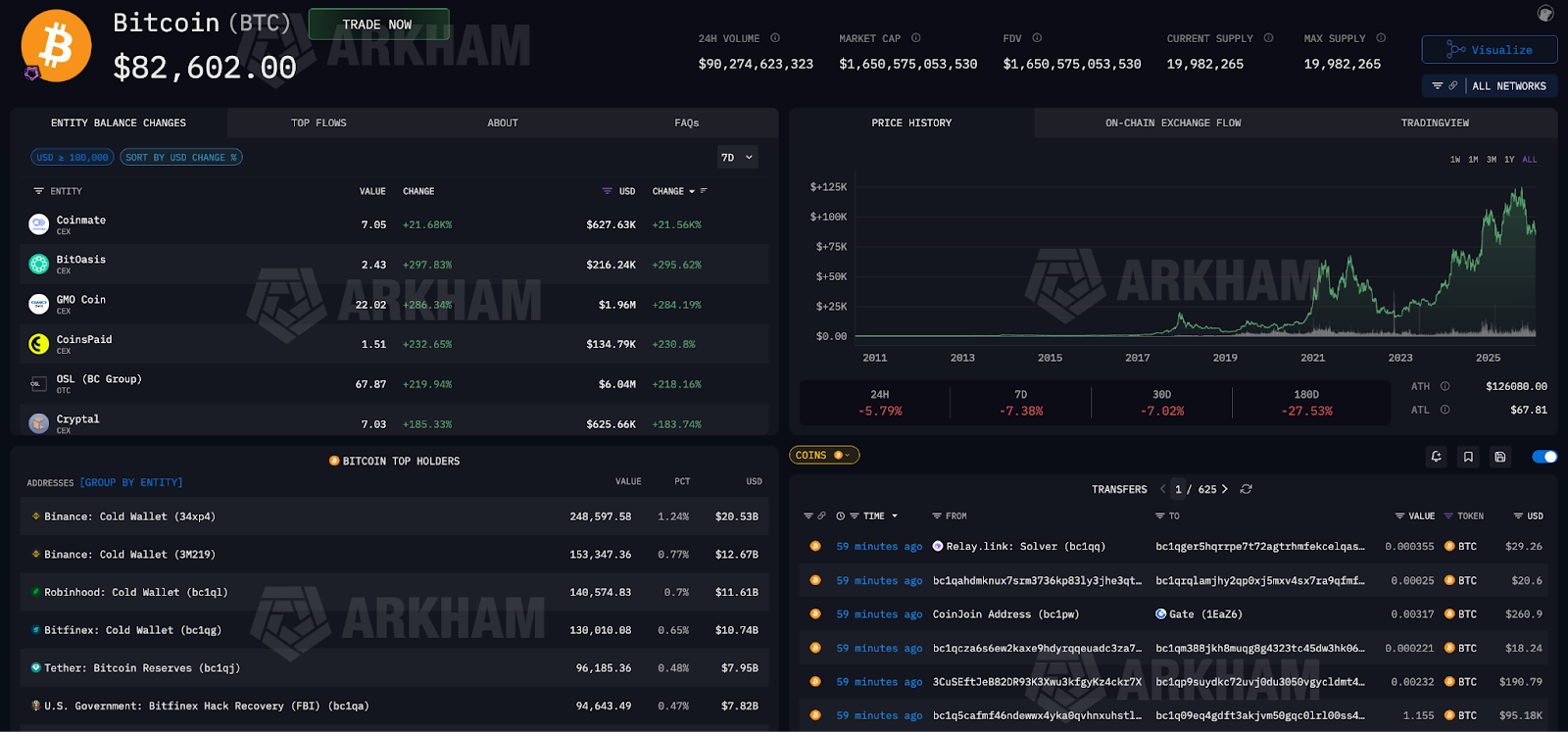

Many different factors can cause a market crash. These can be related to on-chain flows, price action, extraneous ‘shock’ events, macroeconomic factors and many others. Often, it is the conjunction of different factors that cause market crashes. Sometimes, it may even be typical price action - for example, a reversion to the mean after a period of sustained positive price action, that leads to a natural pullback.

One major cause of a crash is the accumulation of extreme leverage. When prices dip slightly, margin calls kick in, forcing a "liquidation cascade" that pushes prices even lower in a vicious spiral.

This is because traders borrow money to bet on higher prices, and even a small drop can trigger an automatic "sell" order to pay back those loans. Forced sales push the price down further, causing a “cascade”. This happened on 29th January 2026 when a disappointing performance from tech stocks led to a small drop in BTC’s price which triggered a cascade of liquidations.

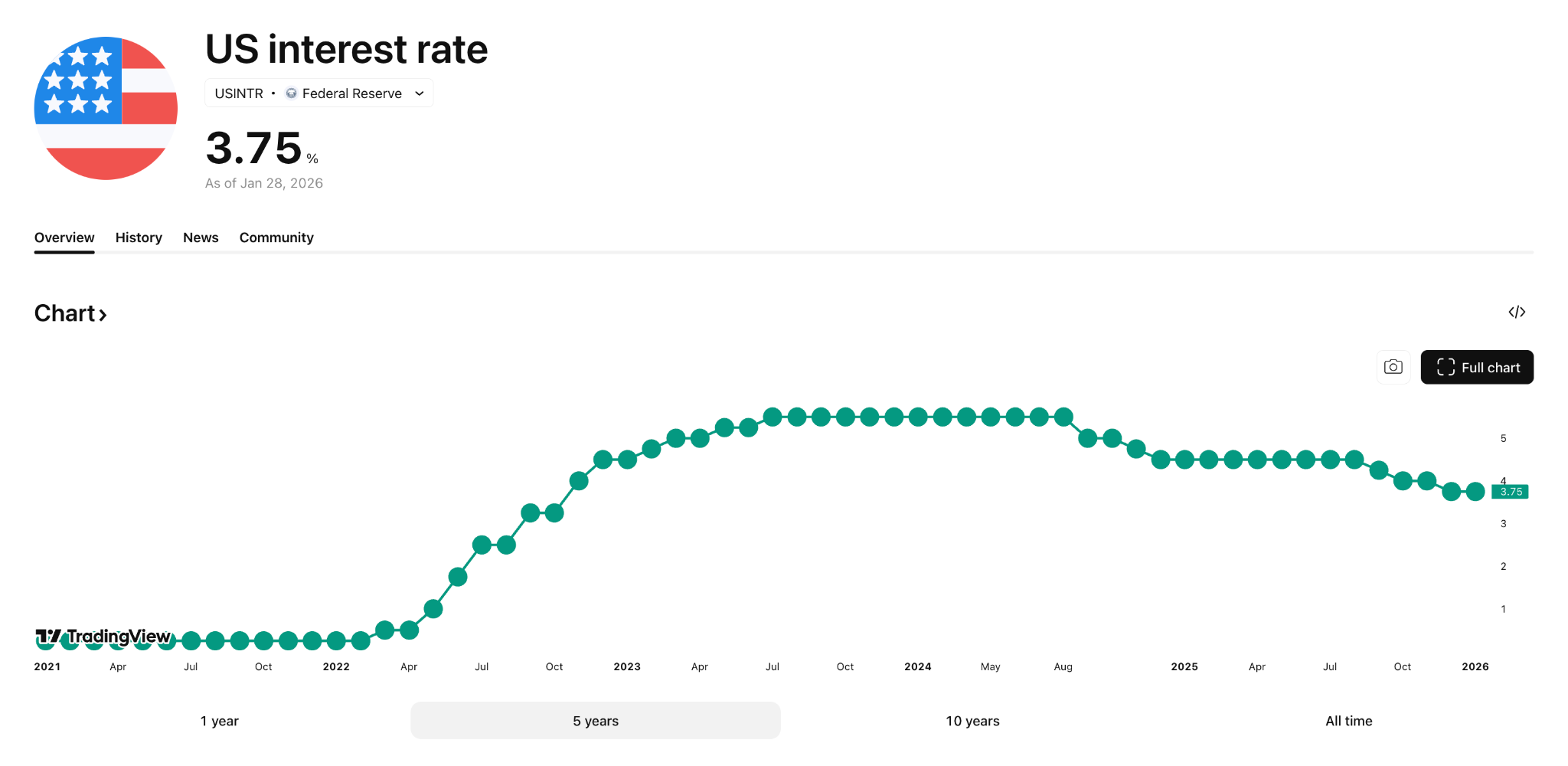

Macroeconomic factors may also play a role. Interest rate hikes or global liquidity shifts can remove capital from markets, leading investors to flee riskier assets. Whilst Bitcoin maximalists see BTC as the ultimate safe haven asset, to many investors it is the ultimate risky play.

A classic example occurred in 2022, when the U.S. Federal Reserve began aggressively raising interest rates to combat 40-year high inflation. This shift in global liquidity caused Bitcoin to lose over 60% of its value that year.

Regulatory uncertainty is also a factor. News of potential bans or government crackdowns has historically triggered mass sell-offs and a loss of trust. This occurred in May 2021, when Bitcoin’s price plummeted by nearly 50% after China intensified its crackdown on mining operations.

Many other factors can also cause market crashes - for example, many coins went down in tandem on the 10th of October 2025, as traders were simultaneously liquidated after a reported 100% tariff on China, leading to large amounts of positions being auto-deleveraged by exchanges, causing multiple billions in aggregated losses.

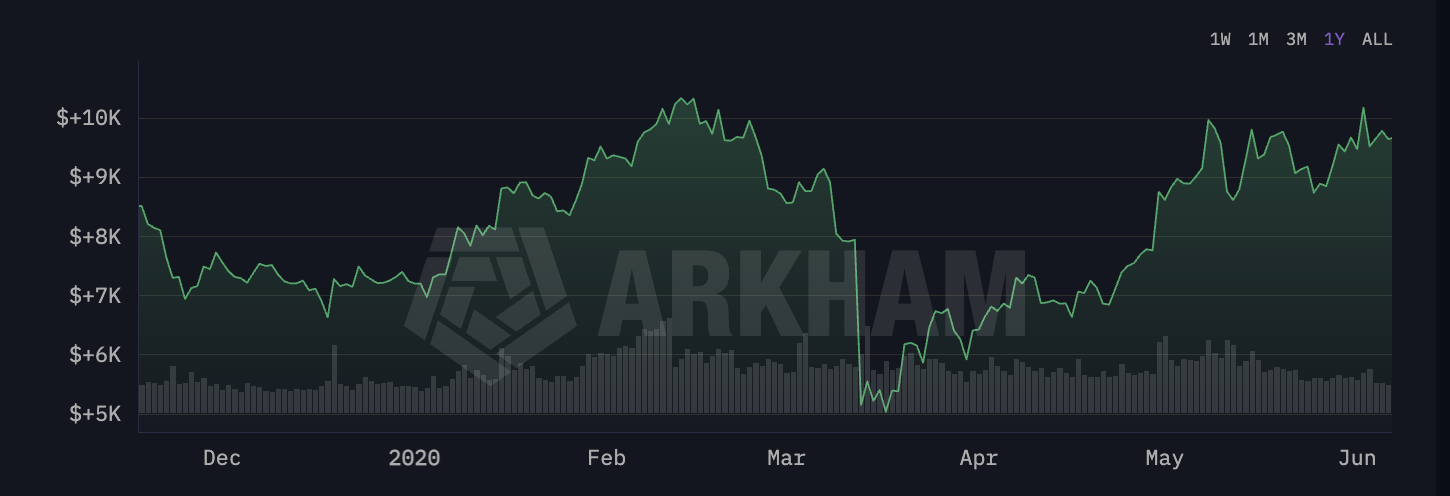

Additionally - and perhaps most famously to traders from the 2021 market cycle, the 2020 COVID crash caused risk asset prices to simultaneously drop, as news of the COVID outbreak pushed investors away from risk assets into the (supposed) safety of cash, causing a 50% price drop within 48 hours.

The Effect on the Market

When Bitcoin crashes, the entire crypto ecosystem typically follows suit. Alt-coins typically see even more drastic price drops as they are typically viewed as higher-risk. Memecoins experience violent swings during a BTC crash.

After the crash, speculators and over-leveraged traders are flushed out of the market in droves. Oftentimes this can lead to a market bottom where investors can begin accumulating and builders can continue to develop without the frenzy of a greedy market.

How To Respond To A Crash

Bitcoin crashes are a demonstration of the importance of risk management. The total value of liquidations of long positions after a crash can number in the multiple billions, depending on the severity of the crash.

Although the 2025 cycle showed that institutional adoption is changing the game with big players like BlackRock providing more stability, sudden price drops are still a characteristic feature of crypto.

.png)