February 13, 2026

at

6:50 am

EST

MIN READ

Anatoly Yakovenko: Net Worth And On-Chain Holdings In 2026

.png)

Anatoly Yakovenko stands among the most influential figures in cryptocurrency, having founded one of the industry's fastest and most widely adopted blockchain platforms. Based on available information about his token holdings and estimated equity stake in Solana Labs, his net worth in 2026 is estimated to fall between $500M and $1.2B, though this figure fluctuates significantly with Solana's token price.

The Russian-American entrepreneur built Solana to address fundamental limitations in earlier blockchain networks, particularly their inability to process transactions at speeds comparable to traditional financial systems. The incumbents, Bitcoin and Ethereum, focused heavily on decentralization and security, which resulted in a speed bottleneck as a trade-off. His background in distributed systems engineering at Qualcomm provided the technical foundation for innovations that would eventually position Solana as a major competitor to Ethereum and other established platforms.

Yakovenko's wealth derives primarily from two sources: his holdings of SOL tokens and his ownership stake in Solana Labs, the company that continues to develop the protocol. This also means that his personal fortune remains closely tied to Solana's market performance.

Summary

- Anatoly Yakovenko's 2026 net worth is estimated between $500M and $1.2B, with his net worth closely tied to Solana’s performance.

- He founded Solana in 2018 after inventing the concept of Proof of History, which was designed to address existing blockchain scalability limitations.

- His wealth derives from his SOL token holdings and his equity stake in Solana Labs, the development company behind the blockchain.

Yakovenko’s Early Life

Born in the Soviet Union, Yakovenko immigrated to the United States with his family, settling in Illinois in the early 1990s. He demonstrated an early aptitude for computer science and engineering, eventually earning a degree in Computer Science from the University of Illinois at Urbana-Champaign, one of the nation's premier programs for the field.

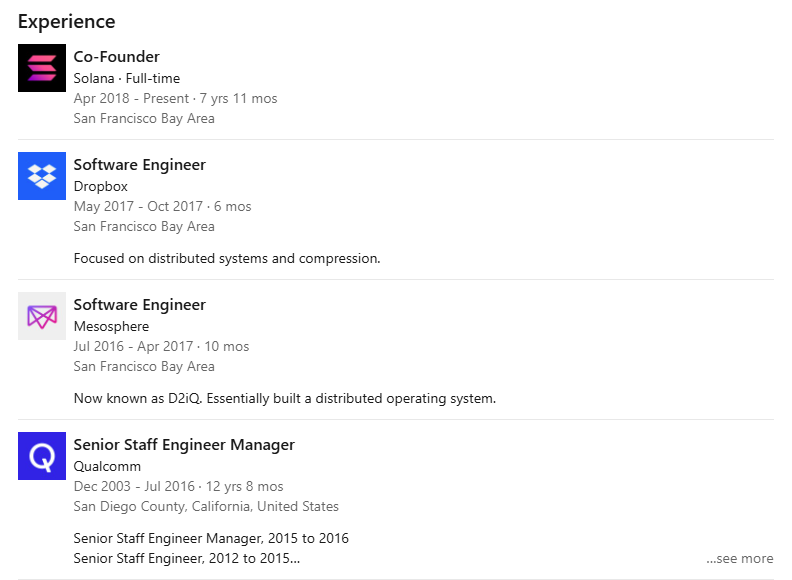

His academic background focused on distributed systems and compression algorithms, technical domains that would later prove essential to his blockchain innovations. After graduation, Yakovenko joined Qualcomm, where he spent over a decade working on operating system-level software and distributed systems. This experience at one of the world's leading communications technology companies gave him deep expertise in building systems that could handle massive scale and throughput.

During his time at Qualcomm, Yakovenko also worked on technologies that needed to coordinate across multiple devices and maintain precise timing, a challenge that shared conceptual similarities with blockchain consensus mechanisms. He later worked briefly at Dropbox, further expanding his understanding of distributed computing challenges within the context of consumer-facing applications.

How Did Yakovenko Get Into Crypto?

Yakovenko's entry into cryptocurrency, like many others, began in Bitcoin mining. He and a friend used profits from mining to offset the cost of graphics processing units for their side project together. This exposure to the crypto markets also allowed him to witness firsthand the scalability limitations of Bitcoin and Ethereum. These networks could only process a handful of transactions per second, creating bottlenecks and high fees that seemed incompatible with mainstream adoption.

Rather than accepting these limitations as inherent to blockchain technology, Yakovenko began exploring whether techniques from other fields could solve the throughput problem. He drew inspiration from his telecommunications background, particularly the concept of using time itself as a reliable reference point in distributed systems.

In November 2017, Yakovenko published a whitepaper describing Proof of History, a cryptographic technique for creating a verifiable passage of time between events. This innovation would allow network validators to process transactions in a predetermined order without extensive communication between nodes, dramatically increasing potential throughput. This concept would eventually become the foundation of Solana.

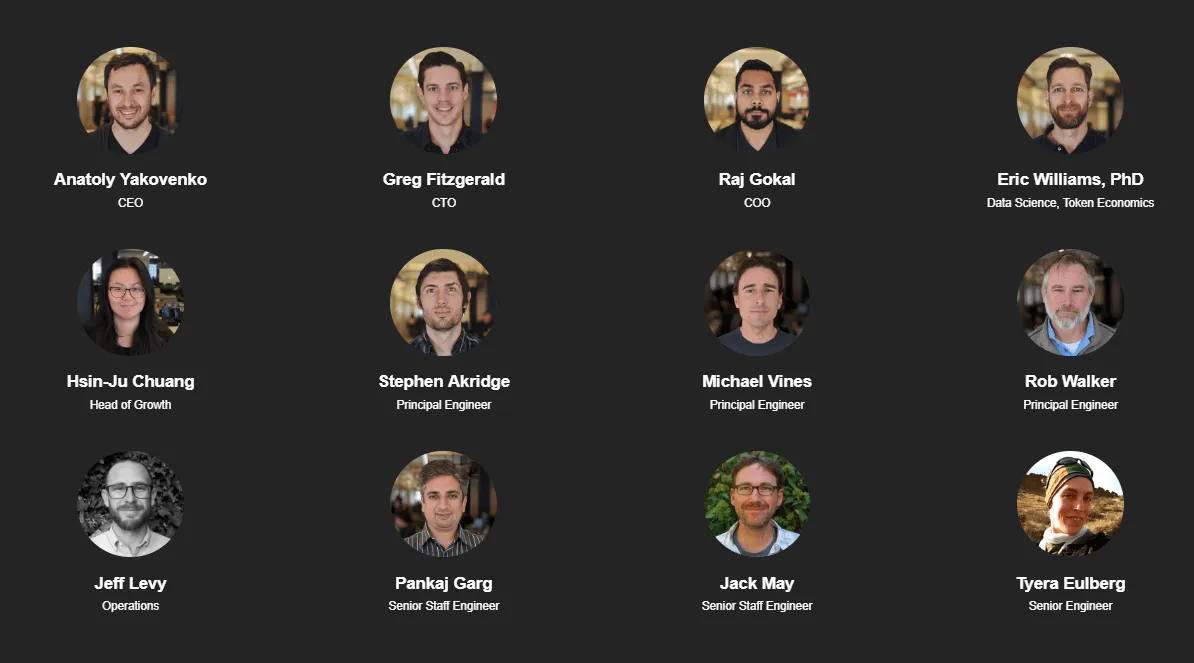

He recruited former Qualcomm colleagues Greg Fitzgerald and Stephen Akridge to help build a prototype. The team officially founded Solana Labs in 2018, securing initial funding to develop the protocol. Raj Gokal, one of the publicly known co-founders of Solana, also joined the project shortly after the Proof-of-History whitepaper, taking the reins as the COO of Solana Labs. The founders launched the first testnet in 2018, followed by the mainnet beta in March 2020, entering the market just as the COVID-19 pandemic was beginning.

On-Chain Holdings

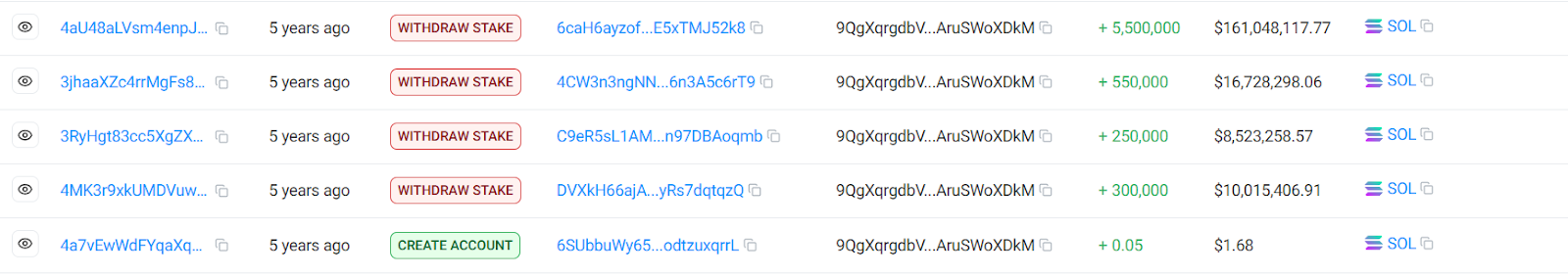

At launch, 500M SOL tokens were minted, of which 12.5% were allocated to the founding team, including Yakovenko. A Solana address, 9QgXq, is popularly rumored, but not confirmed, to be linked to Yakovenko. The wallet holds over 136,725 SOL tokens, of which the majority is staked. The address is over five years old, with early transactions transferring millions worth in SOL into the address. If this wallet truly belongs to the Solana co-founder, this would put the value of his SOL holdings at over $11M.

Historical transactions from this stake account also show large transactions of SOL from this account to various Solana addresses. Between August 2024 and November 2024, over 3M SOL tokens were unstaked and transferred, of which over 1.5M SOL tokens remained staked on these new addresses, including 9E8zG, JQ5jC, A6mJn, and 7pgzZ. If these addresses also belong to Yakovenko, this would place the value of his SOL holdings much, much higher at almost $122M at current value.

Another popular theory links the Solana domain, toly.sol, based on his display name on X, Toly. This domain is owned by 86xCn, which currently holds over $1.3M in various tokens, although its value is predominantly held in an illiquid token, placing the true liquid value of its holdings at approximately $16.5K, or 203.8 SOL worth.

Off-Chain Holdings

Beyond his token holdings, Yakovenko maintains a significant equity stake in Solana Labs, the company that supports the development of the Solana protocol and its related infrastructure. While exact ownership percentages aren’t publicly disclosed, it is estimated that he owns between 5-10% of the company.

As a private company, Solana Labs does not have a publicly disclosed valuation. Solana Labs has raised multiple funding rounds in the past, including from prominent venture capital firms such as a16z (Andreessen Horowitz), Polychain Capital, and Multicoin Capital. These investments have valued the company in the billions, with many estimating the value of the company to be between $5–8B. At these valuations, Yakovenko's equity stake would be worth anywhere between $250M to $800M, independent of his personal token holdings.

Although the valuation of Solana Labs as a company is still partially linked to the market performance of SOL, this dual ownership structure of personal token holdings and company equity provides some diversification in how Yakovenko holds his wealth. While SOL token prices can be volatile, the company equity represents a more stable asset, particularly as Solana Labs expands beyond just protocol development into other blockchain infrastructure projects.

Beyond his stake in Solana Labs, Yakovenko is also an active angel investor, with notable investments in over 40 other companies. Some of these companies have grown to become giants in the Solana ecosystem, including liquid staking service providers, Jito Labs and Solayer, perpetual DEXes, Drift Protocol and Infinex, and staking infrastructure project, Helius.

Who Owns the Most Solana?

Solana has come a long way since its early days as a nascent blockchain. Today, Solana's token distribution reveals a mix of institutional investors, exchanges, founders, and retail participants. Major institutional holders include Solana treasury companies, cryptocurrency exchanges that custody tokens on behalf of users, Solana ETFs, and staking service providers.

According to available data, the largest aggregate holders of SOL tokens are likely the FTX auction winners. Following the collapse and bankruptcy of centralized exchange, FTX, the SOL tokens held by the estate were put up for auction as part of the liquidation process. During this process, 41M SOL tokens were sold, with Galaxy Digital and Pantera Capital acquiring the majority of the supply. Although these tokens were subject to a lockup and vesting schedule, approximately 60-70% of the SOL tokens sold have since been unlocked, and presumably sold. With that in mind, Galaxy Digital likely still holds ~6-8M SOL tokens from their original tranche of 25.5M tokens, while Pantera likely still holds ~3-5M SOL tokens from their original 13.7M SOL tokens. It should be noted too that both of these firms have been actively participating in raises for Solana treasury companies in 2025, which aim to accumulate SOL from the open market.

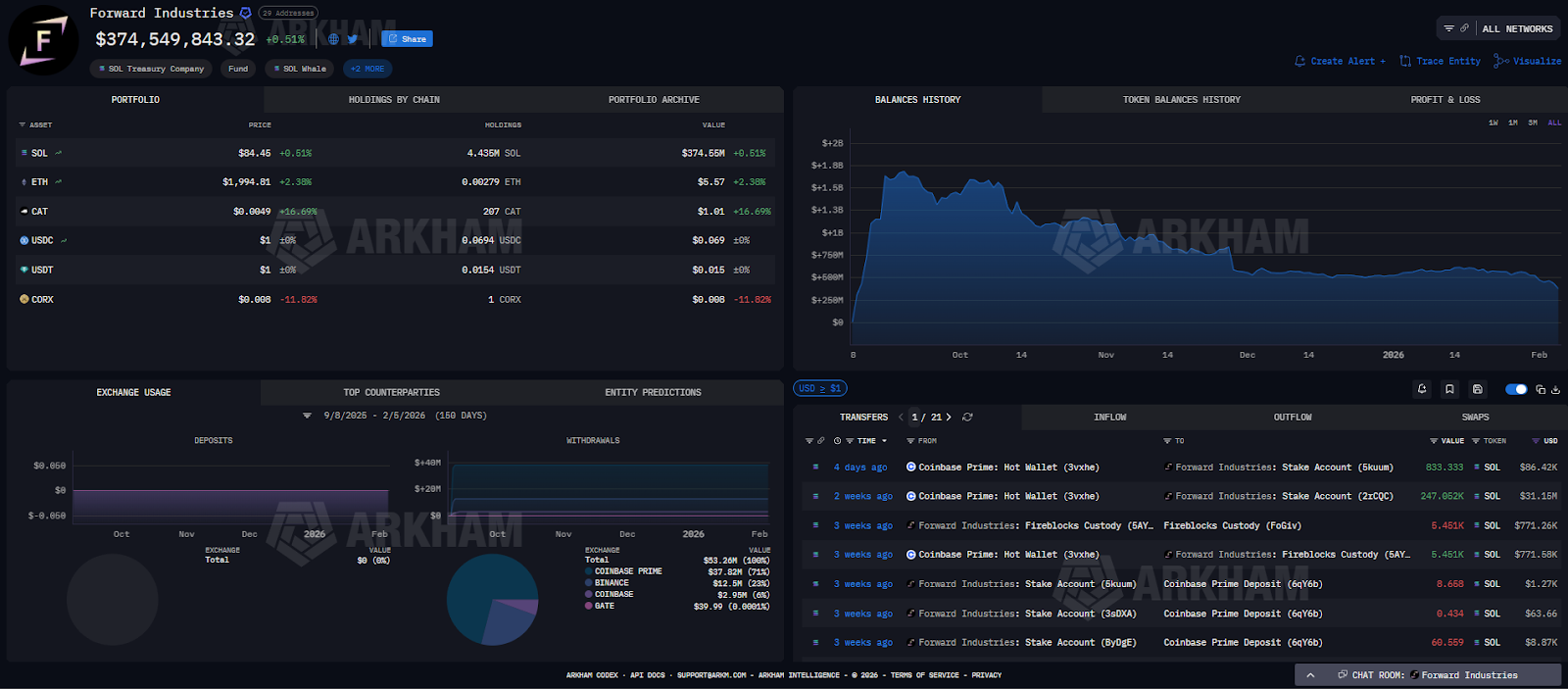

Solana treasury companies took the spotlight in 2025. With their highly public holdings, the largest confirmed SOL holder among them is Forward Industries, the leading Solana treasury company. They currently hold 6.9M SOL tokens ($583M) or 1.115% of the SOL total supply. Other Solana treasury companies remain much further behind, holding a combined 1.5% of the total SOL token supply across the next nine Solana treasury companies.

In terms of custody providers, centralized exchanges like Binance hold millions of SOL tokens for their users, with their latest proof of reserves showing over 24.2M SOL tokens held on the exchange. Similarly, ETF providers have also emerged as some of the largest SOL token holders, with the Bitwise Solana Staking ETF (BSOL) holding over 5.5M SOL tokens as the leading spot SOL ETF.

Among individual holders, Yakovenko likely ranks highly but does not necessarily hold the single largest position. Other Solana Labs co-founders and early team members received substantial allocations, and some early private investors may have accumulated positions larger than any single founder's holdings.

Net Worth Over Time

Yakovenko's net worth over time has likely tracked closely with Solana's market performance, riding its dramatic rise and fall. When SOL reached its cycle high of approximately $260 in November 2021, his combined holdings of tokens and company equity likely pushed his net worth above $2 billion, possibly approaching $3 billion depending on the value assigned to his equity stake in Solana Labs.

On the flip side, the 2022 bear market severely compressed this valuation. As SOL fell below $10 at its lowest point, the value of his token holdings probably fell by well over 95% from peak levels as well. Network outages during this period, along with Solana's heavy association with FTX and Alameda Research, created additional headwinds that weighed on both token price and ecosystem sentiment. Assuming a similar trajectory in net worth, this would’ve placed his net worth under $100M during the bear market.

As the market recovered into a new bull market in 2023 to 2025, his net worth likely followed suit. Solana experienced a particularly strong move through late 2023 and 2024, rising to a new all-time high. This price action, combined with Solana Labs' maturing equity value, now estimated between $4B and $10B, likely once again pushed Yakovenko’s net worth back into the multi-billionaire bracket.

2026 has seen the year open to a brutal sell-off, with Solana falling back under $100. This likely puts his estimated net worth around $500M to $1.2B, depending on the liquidity of his token holdings and the estimated valuation of his equity stake in Solana Labs.

Conclusion

As of early 2026, Anatoly Yakovenko remains a central architect of the digital economy, with a net worth that fluctuates alongside the maturing Solana ecosystem. While the sell-off in early 2026 has compressed his wealth from its multi-billion dollar peaks, his financial standing remains robust, anchored by his equity stake in Solana Labs and a portfolio of early-stage investments.

From a single late-night idea to a full-fledged blockchain that rivals the incumbents, Bitcoin and Ethereum, Yakovenko’s influence on the industry is clear to see. Solana has evolved from a simple high speed chain to its present day form: a hub for institutional finance, stablecoin payments, trading and more.

.png)