September 3, 2024

at

1:05 am

EST

MIN READ

Trader Turns $5K into $670K On Ethervista In Just 48 Hours

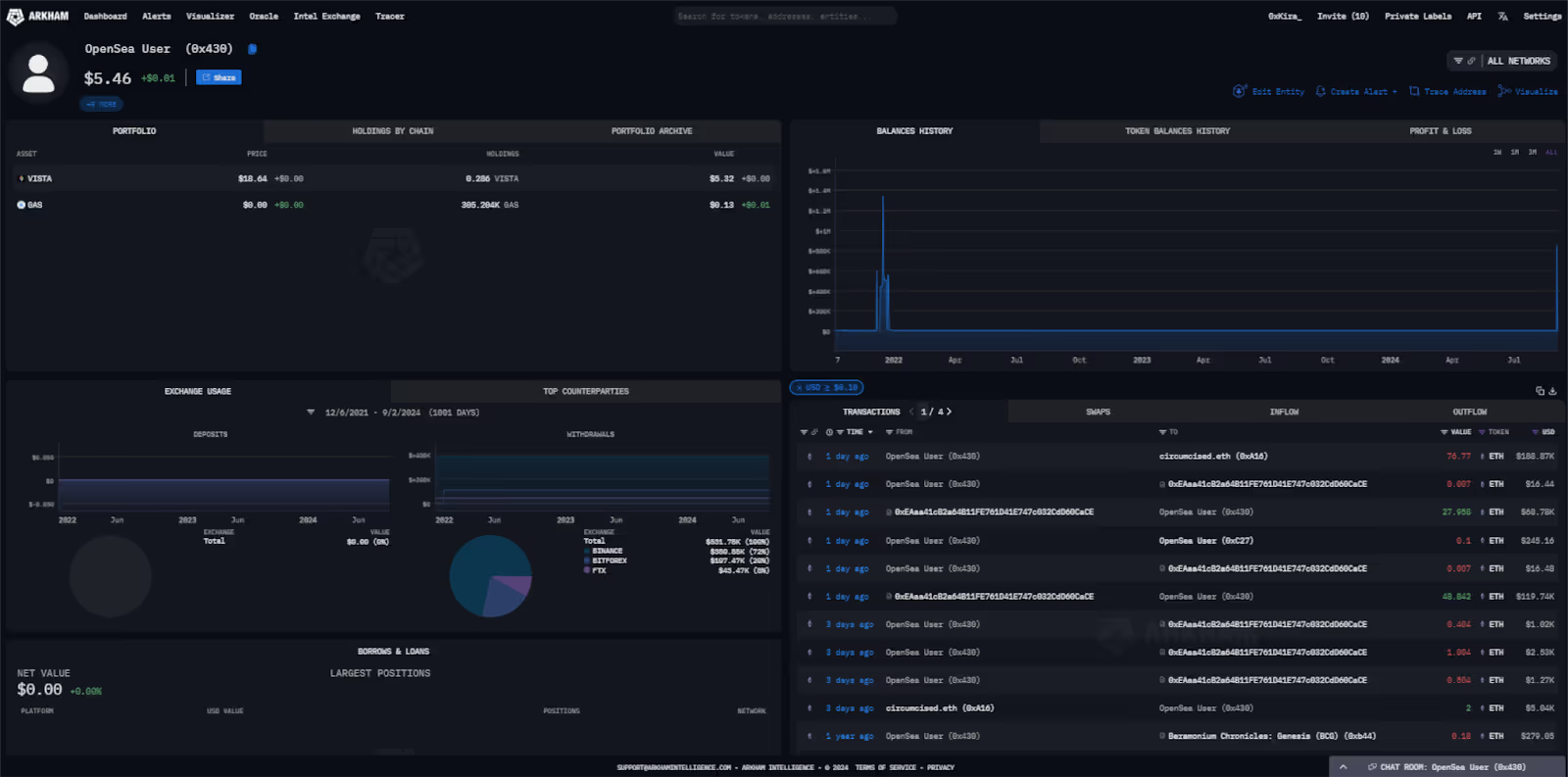

Three days ago, a trader on Ethereum (0x430) acquired 51.649K Ethervista (VISTA) tokens, or about $4.79K worth, in three transactions. This was just over 5.1% of the total token supply of the VISTA token. After just 39 hours, the value of his position had increased to more than $500K. At this point, he began transferring the VISTA tokens out to five other wallets, likely belonging to him as well, before selling off his position from said wallets, netting him a profit of over $670K in ETH.

The trader's ability to realize such a massive profit in an extremely short period highlights the intense volatility and speculative potential inherent in new token launches. This specific event quickly drew significant attention to VISTA and the novel platform model it represents.

Ethervista is a new automated market maker (AMM) model, which has been dubbed the ‘pump.fun of Ethereum’. It is designed to reduce the risks from rug pulls on new token launches and to incentivize liquidity in order to encourage long-term alignment between the project’s team and token holders. Rug pulls of low-liquidity token launches have become a growing problem amidst the memecoin craze of recent months. Ethervista combats this through customizability on their liquidity pool trading fee structure to enable teams to profit more from trading volume. Additionally, Ethervista also implements a five-day lock on the initial liquidity deposited, aiming to prevent an immediate rug pull within the first two to four days, which is when most token rug pulls typically occur.

The prevalence of such rug pulls during the "memecoin craze" has become a significant concern for traders. These incidents, particularly on low-liquidity tokens, can erode trust within the broader decentralized finance (DeFi) ecosystem, making platform-level solutions more critical.

By focusing on this specific timeframe, the five-day liquidity lock provides a crucial, if simple, layer of security. This mechanism directly addresses the common window for immediate rug pulls, offering a baseline of assurance and helping to foster a more stable environment for both project teams and their token holders from the very beginning.

.png)