December 3, 2024

at

12:00 am

EST

MIN READ

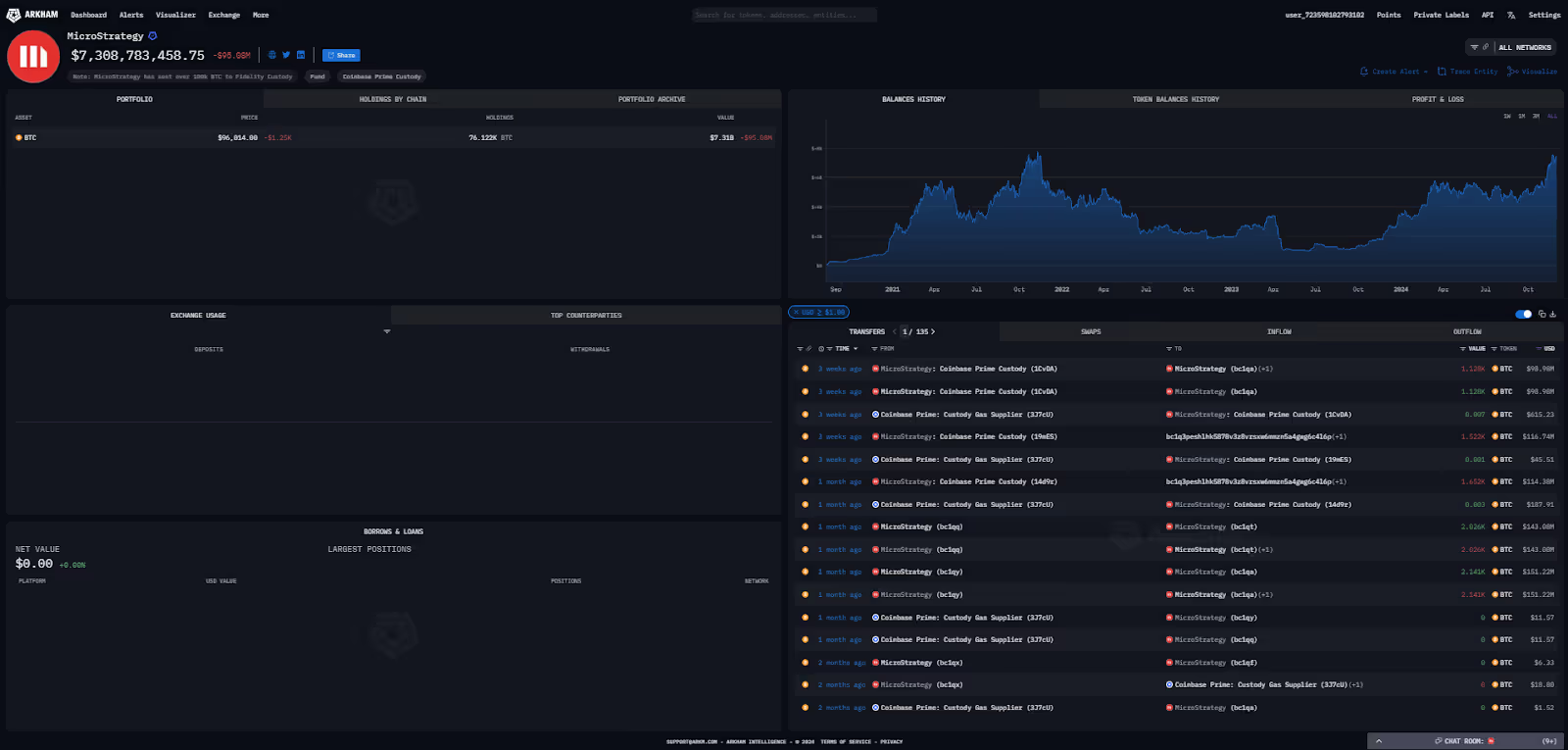

MicroStrategy Buys $1.5B of Bitcoin

Microstrategy purchases another 15,400 BTC at an average price of $95,976 per Bitcoin, totalling $1.5B. This is the latest in a string of purchases across the last four weeks, in which a total of 134,480 BTC was acquired for ~$12.03B. The recent purchases bring Microstrategy’s BTC reserves to 402,100 BTC or $38.4B worth. Their current holdings form just under 2% of the Bitcoin total supply of 21M.

To execute this capital raise, MicroStrategy utilizes a sophisticated mix of "At-The-Market" (ATM) equity offerings and convertible senior notes. ATM offerings allow the company to sell new shares directly into the open market at current prices, effectively turning high investor demand for their stock into immediate cash for Bitcoin. Simultaneously, they issue convertible notes - debt that can be turned into stock later - which allows them to borrow billions at near-zero interest rates. This strategy essentially allows the company to arbitrage the difference between the cost of their capital (low) and the potential appreciation of Bitcoin (high).

In late October this year during their Q3 earnings call, Microstrategy announced an ambitious plan to raise $42B in capital over the upcoming three years for the purpose of acquiring more BTC. The plan aims for $21B in equity raises and another $21B in debt offerings to finance the purchases. With the recent $12B in purchases, or almost 30% of the $42B amount, speculators believe that the plan could potentially have been front-loaded in anticipation of higher Bitcoin prices in the near future.

The strategy of "front-loading" these purchases is rooted in the economic principle of supply shock. By aggressively absorbing over 130,000 BTC in just four weeks, the company is rapidly removing liquid supply from exchanges. With nearly 2% of the total Bitcoin supply now sitting in a single corporate treasury, the "float" - or the amount of Bitcoin actually available for trade - shrinks significantly. In a market where supply is mathematically capped, this manufactured scarcity can act as a catalyst, potentially forcing prices upward as other buyers compete for the remaining inventory.

.png)